- China

- /

- Oil and Gas

- /

- SZSE:000096

Hidden Opportunities In Undiscovered Gems This December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape of interest rate adjustments and economic indicators, small-cap stocks have faced challenges, with the Russell 2000 Index underperforming larger counterparts like the S&P 500. Amidst this backdrop, investors are increasingly seeking hidden opportunities in less prominent stocks that may offer potential growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.98% | 9.72% | 30.78% | ★★★★★★ |

| VICOM | NA | 3.60% | -2.15% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Komori | 9.77% | 7.35% | 59.64% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Abu Dhabi National Hotels Company PJSC (ADX:ADNH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Abu Dhabi National Hotels Company PJSC operates and manages hotels in the United Arab Emirates with a market capitalization of AED6.99 billion.

Operations: ADNH generates revenue primarily from its hotels segment, contributing AED1.39 billion, and transport services, adding AED302.40 million. The company's financials include adjustments and elimination entries that impact overall figures.

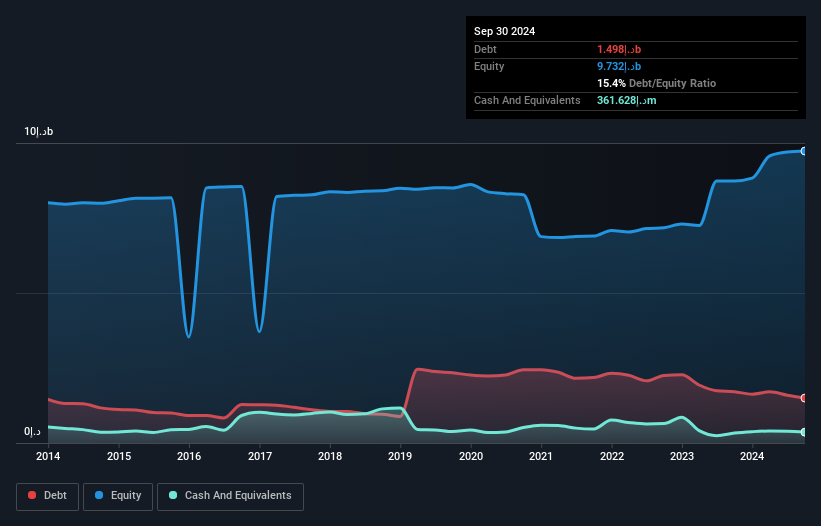

Abu Dhabi National Hotels Company PJSC, a noteworthy player in the hospitality sector, has shown impressive earnings growth of 218.6% over the past year, outpacing the industry's 7.7%. With a debt to equity ratio reduced from 27.5% to 15.4% over five years and net debt to equity at a satisfactory 11.7%, its financial health appears robust. Despite trading at nearly 69% below estimated fair value, earnings are projected to decrease by an average of 19% annually for three years ahead. Recent results highlight sales of AED1.92 billion for nine months ending September, up from AED1.11 billion last year, while net income soared to AED1.18 billion compared to AED288 million previously.

Keeson Technology (SHSE:603610)

Simply Wall St Value Rating: ★★★★★☆

Overview: Keeson Technology Corporation Limited is engaged in the research, development, production, and sale of smart beds, mattresses, and pillows globally with a market capitalization of CN¥3.79 billion.

Operations: Keeson Technology generates revenue primarily from the sale of smart beds, mattresses, and pillows worldwide. The company's financial performance is characterized by its gross profit margin trend, which has shown variability across reporting periods.

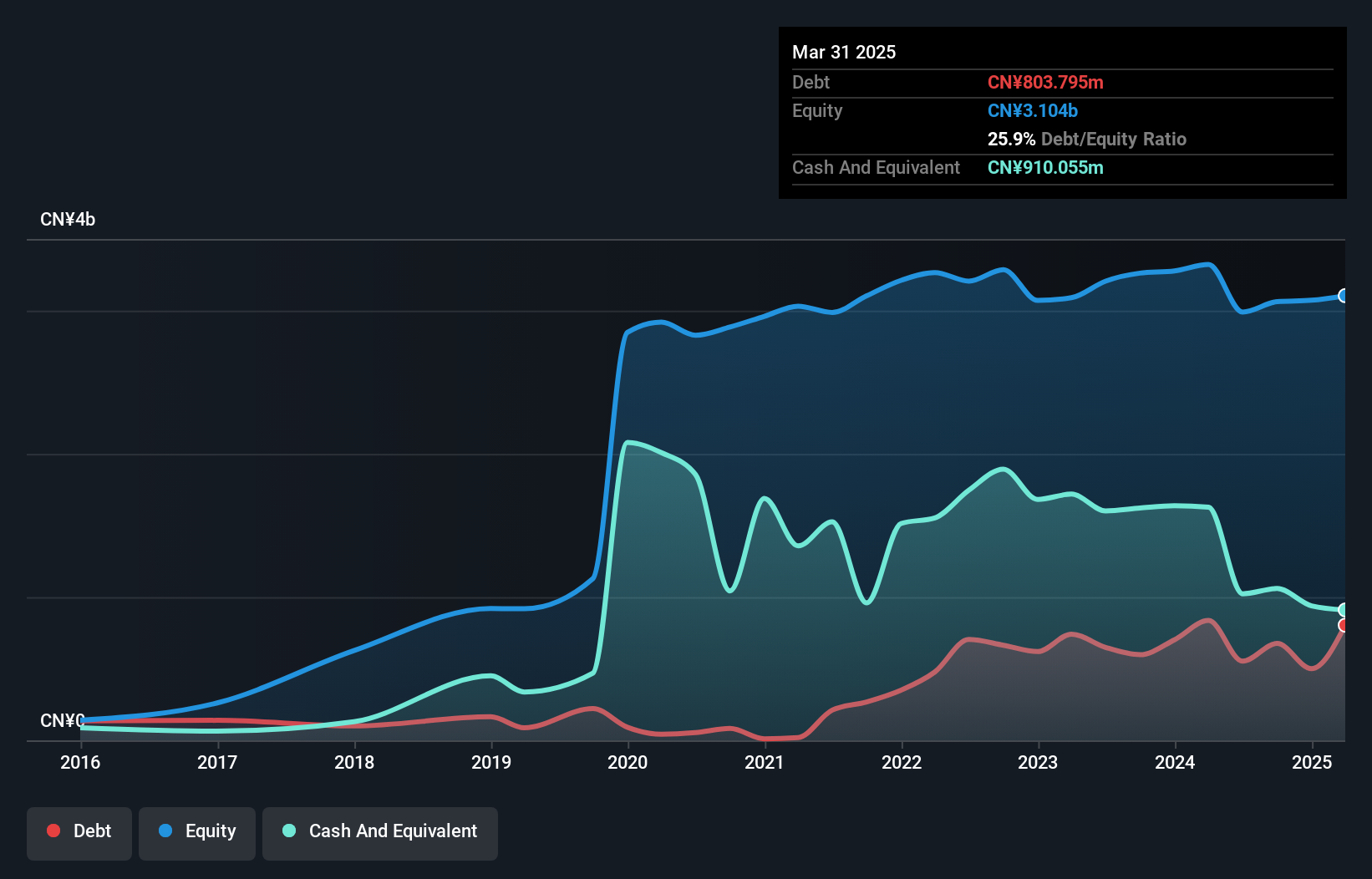

Keeson Technology, a relatively small player in the Consumer Durables sector, has shown impressive earnings growth of 252.8% over the past year, outpacing industry trends. Despite a significant one-off loss of CN¥64M impacting recent financial results, its interest payments are well covered by EBIT at 265 times. The company's price-to-earnings ratio stands at 22.9x, which is favorable compared to the broader Chinese market average of 37.3x. Though Keeson's net income for the first nine months of 2024 was CN¥151M compared to last year's CN¥186M, it remains profitable with more cash than total debt on its books.

Shenzhen Guangju Energy (SZSE:000096)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Guangju Energy Co., Ltd. operates in the storage, transportation, and distribution of liquefied petroleum gas both within China and internationally, with a market cap of CN¥6.61 billion.

Operations: Guangju Energy generates revenue primarily through the storage, transportation, and distribution of liquefied petroleum gas. The company has a market capitalization of CN¥6.61 billion.

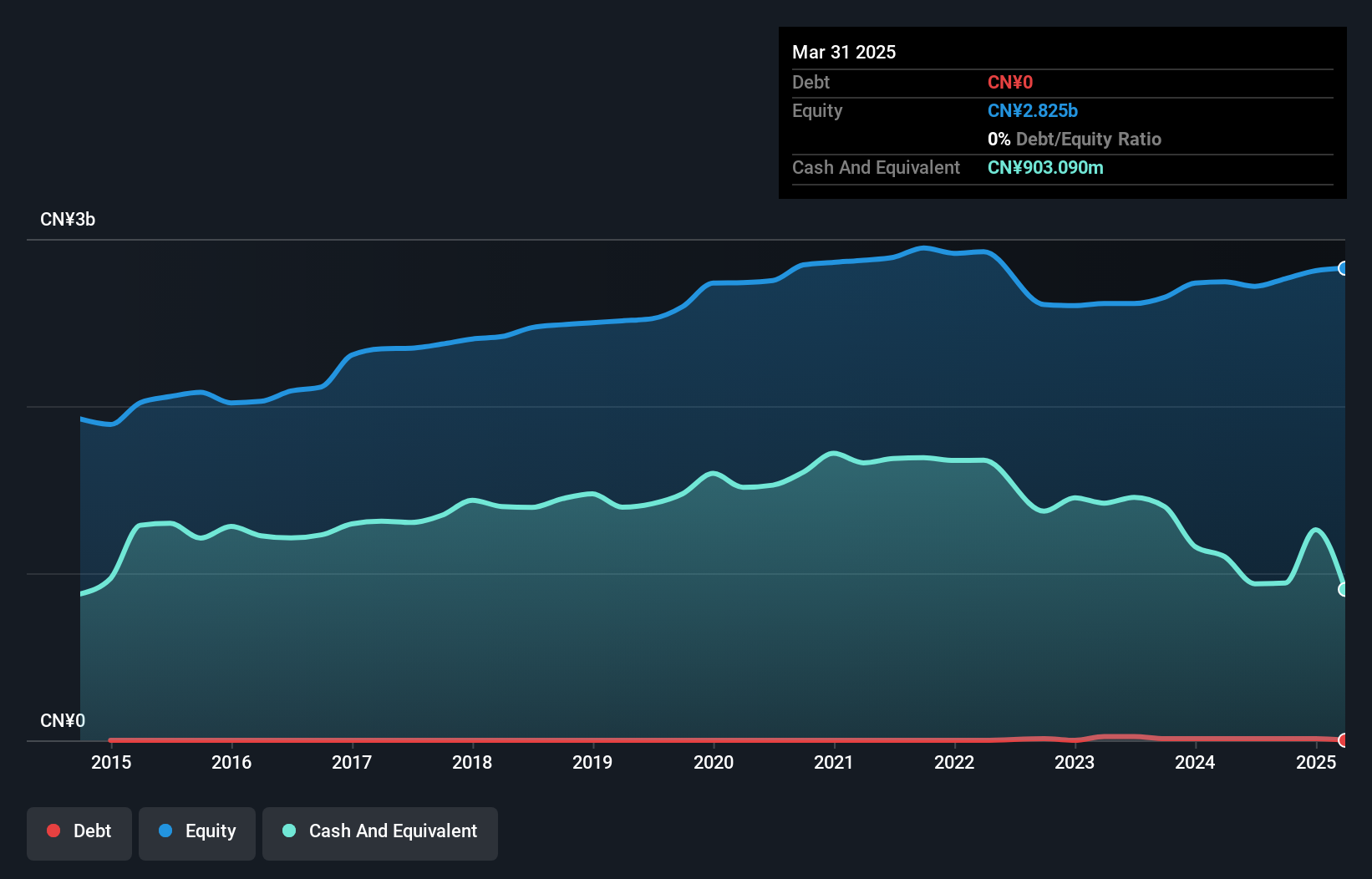

Shenzhen Guangju Energy, a smaller player in the energy sector, has shown notable resilience with a recent earnings growth of 74.6%, outpacing the industry's -16.6%. Despite a modest increase in its debt to equity ratio from 0% to 0.4% over five years, the company remains profitable and not burdened by interest payments due to sufficient coverage. Over nine months ending September 30, 2024, sales reached CNY 1.53 billion while net income improved to CNY 66.91 million from CNY 60.21 million last year; basic earnings per share rose slightly to CNY 0.1267 from CNY 0.114 previously.

- Navigate through the intricacies of Shenzhen Guangju Energy with our comprehensive health report here.

Evaluate Shenzhen Guangju Energy's historical performance by accessing our past performance report.

Key Takeaways

- Delve into our full catalog of 4625 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000096

Shenzhen Guangju Energy

Engages in the storage, transportation, and distribution of liquefied petroleum gas in China and internationally.

Excellent balance sheet with proven track record.