Uncovering Hidden Gems In None With Strong Financial Foundations

Reviewed by Simply Wall St

In a global market characterized by rising inflation and volatile treasury yields, major U.S. stock indexes such as the S&P 500 and Nasdaq Composite are nearing record highs, while small-cap stocks like those in the Russell 2000 have lagged behind their larger counterparts. Amid this backdrop of economic uncertainty and cautious optimism, uncovering stocks with strong financial foundations can be a prudent strategy for investors seeking stability and potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| NSIA Banque Société Anonyme | 10.33% | 13.42% | 31.75% | ★★★★★☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Taokaenoi Food & Marketing (SET:TKN)

Simply Wall St Value Rating: ★★★★★★

Overview: Taokaenoi Food & Marketing Public Company Limited specializes in the production and distribution of various seaweed snacks, with a market capitalization of THB12.35 billion.

Operations: The company's primary revenue stream is derived from its snack segment, generating THB5.85 billion. Additional income comes from its retailer and restaurant segment, contributing THB107.40 million.

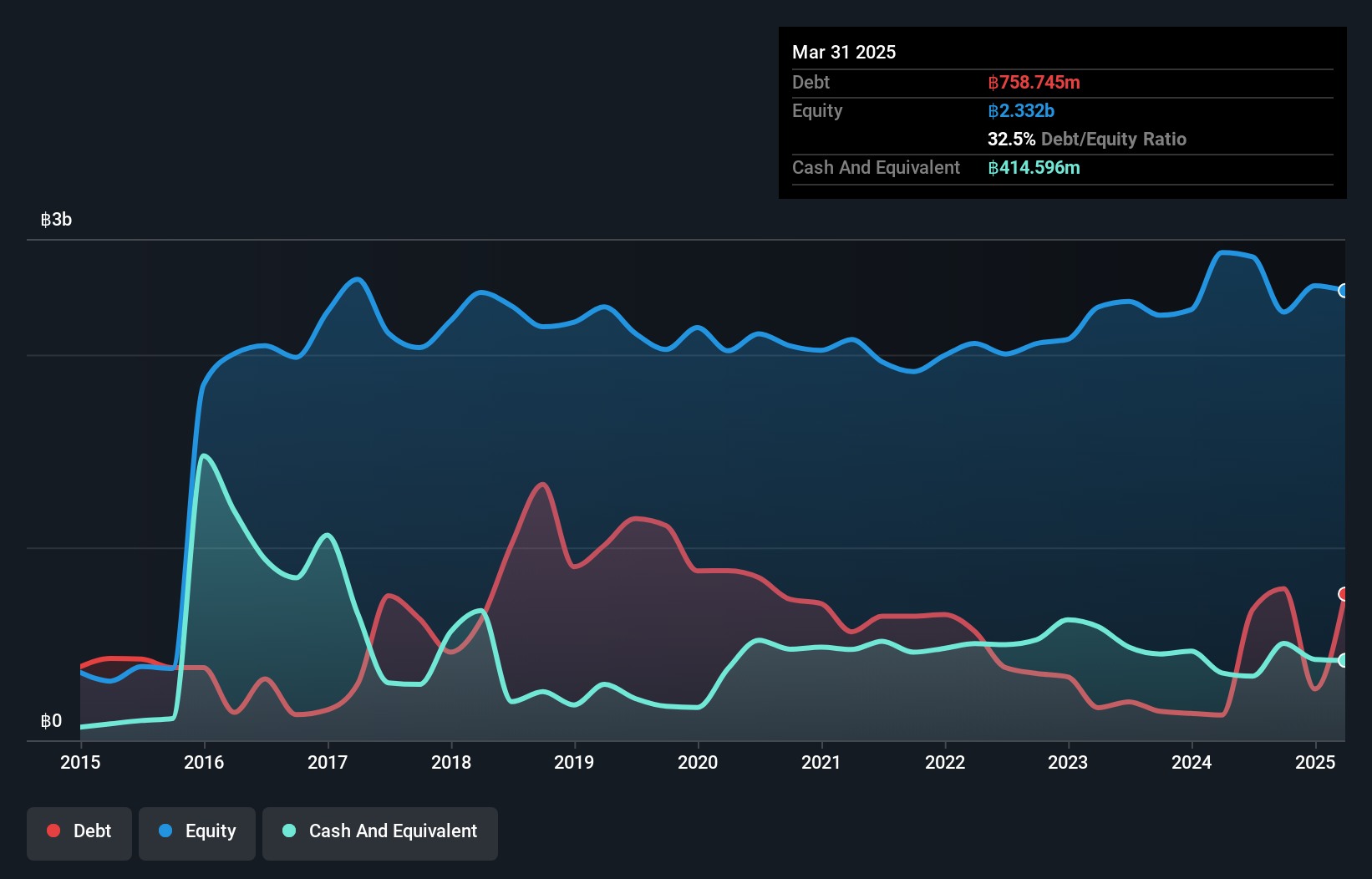

Taokaenoi, a nimble player in the food sector, showcases robust financial health with a net debt to equity ratio of 12.8%, deemed satisfactory. Over the past five years, it has effectively reduced its debt to equity from 54.9% to 35.4%. Earnings have surged at an impressive annual rate of 29.3%, although recent growth of 24% slightly lags behind the industry average of 29.3%. Trading significantly below its estimated fair value by about 69.7%, Taokaenoi also announced a share repurchase program worth THB135 million, aiming to optimize financial management and enhance shareholder returns through increased earnings per share and return on equity.

- Get an in-depth perspective on Taokaenoi Food & Marketing's performance by reading our health report here.

Gain insights into Taokaenoi Food & Marketing's past trends and performance with our Past report.

Nanjing CIGU TechnologyLTD (SHSE:688448)

Simply Wall St Value Rating: ★★★★★★

Overview: Nanjing CIGU Technology Corp., LTD. specializes in the development and industrialization of high-power, high-speed drive equipment and integrated fluid mechanical equipment globally, with a market capitalization of CN¥2.41 billion.

Operations: CIGU Technology derives its revenue primarily from the development and sale of high-power, high-speed drive equipment and integrated fluid mechanical systems. The company's financial performance is highlighted by a market capitalization of CN¥2.41 billion.

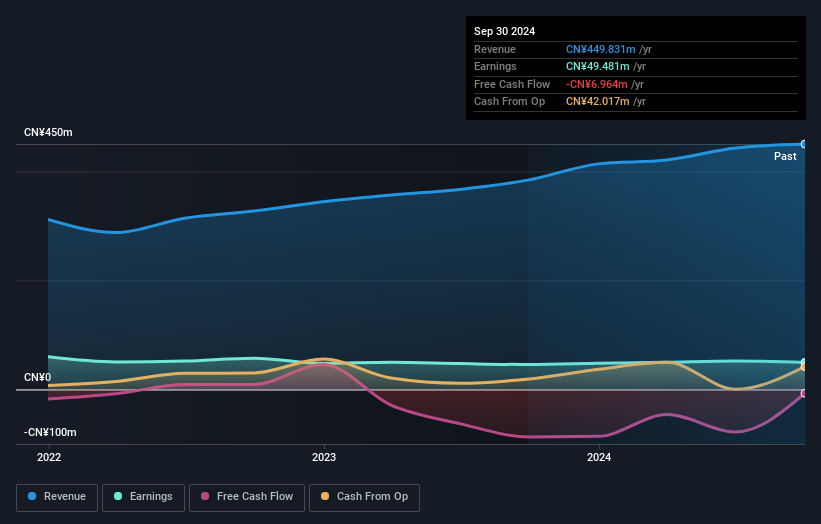

Nanjing CIGU Technology seems to be carving a niche in the machinery sector, with its earnings growth of 8.2% outpacing the industry's -0.06%. The company is debt-free, a significant shift from five years ago when it had a debt-to-equity ratio of 33.8%. A one-off gain of CN¥11 million has influenced recent financial results, suggesting some variability in earnings quality. Despite not being free cash flow positive, recent share repurchases totaling CN¥4.81 million indicate management's confidence in the company's value proposition and commitment to enhancing shareholder returns.

- Delve into the full analysis health report here for a deeper understanding of Nanjing CIGU TechnologyLTD.

Understand Nanjing CIGU TechnologyLTD's track record by examining our Past report.

Japan System Techniques (TSE:4323)

Simply Wall St Value Rating: ★★★★★★

Overview: Japan System Techniques Co., Ltd. operates in the software industry both domestically and internationally, with a market capitalization of ¥48.66 billion.

Operations: Japan System Techniques Co., Ltd. generates revenue through its software business, serving both domestic and international markets. The company's financial performance is highlighted by a market capitalization of ¥48.66 billion, reflecting its position in the industry.

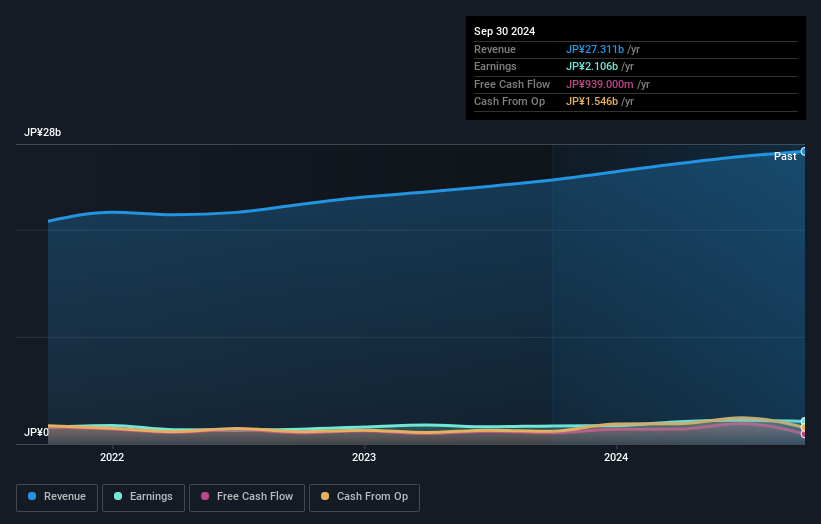

Japan System Techniques, a nimble player in the tech space, has been making waves with its robust financial health and innovative offerings. Over the past year, earnings surged by 41%, outpacing the software industry's average of 14%. The company is well-positioned with more cash than total debt and a significantly reduced debt-to-equity ratio from 31.8% to just 0.5% over five years. Recent initiatives like the Cloud BankNeo Insurance Operations Support for Shizuoka Bank highlight its strategic focus on digital transformation in financial services, promising streamlined processes and enhanced compliance capabilities using Salesforce's platform integration.

- Navigate through the intricacies of Japan System Techniques with our comprehensive health report here.

Learn about Japan System Techniques' historical performance.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4713 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing CIGU TechnologyLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688448

Nanjing CIGU TechnologyLTD

Research, develops, produces, and sells drive equipment and integrated fluid mechanical equipment.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives