- China

- /

- Semiconductors

- /

- SZSE:300604

High Insider-Owned Growth Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks closing out 2024 on a strong note despite recent volatility, investors are keenly observing economic indicators such as the Chicago PMI and GDP forecasts for signs of future trends. In this environment, growth companies with high insider ownership can be particularly appealing, as they often suggest confidence from those closest to the business in its potential resilience and long-term value creation amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.6% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

Let's explore several standout options from the results in the screener.

Hubei Wanrun New Energy TechnologyLtd (SHSE:688275)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hubei Wanrun New Energy Technology Co., Ltd. (ticker: SHSE:688275) operates in the new energy sector and has a market cap of approximately CN¥6.01 billion.

Operations: The company generates revenue from the production and sales of lithium-ion battery material products, amounting to CN¥7.03 billion.

Insider Ownership: 33%

Earnings Growth Forecast: 114.0% p.a.

Hubei Wanrun New Energy Technology Ltd. is poised for significant growth, with revenue expected to increase by 38.9% annually, outpacing the Chinese market's average. Despite a current net loss of CNY 597.78 million for the nine months ending September 2024, projections indicate profitability within three years, surpassing market averages. The stock trades at nearly 90% below its estimated fair value but exhibits high volatility and low forecasted return on equity at 10.7%.

- Get an in-depth perspective on Hubei Wanrun New Energy TechnologyLtd's performance by reading our analyst estimates report here.

- The analysis detailed in our Hubei Wanrun New Energy TechnologyLtd valuation report hints at an deflated share price compared to its estimated value.

Bichamp Cutting Technology (Hunan) (SZSE:002843)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bichamp Cutting Technology (Hunan) Co., Ltd. operates in the cutting tool industry and has a market cap of CN¥4.94 billion.

Operations: Bichamp Cutting Technology generates revenue from its operations in the cutting tool industry.

Insider Ownership: 31.8%

Earnings Growth Forecast: 28.7% p.a.

Bichamp Cutting Technology (Hunan) faces challenges with its recent exclusion from the S&P Global BMI Index and declining earnings, reporting CNY 66.02 million net income for nine months ending September 2024, down from CNY 102.63 million a year ago. Despite this, the company is projected to achieve substantial earnings growth of 28.7% annually over the next three years, outpacing the Chinese market's average growth rate of 25.2%.

- Take a closer look at Bichamp Cutting Technology (Hunan)'s potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Bichamp Cutting Technology (Hunan) is priced higher than what may be justified by its financials.

Hangzhou Changchuan TechnologyLtd (SZSE:300604)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hangzhou Changchuan Technology Co., Ltd specializes in the research, development, production, and sale of integrated circuit equipment and high-frequency communication materials, with a market cap of CN¥24.90 billion.

Operations: The company generates revenue from its operations in integrated circuit equipment and high-frequency communication materials.

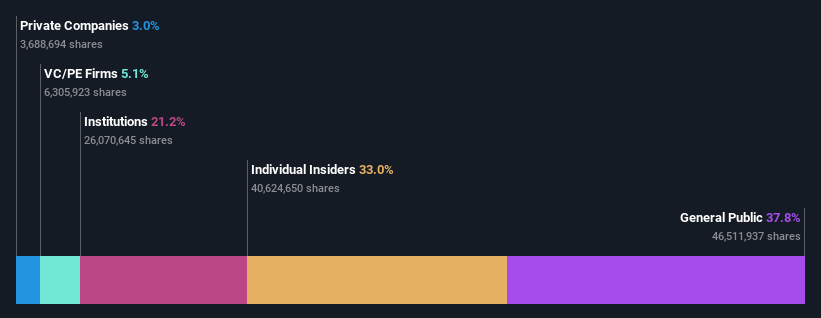

Insider Ownership: 32.3%

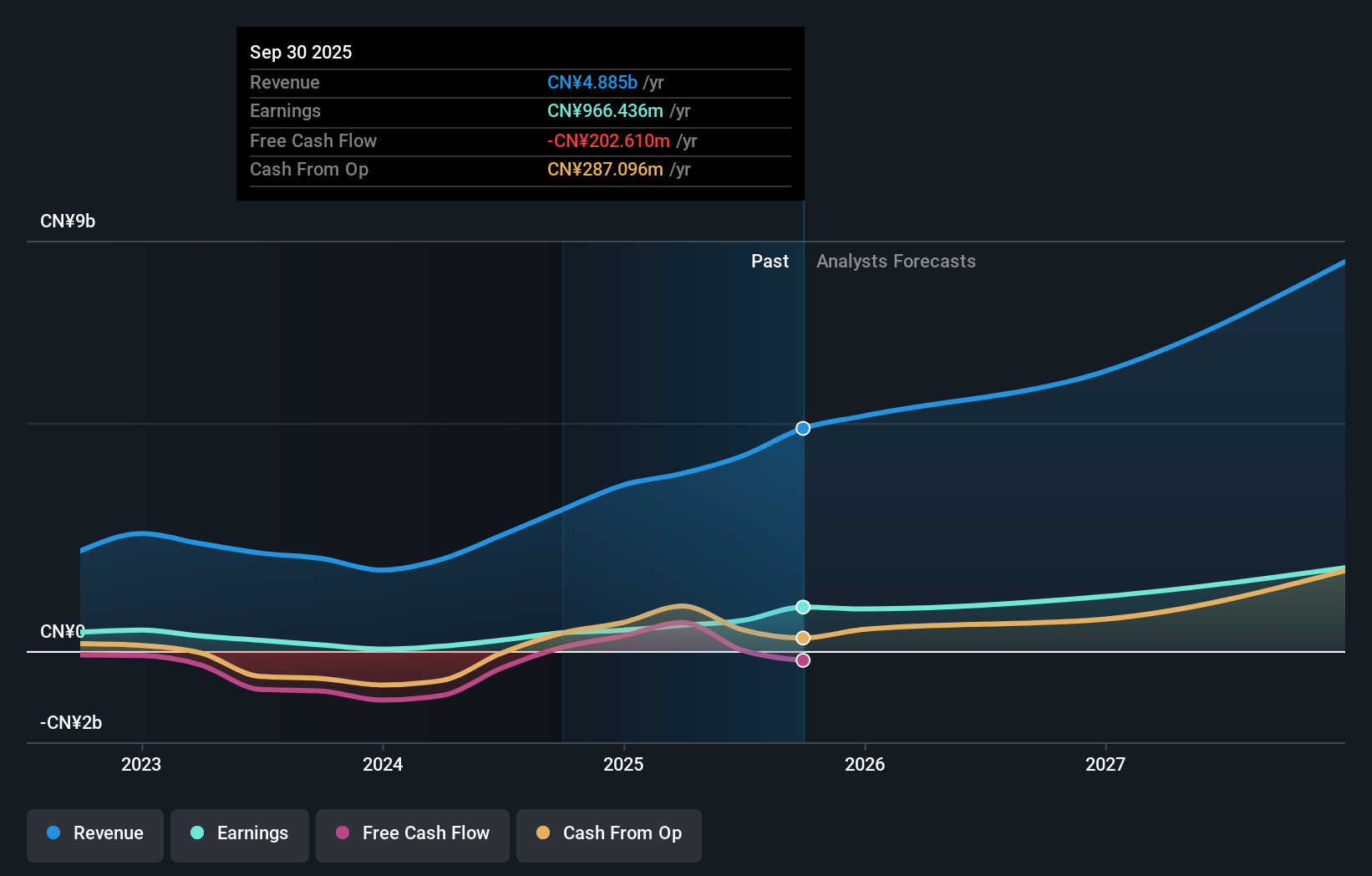

Earnings Growth Forecast: 40.9% p.a.

Hangzhou Changchuan Technology has demonstrated robust growth, with recent earnings for the nine months ending September 2024 showing sales of CNY 2.54 billion, up from CNY 1.21 billion a year earlier. Net income surged to CNY 357.4 million from just CNY 1.33 million previously, reflecting high-quality earnings despite large one-off items impacting results. The company's revenue and earnings are forecast to grow significantly above market averages, underscoring its potential as a growth-focused entity with substantial insider ownership stability.

- Navigate through the intricacies of Hangzhou Changchuan TechnologyLtd with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Hangzhou Changchuan TechnologyLtd's shares may be trading at a premium.

Where To Now?

- Delve into our full catalog of 1484 Fast Growing Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Changchuan TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300604

Hangzhou Changchuan TechnologyLtd

Researches and develops, produces, and sells integrated circuit equipment and high-frequency communication materials.

Exceptional growth potential with excellent balance sheet.