- China

- /

- Tech Hardware

- /

- SZSE:301202

EMRO And 2 More Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by central bank rate cuts and varied index performances, small-cap stocks have faced challenges, with the Russell 2000 Index underperforming against larger counterparts like the S&P 500. In this environment, discerning investors might find opportunities in lesser-known companies that possess strong fundamentals and resilience amid economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.98% | 9.72% | 30.78% | ★★★★★★ |

| VICOM | NA | 3.60% | -2.15% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Komori | 9.77% | 7.35% | 59.64% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

EMRO (KOSDAQ:A058970)

Simply Wall St Value Rating: ★★★★★★

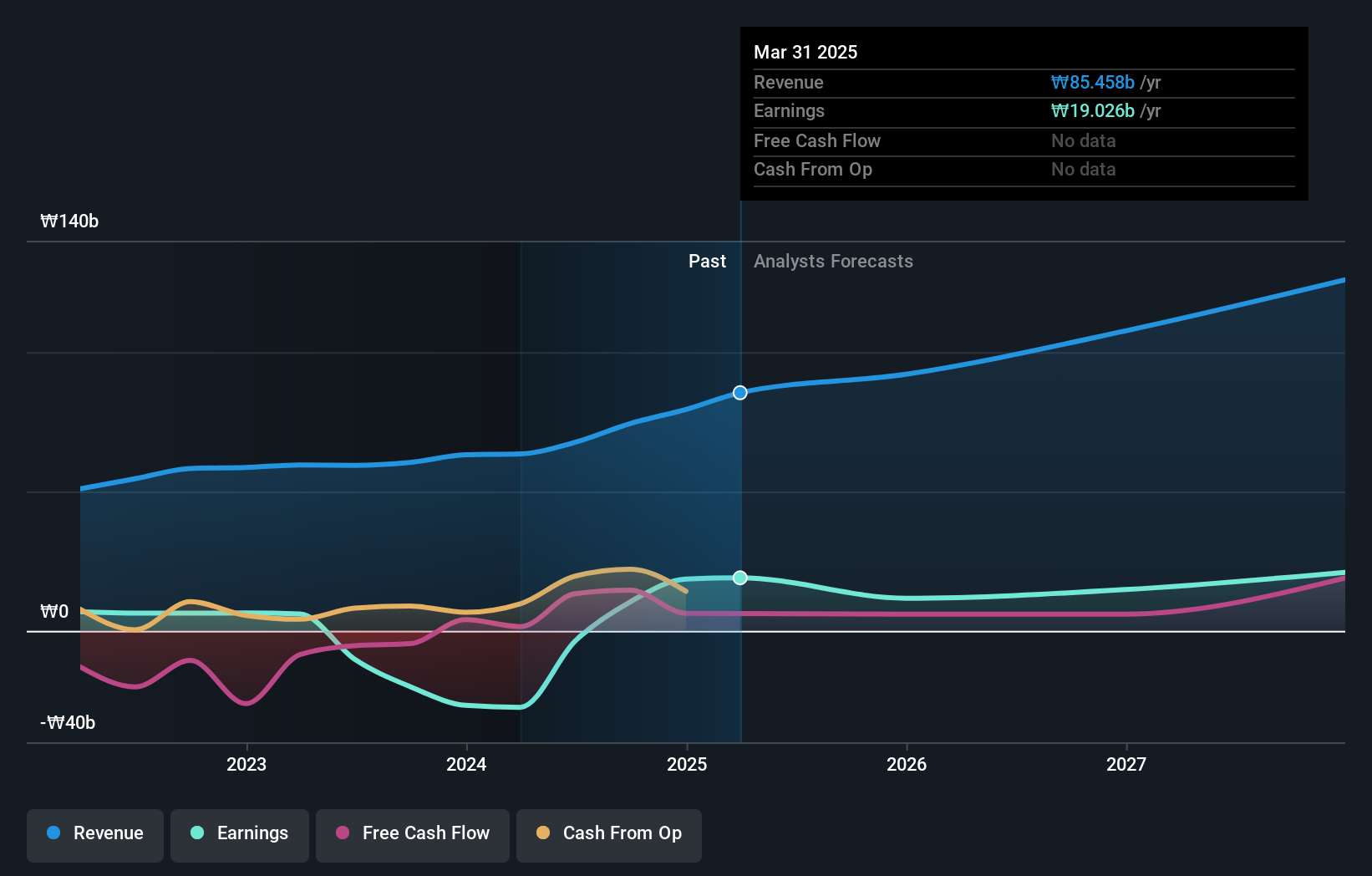

Overview: EMRO, Incorporated offers supply chain management software solutions both in South Korea and internationally, with a market cap of ₩827.81 billion.

