China Western Power Industrial (SZSE:002630) Is Experiencing Growth In Returns On Capital

If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So when we looked at China Western Power Industrial (SZSE:002630) and its trend of ROCE, we really liked what we saw.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for China Western Power Industrial:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0086 = CN¥47m ÷ (CN¥10.0b - CN¥4.6b) (Based on the trailing twelve months to December 2023).

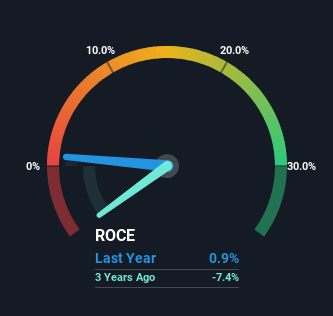

So, China Western Power Industrial has an ROCE of 0.9%. In absolute terms, that's a low return and it also under-performs the Machinery industry average of 6.3%.

See our latest analysis for China Western Power Industrial

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how China Western Power Industrial has performed in the past in other metrics, you can view this free graph of China Western Power Industrial's past earnings, revenue and cash flow.

What Does the ROCE Trend For China Western Power Industrial Tell Us?

Even though ROCE is still low in absolute terms, it's good to see it's heading in the right direction. The figures show that over the last five years, ROCE has grown 22% whilst employing roughly the same amount of capital. So it's likely that the business is now reaping the full benefits of its past investments, since the capital employed hasn't changed considerably. On that front, things are looking good so it's worth exploring what management has said about growth plans going forward.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 46%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. This tells us that China Western Power Industrial has grown its returns without a reliance on increasing their current liabilities, which we're very happy with. However, current liabilities are still at a pretty high level, so just be aware that this can bring with it some risks.

The Key Takeaway

As discussed above, China Western Power Industrial appears to be getting more proficient at generating returns since capital employed has remained flat but earnings (before interest and tax) are up. And since the stock has fallen 16% over the last five years, there might be an opportunity here. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

One more thing to note, we've identified 1 warning sign with China Western Power Industrial and understanding it should be part of your investment process.

While China Western Power Industrial may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002630

China Western Power Industrial

Designs, manufactures, and sells boilers in China.

Good value with mediocre balance sheet.

Market Insights

Community Narratives