Monalisa GroupLtd (SZSE:002918) sheds CN¥437m, company earnings and investor returns have been trending downwards for past three years

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the last three years have been particularly tough on longer term Monalisa Group CO.,Ltd (SZSE:002918) shareholders. Sadly for them, the share price is down 62% in that time. The more recent news is of little comfort, with the share price down 28% in a year. Unfortunately the share price momentum is still quite negative, with prices down 17% in thirty days.

If the past week is anything to go by, investor sentiment for Monalisa GroupLtd isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Monalisa GroupLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

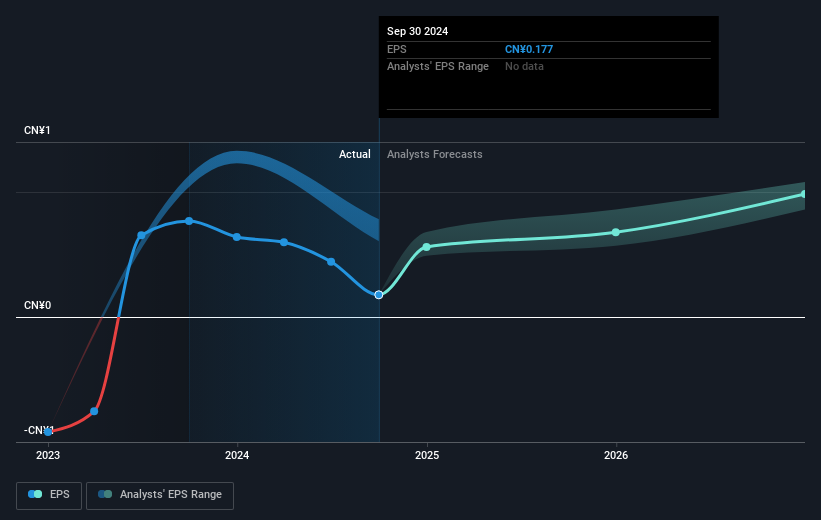

Monalisa GroupLtd saw its EPS decline at a compound rate of 51% per year, over the last three years. This fall in the EPS is worse than the 28% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. With a P/E ratio of 51.56, it's fair to say the market sees a brighter future for the business.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Monalisa GroupLtd's key metrics by checking this interactive graph of Monalisa GroupLtd's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Monalisa GroupLtd, it has a TSR of -60% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Investors in Monalisa GroupLtd had a tough year, with a total loss of 25% (including dividends), against a market gain of about 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Monalisa GroupLtd better, we need to consider many other factors. Take risks, for example - Monalisa GroupLtd has 3 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002918

Monalisa GroupLtd

Researches, develops, produces, and sells ceramic products in China.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives