- China

- /

- Aerospace & Defense

- /

- SHSE:688511

Sichuan Tianwei Electronic Co.,Ltd.'s (SHSE:688511) 36% Price Boost Is Out Of Tune With Earnings

Sichuan Tianwei Electronic Co.,Ltd. (SHSE:688511) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 45% over that time.

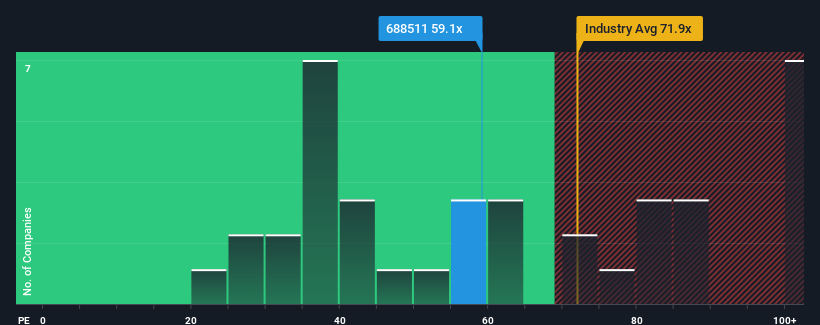

Since its price has surged higher, Sichuan Tianwei ElectronicLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 59.1x, since almost half of all companies in China have P/E ratios under 33x and even P/E's lower than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For instance, Sichuan Tianwei ElectronicLtd's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Sichuan Tianwei ElectronicLtd

Is There Enough Growth For Sichuan Tianwei ElectronicLtd?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Sichuan Tianwei ElectronicLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 46% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 86% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 37% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Sichuan Tianwei ElectronicLtd is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Shares in Sichuan Tianwei ElectronicLtd have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Sichuan Tianwei ElectronicLtd revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 4 warning signs for Sichuan Tianwei ElectronicLtd (2 are a bit concerning!) that you need to take into consideration.

You might be able to find a better investment than Sichuan Tianwei ElectronicLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688511

Sichuan Tianwei ElectronicLtd

Engages in production and sale of high-speed automatic fire suppression and explosion suppression systems, high-energy aviation ignition discharge devices, and high-precision fuse devices in China.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives