- China

- /

- Electronic Equipment and Components

- /

- SZSE:002808

Top Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with U.S. stocks showing resilience despite some economic headwinds, investors are looking for opportunities across various sectors. Penny stocks, although an older term, remain relevant as they represent smaller or newer companies that can offer significant growth potential when backed by strong financials. In this article, we explore three penny stocks that stand out for their financial robustness and potential upside in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.14B | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £425.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.01 | £757.4M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.70 | HK$40.08B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.87 | £469.45M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.966 | £152.38M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,823 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Infore Environment Technology Group (SZSE:000967)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Infore Environment Technology Group Co., Ltd. operates in the environmental technology sector, focusing on providing comprehensive environmental management services, with a market cap of approximately CN¥15.17 billion.

Operations: No revenue segments are reported for the company.

Market Cap: CN¥15.17B

Infore Environment Technology Group shows a mixed financial profile, with operating cash flow well covering its debt and more cash than total debt, indicating strong liquidity. However, the company's earnings have declined significantly over the past five years. The dividend yield of 2.56% is not supported by free cash flows, raising sustainability concerns. Despite stable weekly volatility and an experienced management team, the return on equity remains low at 2.8%. Recent earnings reports show slight revenue growth to CN¥9.28 billion for the first nine months of 2024 but stagnant net income compared to last year.

- Click here and access our complete financial health analysis report to understand the dynamics of Infore Environment Technology Group.

- Evaluate Infore Environment Technology Group's prospects by accessing our earnings growth report.

Suzhou Goldengreen Technologies (SZSE:002808)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Suzhou Goldengreen Technologies Ltd. researches, develops, manufactures, and sells laser organic photo-conductor drum products in China, with a market cap of CN¥835.97 million.

Operations: No specific revenue segments have been reported for Suzhou Goldengreen Technologies.

Market Cap: CN¥835.97M

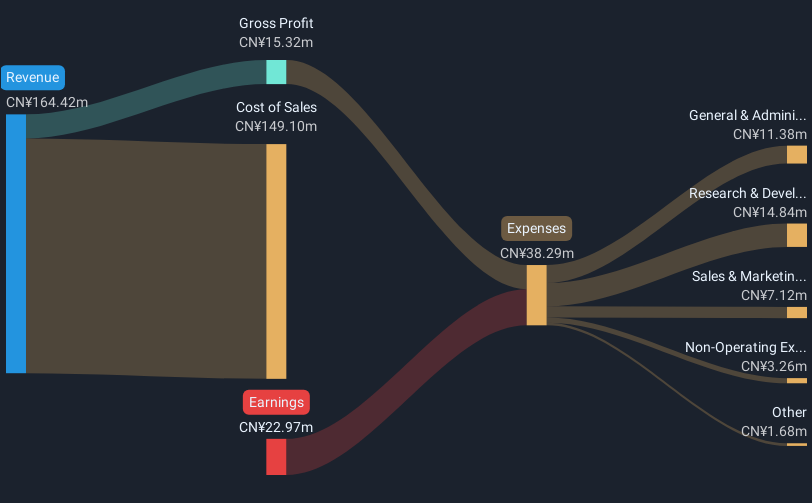

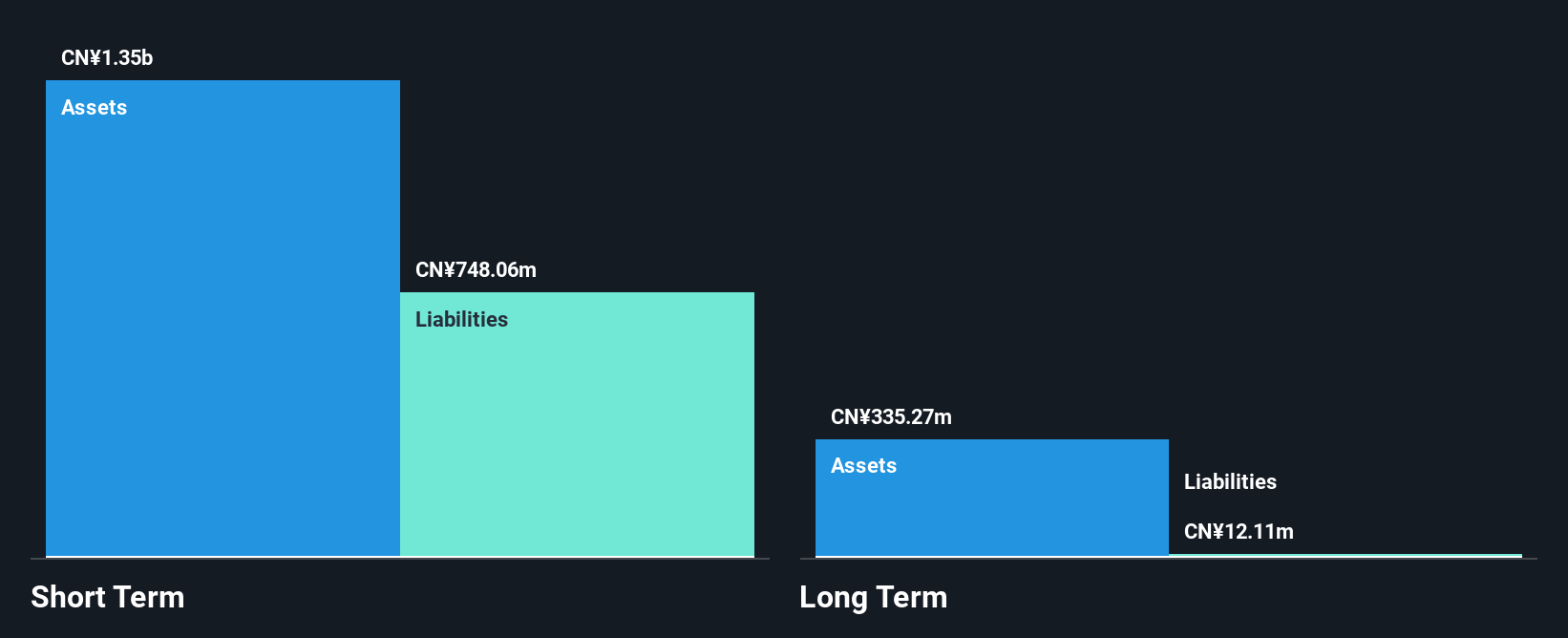

Suzhou Goldengreen Technologies presents a complex investment picture. The company has demonstrated revenue growth, with sales reaching CN¥115.67 million for the first nine months of 2024, up from CN¥105.67 million the previous year, while also reducing net losses to CN¥17.05 million from CN¥26.69 million. Despite this progress, it remains unprofitable with a negative return on equity and increased debt-to-equity ratio over five years. On the positive side, its short-term assets significantly exceed liabilities and cash reserves cover more than a year's runway at current burn rates, supported by an experienced management team averaging 14 years tenure.

- Take a closer look at Suzhou Goldengreen Technologies' potential here in our financial health report.

- Explore historical data to track Suzhou Goldengreen Technologies' performance over time in our past results report.

Jiangsu Baoli International Investment (SZSE:300135)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jiangsu Baoli International Investment Co., Ltd. operates in various investment sectors and has a market cap of CN¥3.47 billion.

Operations: The company's revenue is primarily generated from its operations in China, amounting to CN¥2.33 billion.

Market Cap: CN¥3.47B

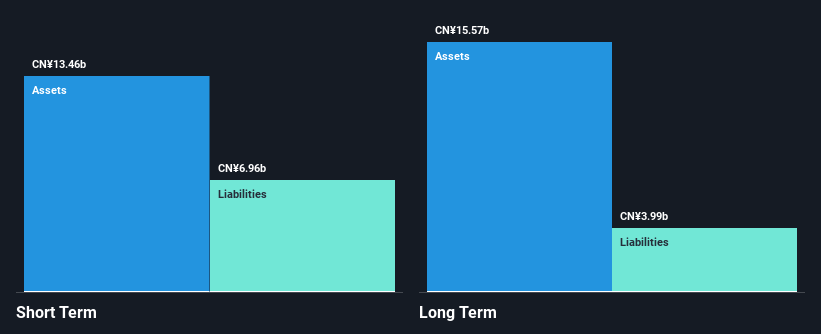

Jiangsu Baoli International Investment Co., Ltd. faces challenges as it remains unprofitable, with a negative return on equity of -4.89%. Despite this, the company reported revenue growth to CN¥1.68 billion for the first nine months of 2024, up from CN¥1.50 billion the previous year, and increased net income to CN¥6.97 million from CN¥2.53 million a year ago. The company boasts an experienced management team and board, with average tenures of 3.3 and 5.2 years respectively, while short-term assets surpass liabilities by a comfortable margin despite high net debt levels at 42%.

- Unlock comprehensive insights into our analysis of Jiangsu Baoli International Investment stock in this financial health report.

- Learn about Jiangsu Baoli International Investment's historical performance here.

Next Steps

- Unlock more gems! Our Penny Stocks screener has unearthed 5,820 more companies for you to explore.Click here to unveil our expertly curated list of 5,823 Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002808

Suzhou Goldengreen Technologies

Researches, develops, manufactures, and sells laser organic photo-conductor drum products in China.

Excellent balance sheet very low.