Why Investors Shouldn't Be Surprised By Farsoon Technologies Co., Ltd.'s (SHSE:688433) 33% Share Price Surge

Farsoon Technologies Co., Ltd. (SHSE:688433) shareholders have had their patience rewarded with a 33% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 8.6% isn't as attractive.

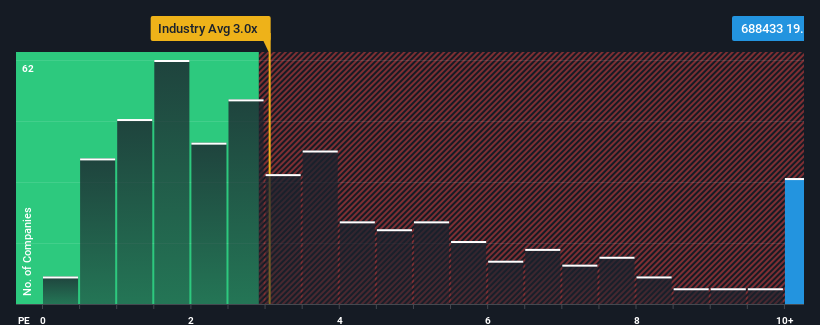

Since its price has surged higher, given around half the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 3x, you may consider Farsoon Technologies as a stock to avoid entirely with its 19.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Farsoon Technologies

How Farsoon Technologies Has Been Performing

Farsoon Technologies' revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Farsoon Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Farsoon Technologies would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.8%. Pleasingly, revenue has also lifted 74% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 92% during the coming year according to the dual analysts following the company. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

With this information, we can see why Farsoon Technologies is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Farsoon Technologies have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Farsoon Technologies shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Farsoon Technologies is showing 2 warning signs in our investment analysis, and 1 of those is concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688433

Farsoon Technologies

Farsoon Technologies supplies industrial plastic laser sintering and metal laser melting systems in China, North America, and Europe.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives