Getting In Cheap On Zhejiang Sanhua Intelligent Controls Co.,Ltd (SZSE:002050) Is Unlikely

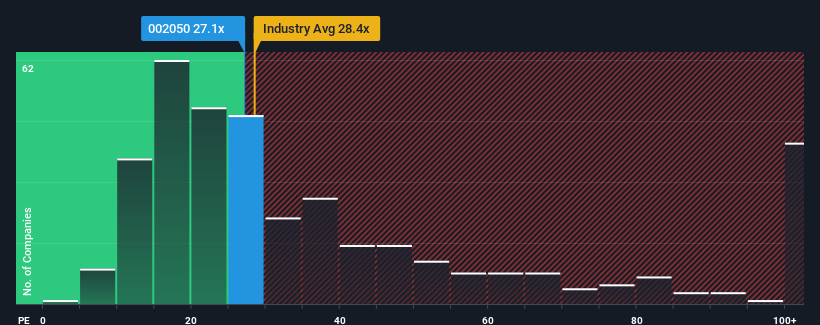

There wouldn't be many who think Zhejiang Sanhua Intelligent Controls Co.,Ltd's (SZSE:002050) price-to-earnings (or "P/E") ratio of 27.1x is worth a mention when the median P/E in China is similar at about 29x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Zhejiang Sanhua Intelligent ControlsLtd certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Zhejiang Sanhua Intelligent ControlsLtd

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Zhejiang Sanhua Intelligent ControlsLtd would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a decent 6.4% gain to the company's bottom line. Pleasingly, EPS has also lifted 78% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 17% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 25% per annum, which is noticeably more attractive.

With this information, we find it interesting that Zhejiang Sanhua Intelligent ControlsLtd is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Zhejiang Sanhua Intelligent ControlsLtd's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Zhejiang Sanhua Intelligent ControlsLtd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Zhejiang Sanhua Intelligent ControlsLtd you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Sanhua Intelligent ControlsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002050

Zhejiang Sanhua Intelligent ControlsLtd

Engages in the research, manufacture, and sale of refrigeration and air-conditioning electrical parts, and auto parts in China and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives