- China

- /

- Trade Distributors

- /

- SZSE:000151

Optimistic Investors Push China National Complete Plant Import & Export Corporation Limited (SZSE:000151) Shares Up 29% But Growth Is Lacking

China National Complete Plant Import & Export Corporation Limited (SZSE:000151) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

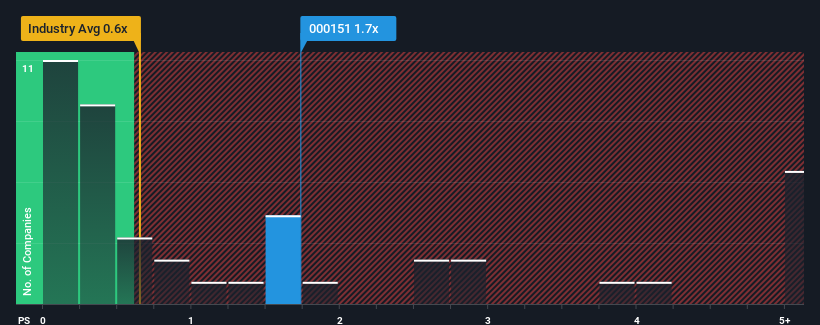

Following the firm bounce in price, given close to half the companies operating in China's Trade Distributors industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider China National Complete Plant Import & Export as a stock to potentially avoid with its 1.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for China National Complete Plant Import & Export

What Does China National Complete Plant Import & Export's Recent Performance Look Like?

As an illustration, revenue has deteriorated at China National Complete Plant Import & Export over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China National Complete Plant Import & Export will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, China National Complete Plant Import & Export would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 52%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 17% shows it's noticeably less attractive.

In light of this, it's alarming that China National Complete Plant Import & Export's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On China National Complete Plant Import & Export's P/S

The large bounce in China National Complete Plant Import & Export's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that China National Complete Plant Import & Export currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with China National Complete Plant Import & Export.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000151

China National Complete Plant Import & Export

Trades in of equipment in Asia, Africa, Latin America, and internationally.

Excellent balance sheet minimal.

Market Insights

Community Narratives