Operations: EMRO generates revenue primarily from cattle sales, amounting to ₩74.43 billion.

EMRO, a nimble player in its sector, recently turned profitable, aligning with high-quality earnings. The company is debt-free and has maintained this status over the past five years. Despite shareholder dilution in the last year, EMRO's free cash flow turned positive at US$14.57 million by September 2024 after previous fluctuations. Capital expenditure was consistent at around US$4.94 million during the same period, suggesting disciplined investment strategies likely bolstered performance. Earnings are projected to grow annually by 6%, indicating potential for future expansion despite recent challenges in shareholder equity adjustments.

- Click here and access our complete health analysis report to understand the dynamics of EMRO.

Assess EMRO's past performance with our detailed historical performance reports.

Suzhou Longway Eletronic Machinery (SZSE:301202)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Longway Electronic Machinery Co., Ltd specializes in the research, development, production, sale, and service of data center cabinets and integrated wiring products in China and has a market cap of CN¥4.81 billion.

Operations: Longway Electronic Machinery generates revenue primarily from the sale of server cabinets, hot and cold aisles, micro modules, and T-block racks. The company's net profit margin shows a notable trend over recent periods.

Suzhou Longway Electronic Machinery, a smaller player in its field, shows promising financial health with earnings growth of 6.8% over the past year, outpacing the tech industry’s -0.7%. The company's debt to equity ratio impressively decreased from 83.5% to 10.4% over five years, indicating effective debt management. Despite a volatile share price recently, Suzhou Longway remains free cash flow positive and has more cash than total debt, suggesting robust financial footing. Recent earnings reveal sales of CNY 896 million and net income of CNY 55 million for nine months ending September 2024, reflecting solid operational performance amidst executive changes and strategic meetings focusing on board elections and profit distribution plans.

Nitta (TSE:5186)

Simply Wall St Value Rating: ★★★★★★

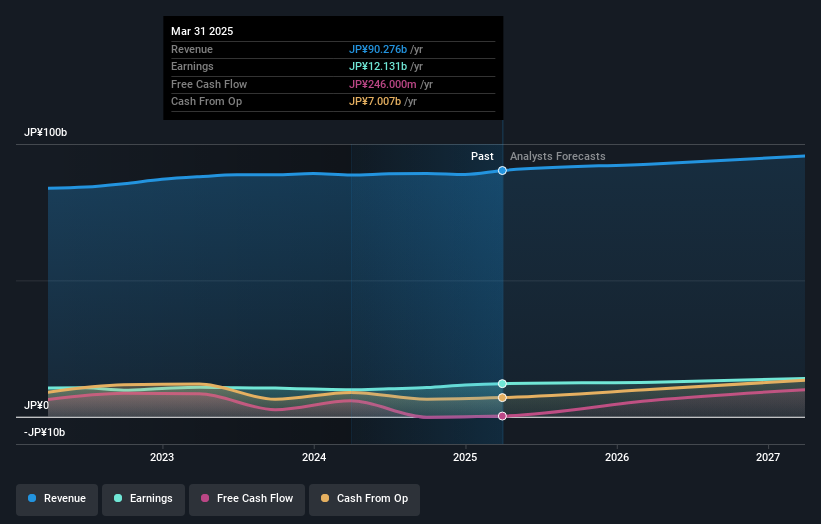

Overview: Nitta Corporation, with a market cap of ¥100.23 billion, specializes in the production and distribution of power transmission belts, conveyor belts and units, serving both domestic and international markets.

Operations: Nitta Corporation generates significant revenue from its Hose Tube Product Business and Belt/Rubber Products Business, with ¥31.90 billion and ¥29.21 billion respectively. The Chemical Products Business also contributes notably to the company's revenue at ¥12.39 billion.

Known for its solid footing in the machinery sector, Nitta has shown a promising trajectory with earnings growth of 1.7% over the past year, outpacing the industry average of 0.8%. Its debt to equity ratio has impressively reduced from 0.3 to 0.1 over five years, highlighting financial prudence. Trading at a significant discount of 54% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Despite not being free cash flow positive, Nitta's high-quality earnings and strong interest coverage indicate robust operational health and resilience in navigating industry challenges while maintaining profitability prospects.

- Click here to discover the nuances of Nitta with our detailed analytical health report.

Gain insights into Nitta's past trends and performance with our Past report.

Turning Ideas Into Actions

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4622 more companies for you to explore.Click here to unveil our expertly curated list of 4625 Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301202

Suzhou Longway Eletronic Machinery

Engages in the research, development, production, sale, and service of server cabinets, hot and cold aisles, micro modules, T-block racks, and other data center cabinets and integrated wiring products in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives