As global markets navigate a mixed start to the year, with indices showing varied performances and economic indicators like the Chicago PMI highlighting ongoing challenges, investors are increasingly turning their focus to stable income-generating options. In this context, dividend stocks become particularly appealing as they offer the potential for regular income streams amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.35% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.63% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.09% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 2010 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

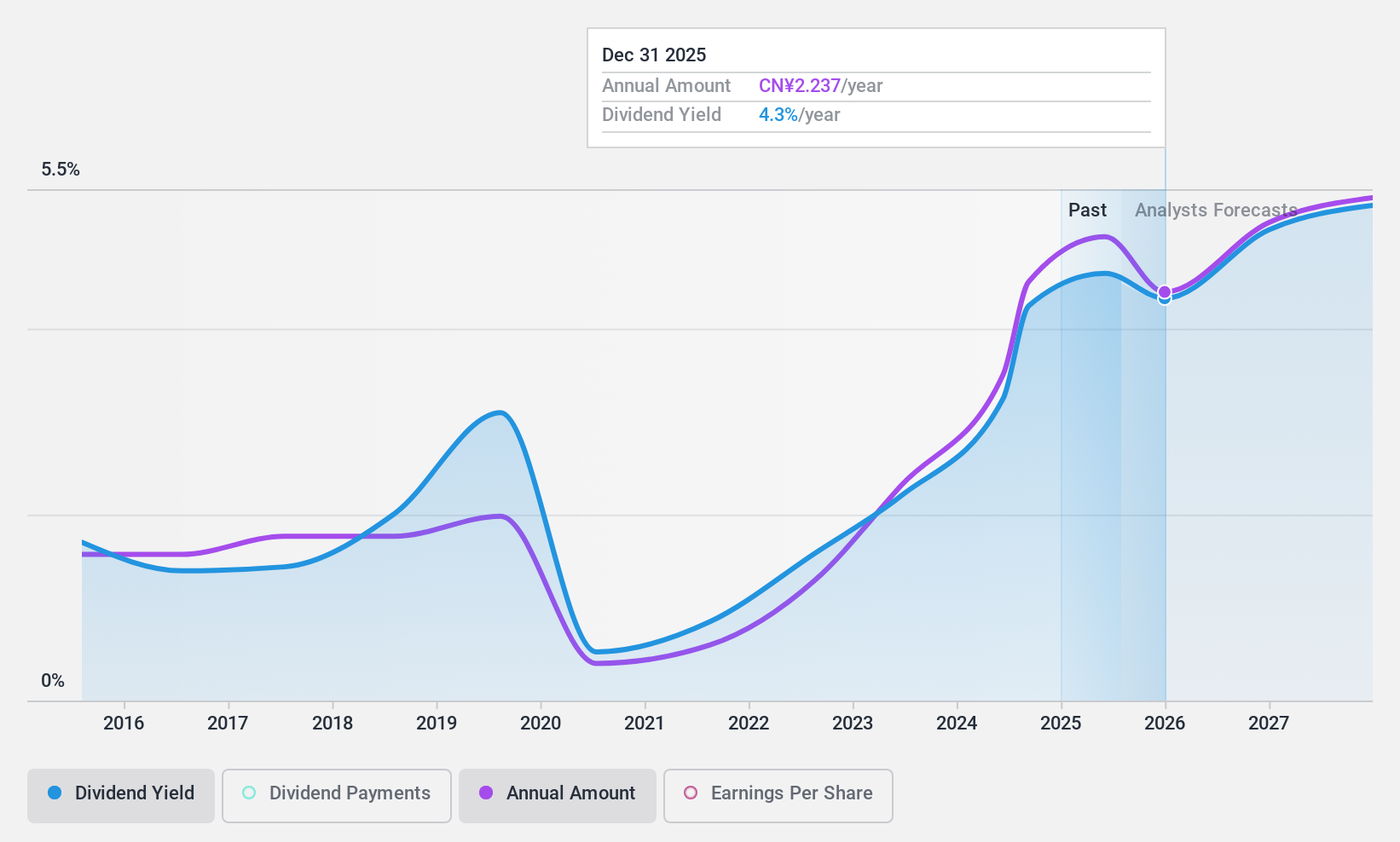

Dong-E-E-JiaoLtd (SZSE:000423)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dong-E-E-Jiao Co., Ltd. engages in the research, development, production, and sale of Ejiao along with various Chinese patent medicines and health foods, with a market cap of CN¥39.67 billion.

Operations: Dong-E-E-Jiao Co., Ltd. generates revenue primarily from the operation of Ejiao and its series of products, amounting to CN¥5.62 billion.

Dividend Yield: 3.7%

Dong-E-E-Jiao Ltd. has shown robust earnings growth, with a 44.6% increase over the past year and recent nine-month net income rising to CNY 1.15 billion from CNY 783.67 million a year ago, indicating strong financial performance. However, its dividend payments have been volatile over the past decade and are not well covered by earnings due to a high payout ratio of 123.8%. Despite this, it offers a competitive yield of 3.7%, ranking in the top quartile in China, though sustainability concerns persist given its cash flow coverage challenges and historical volatility in dividends.

- Take a closer look at Dong-E-E-JiaoLtd's potential here in our dividend report.

- Our valuation report unveils the possibility Dong-E-E-JiaoLtd's shares may be trading at a discount.

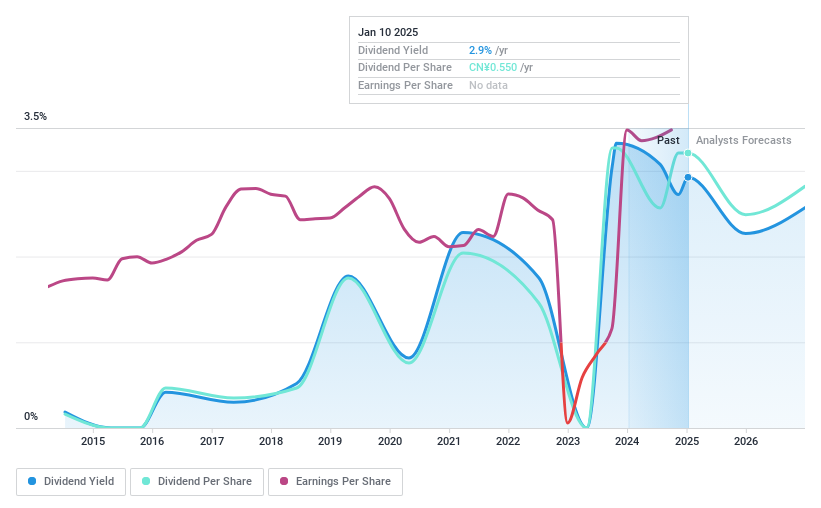

Newland Digital TechnologyLtd (SZSE:000997)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Newland Digital Technology Co., Ltd. offers bar code and financial POS terminal equipment, mobile and communications services, as well as IoT solutions both in China and internationally, with a market cap of CN¥18.55 billion.

Operations: Newland Digital Technology Co., Ltd. generates revenue through its offerings in bar code and financial POS terminal equipment, mobile communication services, and IoT solutions across domestic and international markets.

Dividend Yield: 2.9%

Newland Digital Technology Ltd. offers a competitive dividend yield of 2.93%, ranking in the top 25% of CN market payers, with dividends covered by earnings (payout ratio: 55.5%) and cash flows (cash payout ratio: 88.7%). Despite this, its dividend history is unstable, marked by volatility over the past decade. Recent results show stable net income at CNY 818.76 million for nine months ending September 2024, with consistent earnings per share performance year-over-year.

- Delve into the full analysis dividend report here for a deeper understanding of Newland Digital TechnologyLtd.

- Upon reviewing our latest valuation report, Newland Digital TechnologyLtd's share price might be too pessimistic.

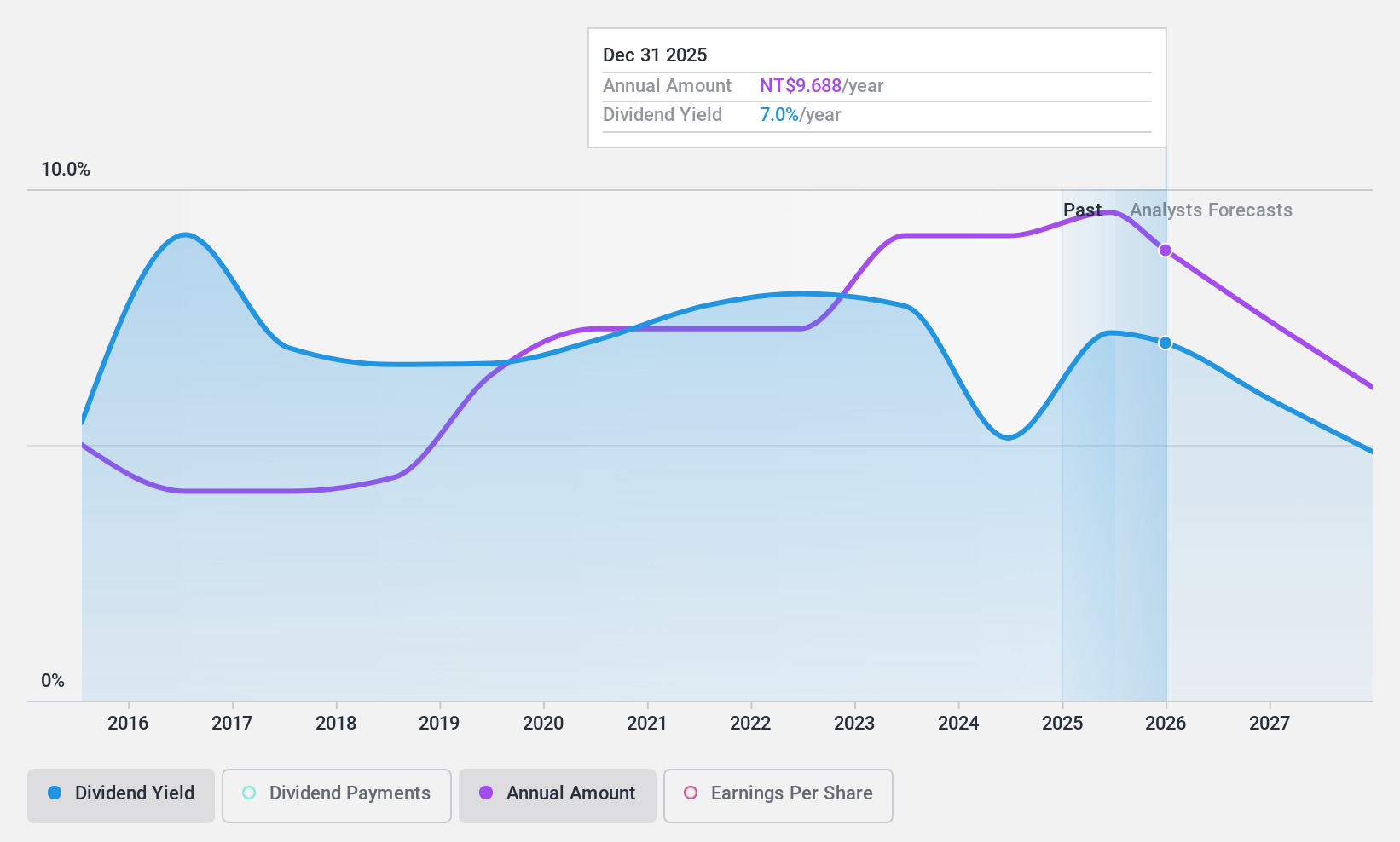

Radiant Opto-Electronics (TWSE:6176)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Radiant Opto-Electronics Corporation manufactures and sells backlight modules and light guide plates for LCD panels across Asia, Europe, and the United States, with a market cap of NT$90.22 billion.

Operations: Radiant Opto-Electronics Corporation's revenue segments include NT$27.42 billion from the Taiwan Regional market and NT$36.25 billion from the Mainland District, with additional contributions of NT$484.88 million from other regions.

Dividend Yield: 5.1%

Radiant Opto-Electronics offers a high dividend yield of 5.13%, placing it in the top 25% of payers in Taiwan, but its dividend payments have been volatile and unreliable over the past decade. Recent announcements include significant cash dividends from a subsidiary, though these are not well covered by earnings or free cash flows, with a high payout ratio of 79.6% and cash payout ratio at 91%. Despite recent revenue growth, earnings are forecasted to decline.

- Click here and access our complete dividend analysis report to understand the dynamics of Radiant Opto-Electronics.

- According our valuation report, there's an indication that Radiant Opto-Electronics' share price might be on the cheaper side.

Make It Happen

- Discover the full array of 2010 Top Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000423

Dong-E-E-JiaoLtd

Research and development, production, and sale of Ejiao and a series of Chinese patent medicines, health foods, and foods.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives