Discovering Shanghai Zhongchen Electronic TechnologyLtd And 2 Other Top Small Caps With Solid Foundations

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by geopolitical tensions and economic shifts, small-cap stocks have emerged as notable performers, with the Russell 2000 Index reaching new highs. In this dynamic environment, identifying stocks with solid foundations becomes crucial, and companies like Shanghai Zhongchen Electronic Technology Ltd exemplify the kind of robust fundamentals that can offer potential opportunities in today's market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 25.29% | 10.45% | 0.43% | ★★★★★☆ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Shanghai Zhongchen Electronic TechnologyLtd (SHSE:603275)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Zhongchen Electronic Technology Co., Ltd. operates in the electronic technology sector, focusing on the development and production of electronic components, with a market cap of CN¥5.09 billion.

Operations: Shanghai Zhongchen Electronic Technology Co., Ltd. generates its revenue primarily from the development and production of electronic components. The company's financial performance is reflected in its market capitalization, which stands at approximately CN¥5.09 billion.

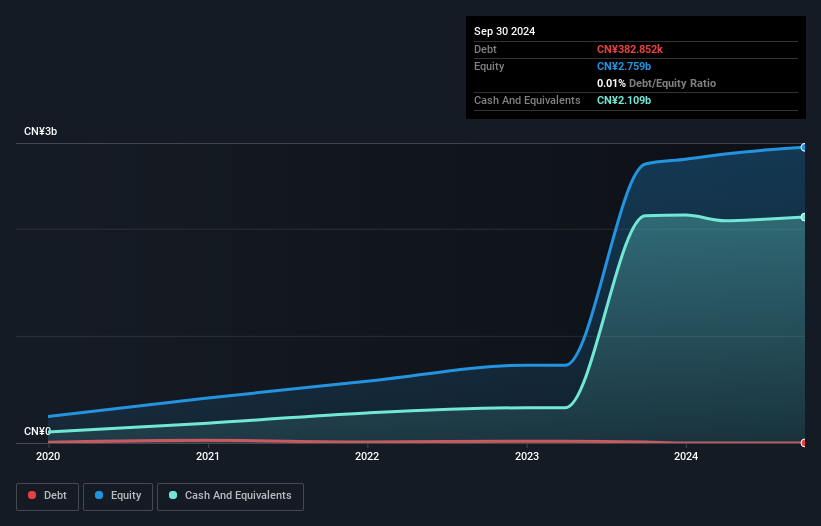

Shanghai Zhongchen Electronic Technology, an intriguing player in the electronics sector, showcases a compelling mix of financial strength and growth potential. With earnings growth of 10% over the past year, it outpaces the industry average of 1%. The company’s price-to-earnings ratio stands at 27.5x, offering better value compared to the CN market's 36.3x. Recent reports highlight a net income increase to CNY 161 million from CNY 149 million last year, despite basic earnings per share dipping slightly to CNY 1.08 from CNY 1.29. Additionally, they repurchased approximately 875k shares for CNY 23 million recently.

- Click here and access our complete health analysis report to understand the dynamics of Shanghai Zhongchen Electronic TechnologyLtd.

Understand Shanghai Zhongchen Electronic TechnologyLtd's track record by examining our Past report.

Zhongshan Broad-Ocean Motor (SZSE:002249)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhongshan Broad-Ocean Motor Co., Ltd. operates in the motor systems sector in China and has a market capitalization of approximately CN¥13.29 billion.

Operations: Broad-Ocean Motor generates revenue primarily from its motor systems business in China. The company has a market capitalization of approximately CN¥13.29 billion, reflecting its scale in the sector.

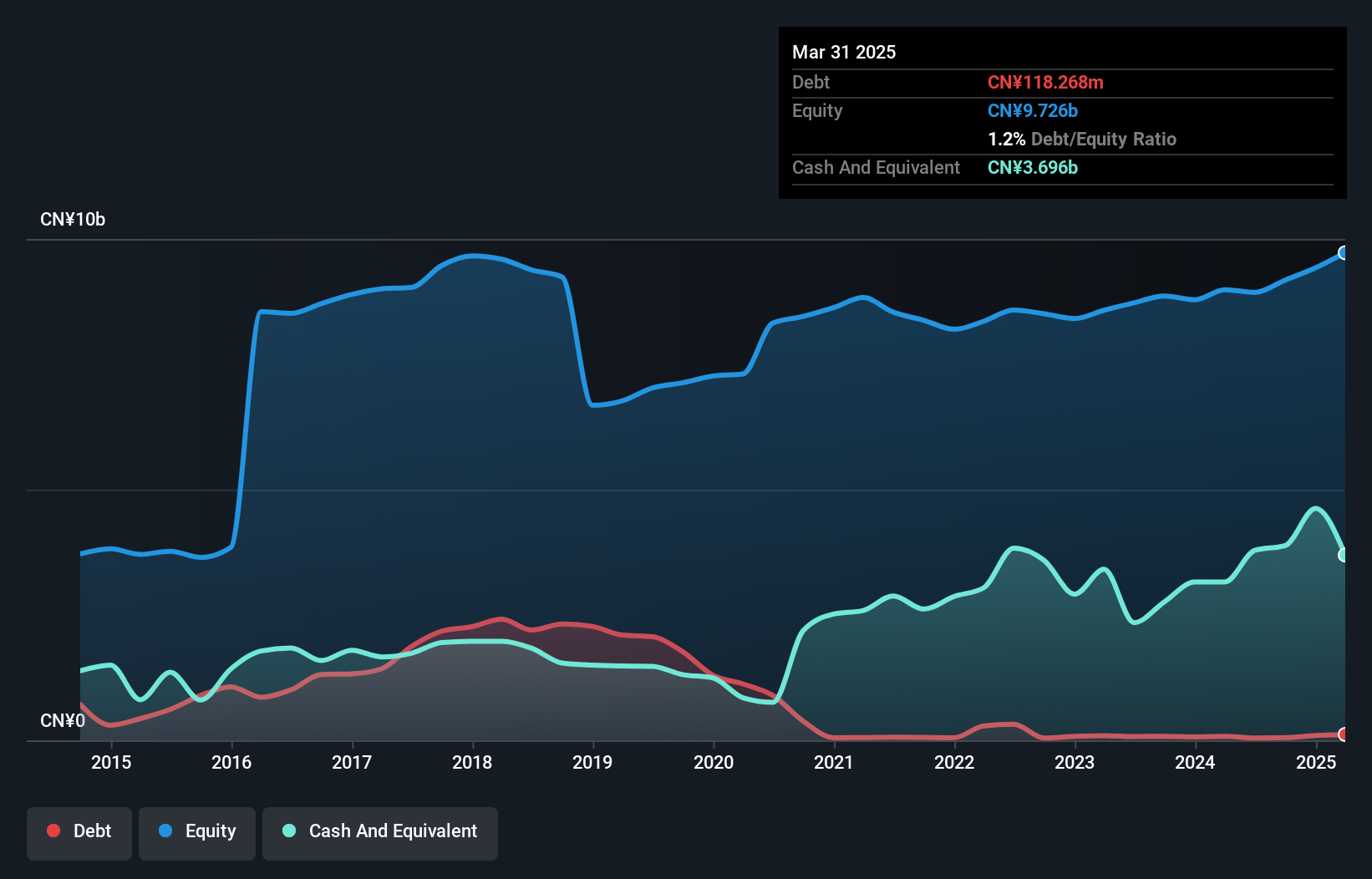

Broad-Ocean Motor, a small player in the motor industry, has shown promising financial health recently. Over the past five years, its debt-to-equity ratio impressively dropped from 24.8% to 0.6%, indicating effective debt management. The company reported earnings growth of 50.4% last year, outpacing the electrical industry's modest 1.1%. This growth is supported by high-quality earnings and robust interest coverage capabilities. Trading at a significant discount of about 50% below its estimated fair value adds appeal for potential investors seeking undervalued opportunities. Additionally, their recent share repurchase program highlights a commitment to enhancing shareholder value through strategic buybacks worth up to CNY 200 million.

Chugin Financial GroupInc (TSE:5832)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chugin Financial Group, Inc., via its subsidiary The Chugoku Bank, Limited, offers a range of financial services to both corporate and individual clients in Japan, with a market capitalization of ¥290.18 billion.

Operations: Chugin Financial Group, Inc., primarily generates revenue through its subsidiary, The Chugoku Bank, Limited, by offering financial services to corporate and individual clients in Japan. The company's net profit margin is a key indicator of its profitability.

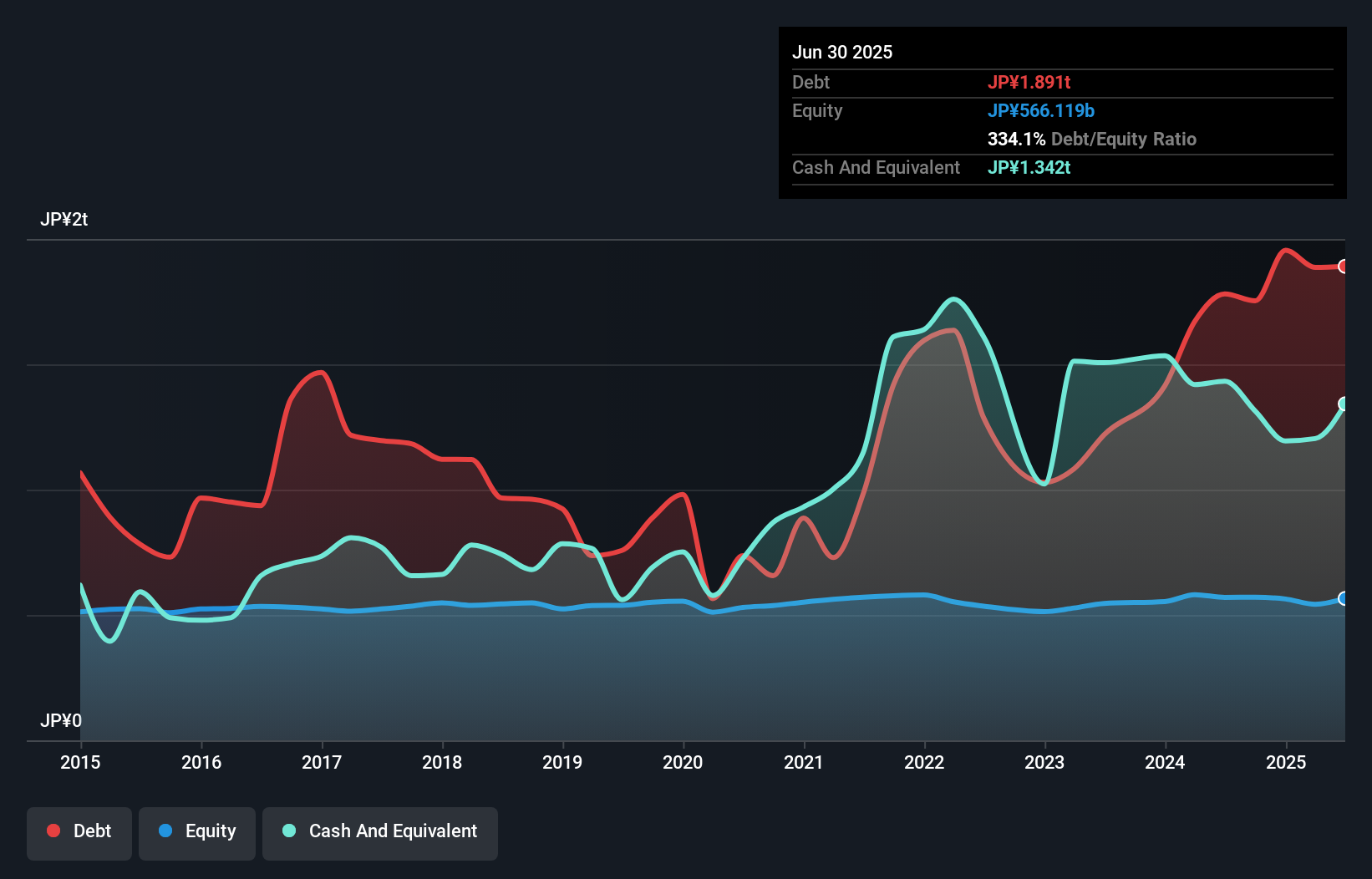

Chugin Financial Group, with assets totaling ¥10,657.6 billion and equity of ¥570.9 billion, seems to be a promising player in the banking sector. Despite an insufficient allowance for bad loans at 56%, its non-performing loans are appropriately low at 1.7%. The company has demonstrated robust earnings growth of 26.8% over the past year, outpacing the industry average of 22.6%. Additionally, Chugin's funding is primarily low-risk due to customer deposits making up 80% of liabilities. Recent activities include share repurchases worth ¥4,999 million and a dividend increase to ¥26.50 per share for Q2 fiscal year ending March 2025.

Where To Now?

- Access the full spectrum of 4630 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5832

Chugin Financial GroupInc

Through its subsidiary The Chugoku Bank, Limited, provides various financial services to corporate and individual customers in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives