- China

- /

- Electronic Equipment and Components

- /

- SZSE:301379

Discovering Hidden Opportunities These 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments and monetary policy shifts, small-cap stocks have faced challenges with the Russell 2000 Index underperforming compared to its larger peers. Amidst this backdrop, investors are increasingly on the lookout for hidden opportunities that may offer strong potential despite broader market volatility. Identifying promising stocks often involves assessing their fundamentals, growth prospects, and resilience in uncertain times—qualities that can transform these lesser-known equities into valuable assets in an investor's portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| VICOM | NA | 3.60% | -2.15% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Komori | 9.77% | 7.35% | 59.64% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

| NCD | nan | nan | nan | ☆☆☆☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Chongqing Xishan Science & Technology (SHSE:688576)

Simply Wall St Value Rating: ★★★★★★

Overview: Chongqing Xishan Science & Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥3.23 billion.

Operations: Chongqing Xishan Science & Technology generates revenue primarily from its technology-related activities. The company's net profit margin is a key financial metric, reflecting the efficiency of its operations and cost management.

Chongqing Xishan Science & Technology, a small player in the industry, has shown resilience with earnings growth of 22.4% over the past year, outpacing the Medical Equipment sector's -8.8%. The company remains debt-free and trades at 4.1% below its estimated fair value. Despite reporting sales of CNY 207 million for nine months ending September 2024, slightly down from CNY 214 million the previous year, net income improved to CNY 66 million from CNY 65 million. Recent strategic moves include repurchasing shares worth CNY 87 million as part of a larger buyback plan aimed at enhancing shareholder value.

Pamica Technology (SZSE:001359)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pamica Technology Corporation specializes in the research, development, production, and sale of mica insulation materials, glass fiber cloth, and new energy insulation materials with a market capitalization of CN¥4.82 billion.

Operations: Pamica Technology's revenue is primarily derived from the sale of mica insulation materials, glass fiber cloth, and new energy insulation materials. The company's gross profit margin has shown variability across different reporting periods.

Pamica Technology, a small player in the tech arena, has shown promising growth with earnings rising by 30.7% over the past year, outpacing the Electrical industry’s 1.1%. Despite trading at 40.2% below its estimated fair value, Pamica's financials indicate strength; it covers interest payments comfortably and holds more cash than total debt. Recent reports highlight sales of CNY 776.85 million for nine months ending September 2024, up from CNY 676.98 million last year, alongside net income climbing to CNY 163.72 million from CNY 123.87 million previously—a testament to its robust performance and potential future growth prospects.

Techshine ElectronicsLtd (SZSE:301379)

Simply Wall St Value Rating: ★★★★★★

Overview: Techshine Electronics Co., Ltd. focuses on the R&D, design, production, and sales of LCD displays and related modules in China with a market cap of CN¥3.06 billion.

Operations: Techshine Electronics generates revenue primarily from electronic components and parts, amounting to CN¥1.37 billion.

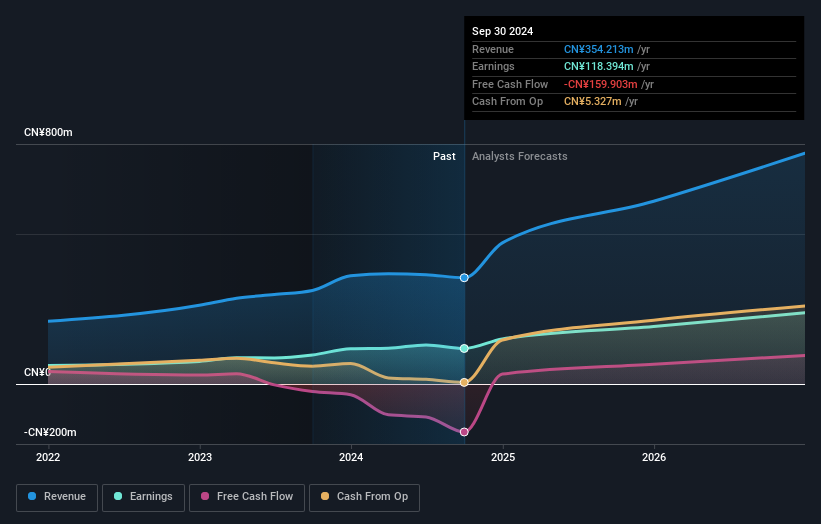

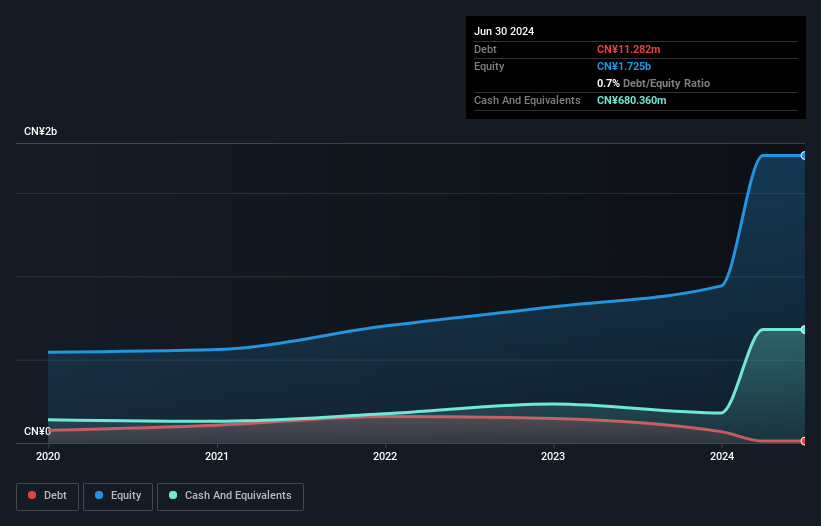

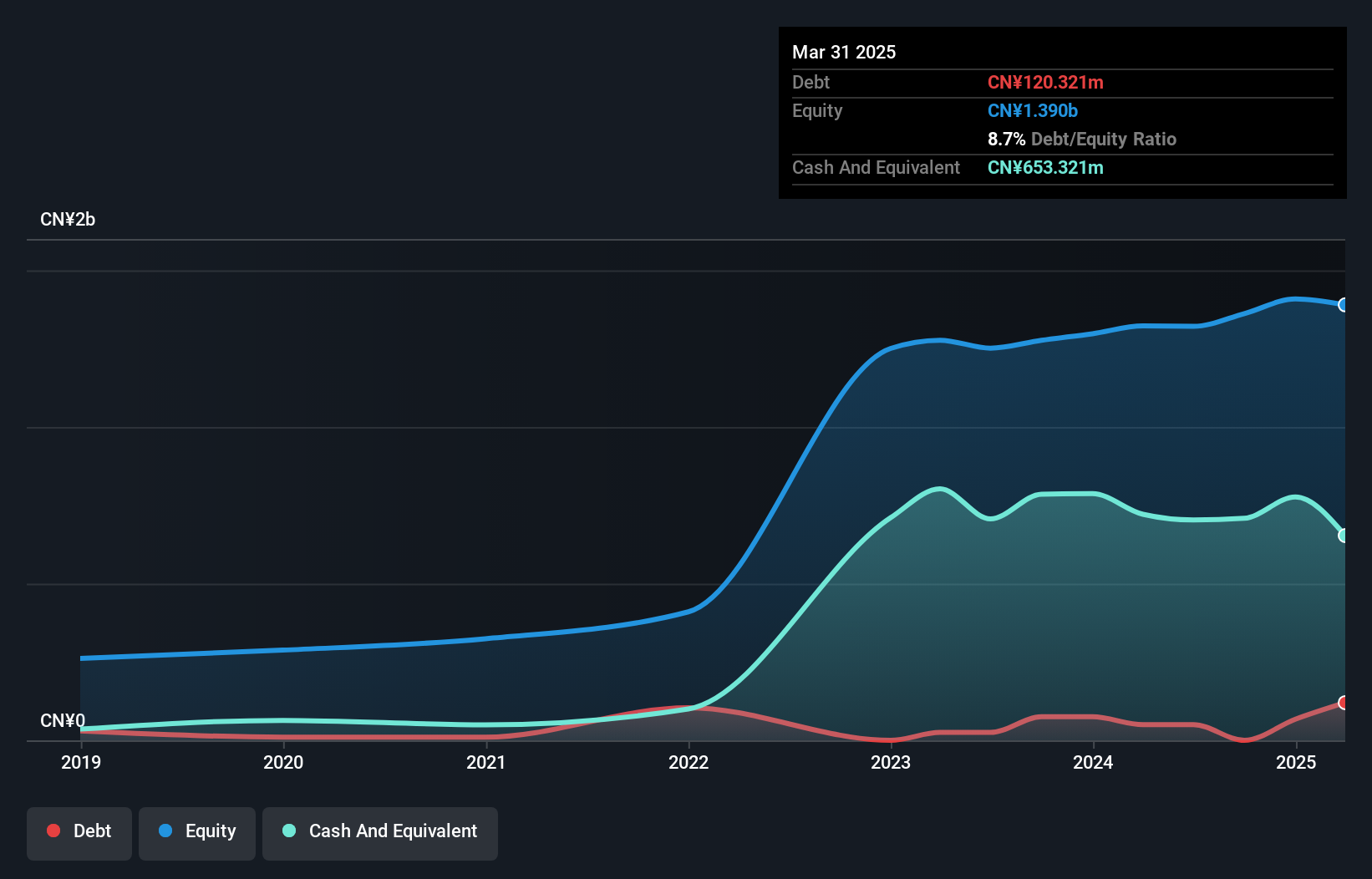

Techshine Electronics, a promising player in the electronics sector, has shown notable progress with earnings rising by 12% over the past year, outpacing the industry average of 2%. The company reported sales of CN¥1.06 billion for the first nine months of 2024, up from CN¥950.71 million last year. Net income reached CN¥104.79 million compared to CN¥86.95 million previously, reflecting its robust performance despite a significant one-off gain of CN¥27.1 million affecting recent results. With a price-to-earnings ratio at 24x—lower than China's market average—and operating debt-free for five years now, Techshine seems well-positioned financially and competitively within its industry context.

- Navigate through the intricacies of Techshine ElectronicsLtd with our comprehensive health report here.

Evaluate Techshine ElectronicsLtd's historical performance by accessing our past performance report.

Next Steps

- Embark on your investment journey to our 4625 Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Techshine ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301379

Techshine ElectronicsLtd

Engages in the research and development, design, production, and sale of LCD liquid crystal displays, LCM black and white modules, and TFT color screen modules in China.

Flawless balance sheet with acceptable track record.