- China

- /

- Auto Components

- /

- SHSE:603166

Discover Shanghai Jin Jiang Online Network Service And 2 Other Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 marking a robust two-year performance despite recent economic concerns like the Chicago PMI slump and revised GDP forecasts, small-cap stocks have shown resilience. The Russell 2000 Index's recent gains highlight investor interest in smaller companies that often offer unique growth opportunities amidst broader market fluctuations. In this context, identifying promising small-cap stocks such as Shanghai Jin Jiang Online Network Service can be particularly rewarding for investors seeking potential undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Mamata Machinery | 8.30% | 14.61% | 34.29% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Renaissance Global | 47.81% | -2.99% | 0.28% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai Jin Jiang Online Network Service (SHSE:600650)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Jin Jiang Online Network Service Co., Ltd. operates in the online network service industry and has a market capitalization of approximately CN¥5.80 billion.

Operations: The company generates revenue through its operations in the online network service industry.

Shanghai Jin Jiang Online Network Service, a small cap player in the industry, has seen its earnings grow by 60.6% over the past year, outpacing the Specialty Retail sector's -5.5%. Despite a decline in sales to CN¥1.34 billion from CN¥1.49 billion compared to last year, net income rose to CN¥163.73 million from CN¥117.71 million, thanks partly to a significant one-off gain of CN¥53.5 million impacting recent results. The company also reduced its debt-to-equity ratio from 1.2 to 1 over five years and maintains more cash than total debt, indicating solid financial footing amidst volatility concerns.

- Unlock comprehensive insights into our analysis of Shanghai Jin Jiang Online Network Service stock in this health report.

Learn about Shanghai Jin Jiang Online Network Service's historical performance.

GUILIN FUDALtd (SHSE:603166)

Simply Wall St Value Rating: ★★★★★☆

Overview: GUILIN FUDA Co., Ltd. is engaged in the research, development, production, and sale of auto parts and components in China with a market capitalization of approximately CN¥4.51 billion.

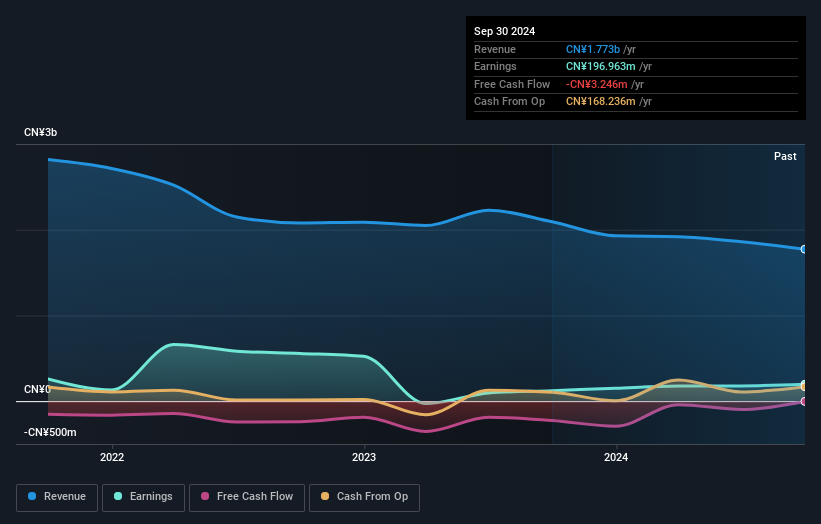

Operations: GUILIN FUDA generates revenue primarily from its Automobile and Internal Combustion Engine Parts segment, amounting to CN¥1.51 billion.

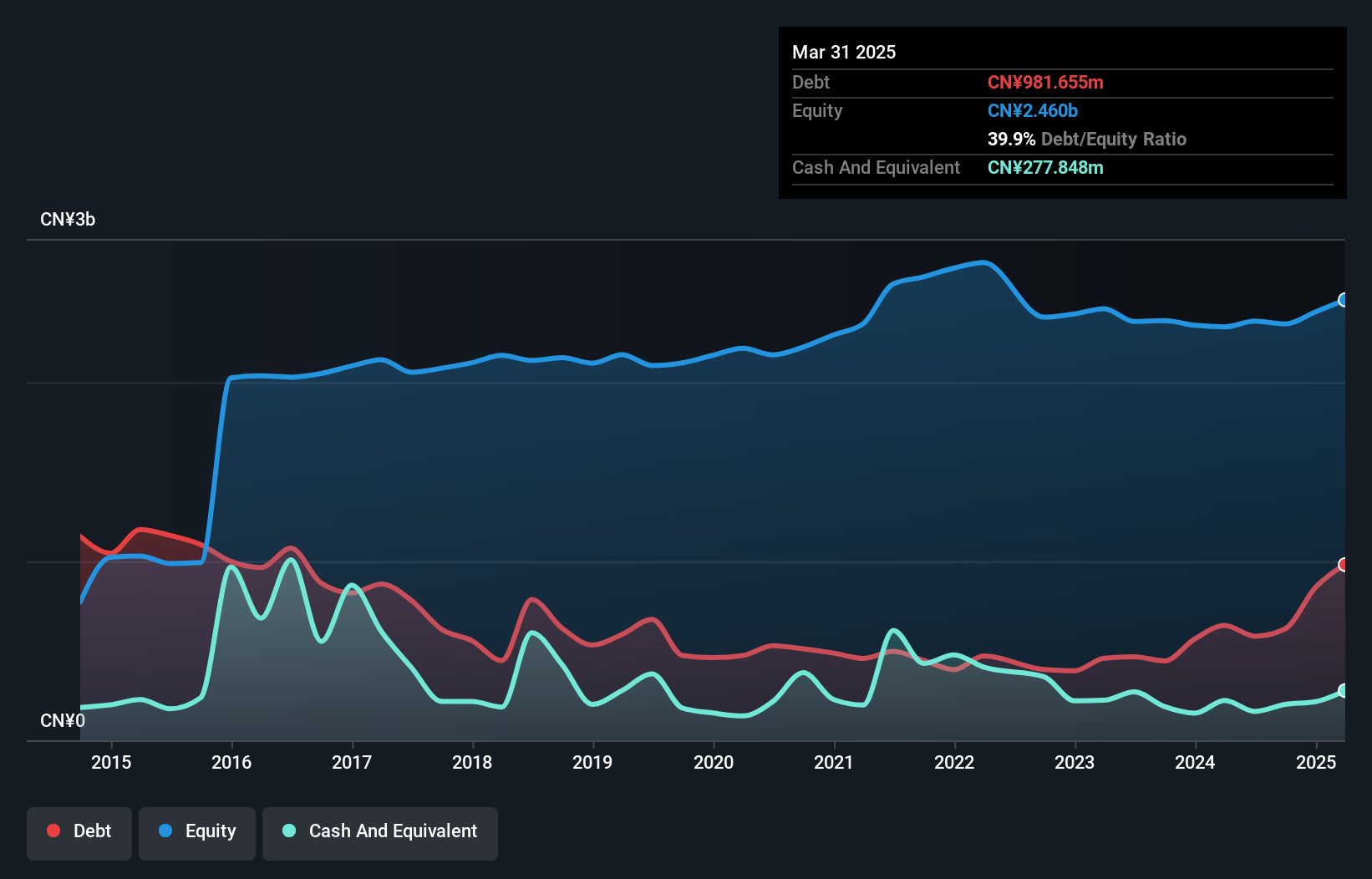

Guilin FUDA, a smaller player in the auto components sector, reported impressive earnings growth of 97.9% last year, outpacing the industry average of 10.5%. Its net debt to equity ratio stands at a satisfactory 18.2%, indicating prudent financial management despite an increase from 22.5% to 26.8% over five years. The company's interest payments are well covered by EBIT at a robust 13.3 times coverage, showcasing strong operational efficiency. Recent earnings showed sales climbing to CNY1,110 million from CNY949 million and net income rising to CNY120 million from CNY64 million year-on-year, reflecting its potential as an investment opportunity in its niche market segment.

- Dive into the specifics of GUILIN FUDALtd here with our thorough health report.

Examine GUILIN FUDALtd's past performance report to understand how it has performed in the past.

EZconn (TWSE:6442)

Simply Wall St Value Rating: ★★★★★★

Overview: EZconn Corporation manufactures and sells precision metal and optical fiber components for electronic products across Taiwan, Asia, the United States, and Europe with a market capitalization of NT$44.46 billion.

Operations: EZconn generates revenue primarily from its Optical Fiber Component segment, contributing NT$4.06 billion, and High Frequency Connectors segment, adding NT$469.51 million.

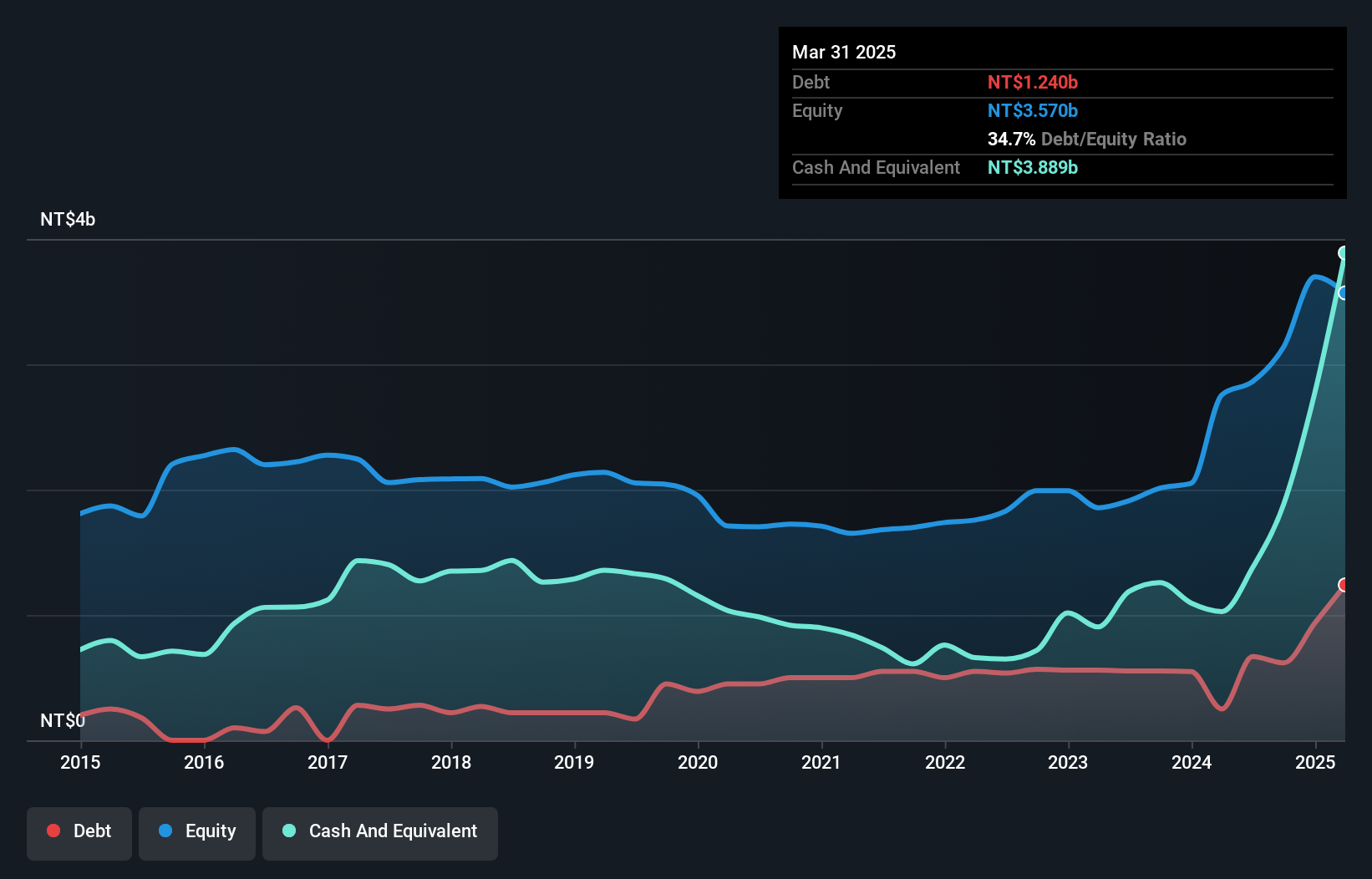

EZconn, a relatively small player in the communications industry, has demonstrated impressive financial performance recently. For the third quarter of 2024, sales reached TWD 1.64 billion, significantly higher than last year's TWD 666.54 million. Net income also surged to TWD 259.16 million from TWD 67.67 million previously, with basic earnings per share jumping to TWD 3.43 from TWD 1.02 a year ago. The company seems well-positioned financially with more cash than total debt and a reduced debt-to-equity ratio over five years from 22% to approximately 19%. However, shareholder dilution occurred in the past year amidst earnings growth outpacing industry trends by over threefold at around 331%.

- Navigate through the intricacies of EZconn with our comprehensive health report here.

Gain insights into EZconn's historical performance by reviewing our past performance report.

Summing It All Up

- Discover the full array of 4651 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603166

GUILIN FUDALtd

Researches and develops, produces, and sells auto parts and components in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives