In the current global market landscape, marked by renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, investors are navigating through heightened economic uncertainty. Despite these challenges, growth companies with high insider ownership continue to attract attention due to their potential resilience and alignment of interests between shareholders and management. In such volatile times, stocks that demonstrate strong growth prospects coupled with significant insider investment can offer a compelling proposition for those seeking stability amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| KebNi (OM:KEBNI B) | 36.3% | 74% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 97.9% |

| CD Projekt (WSE:CDR) | 29.7% | 43.1% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

We're going to check out a few of the best picks from our screener tool.

Farsoon Technologies (SHSE:688433)

Simply Wall St Growth Rating: ★★★★★☆

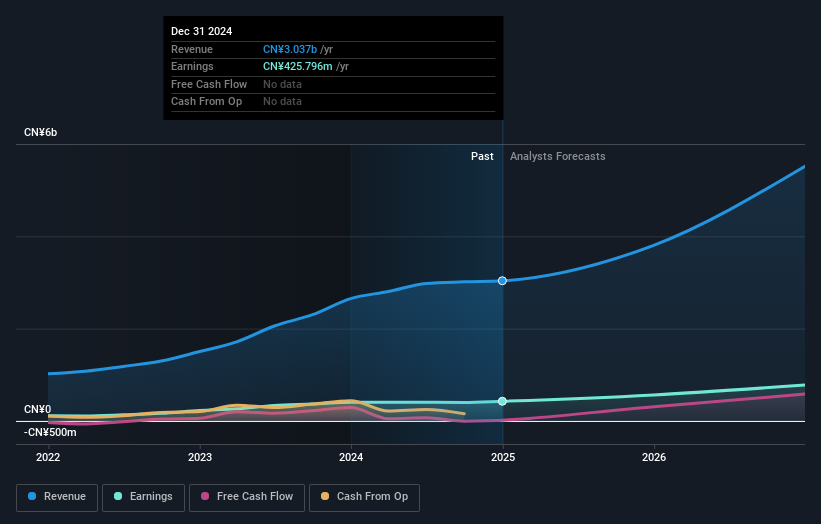

Overview: Farsoon Technologies, with a market cap of CN¥21.88 billion, supplies industrial plastic laser sintering and metal laser melting systems across China, North America, and Europe.

Operations: Farsoon Technologies generates revenue primarily from its Machinery & Industrial Equipment segment, totaling CN¥504.29 million.

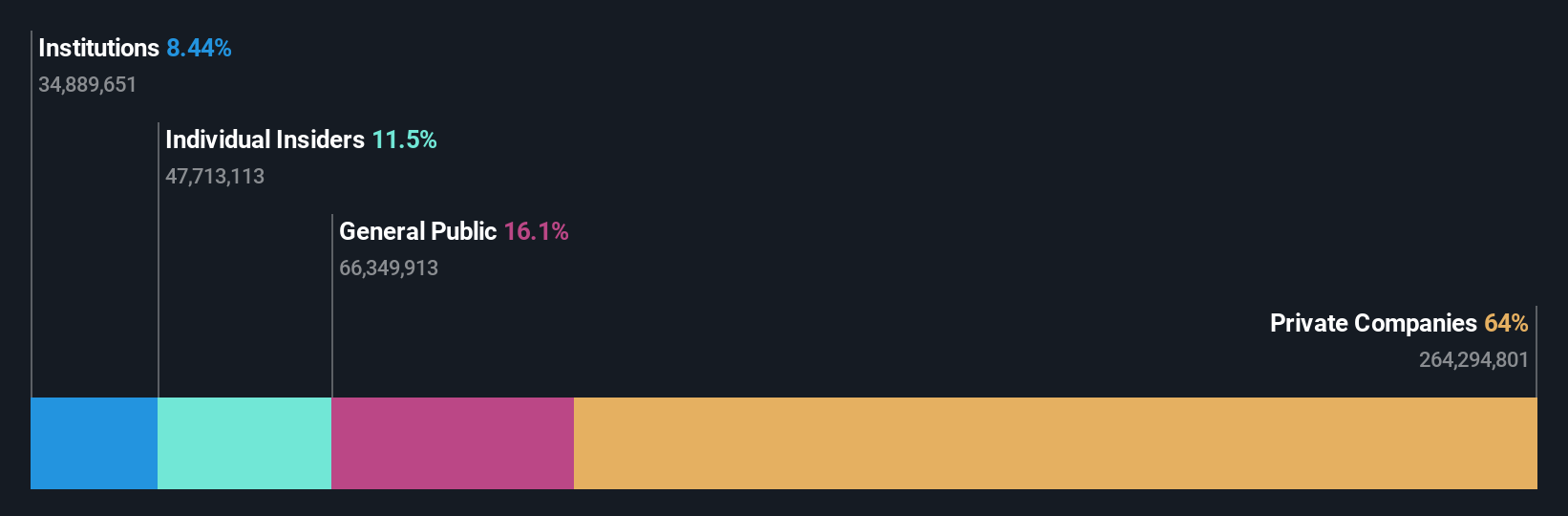

Insider Ownership: 11.5%

Farsoon Technologies shows potential as a growth company with high insider ownership, despite recent challenges. Its revenue is forecasted to grow at an impressive 36.7% annually, outpacing the broader market in China. However, the company's net profit margin has declined from 20.5% to 7.7%, and its return on equity is expected to remain low at 5.5%. Recent earnings reports indicate a drop in net income from CNY 32.9 million to CNY 4.51 million year-over-year.

- Dive into the specifics of Farsoon Technologies here with our thorough growth forecast report.

- The analysis detailed in our Farsoon Technologies valuation report hints at an inflated share price compared to its estimated value.

Shenzhen Sinexcel ElectricLtd (SZSE:300693)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Sinexcel Electric Co., Ltd. operates as a provider of energy interconnection ecosystems across multiple continents, with a market cap of CN¥13.27 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 28.6%

Shenzhen Sinexcel Electric Ltd. is poised for significant growth, with earnings expected to increase 28.3% annually, surpassing the Chinese market average. Despite a recent dip in half-year net income to CNY 158.06 million, the company trades at a favorable P/E ratio of 33.2x compared to the market's 45.8x, indicating good relative value. Its strategic partnership with SMTC Corporation enhances its U.S presence and supply chain resilience by localizing EV charger production under Made in America standards.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen Sinexcel ElectricLtd.

- The valuation report we've compiled suggests that Shenzhen Sinexcel ElectricLtd's current price could be quite moderate.

Caliway Biopharmaceuticals (TWSE:6919)

Simply Wall St Growth Rating: ★★★★★☆

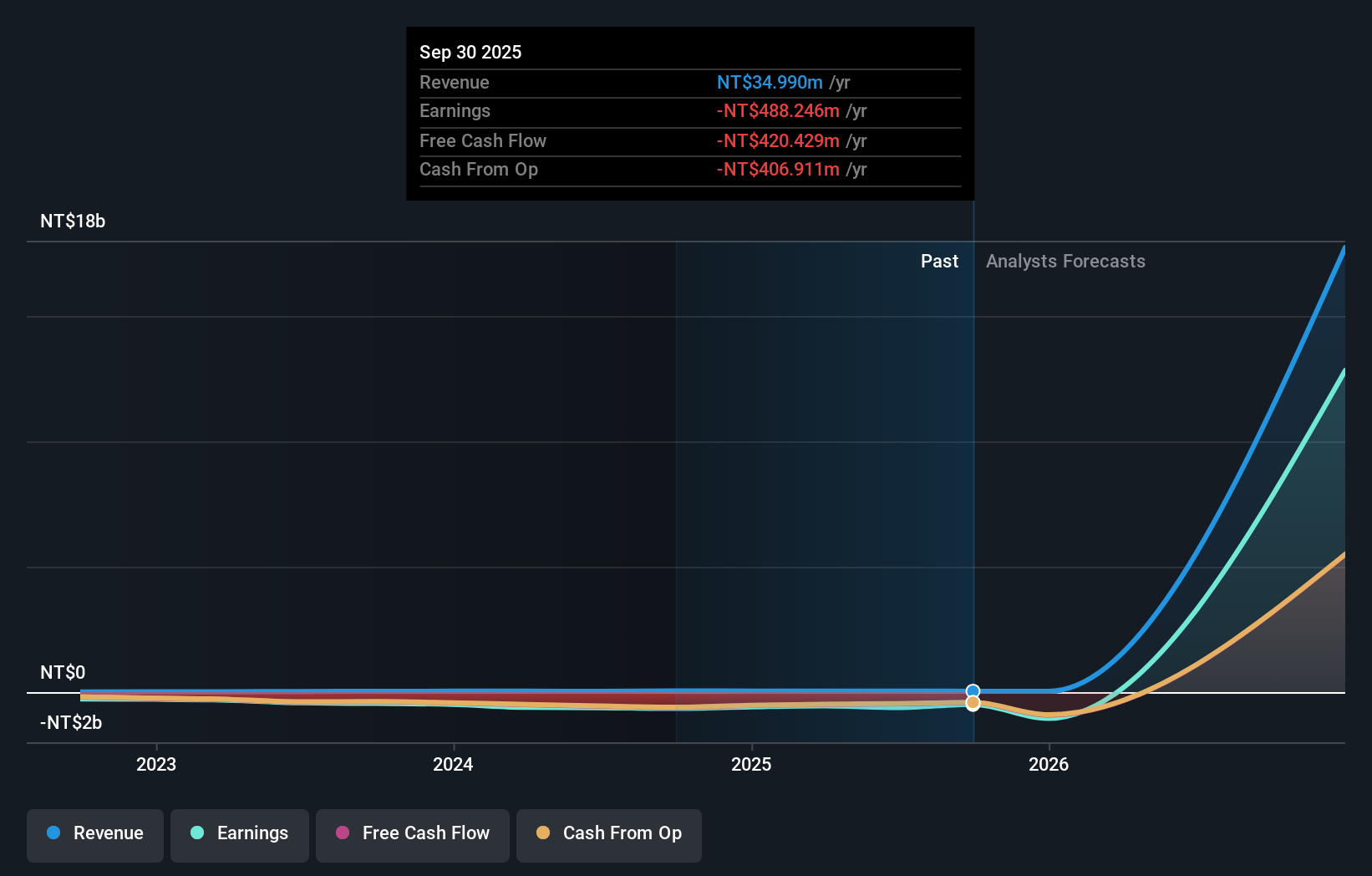

Overview: Caliway Biopharmaceuticals Co., Ltd., along with its subsidiaries, focuses on developing drugs for aesthetic medicine and chronic inflammation, with a market cap of NT$248.16 billion.

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to NT$44.83 million.

Insider Ownership: 24.3%

Caliway Biopharmaceuticals, recently added to the FTSE All-World and MSCI Global Standard Indexes, is positioned for rapid growth with a forecasted revenue increase of over 200% annually. Despite not yet having meaningful revenue (US$1.4 million), it trades significantly below its fair value estimate. The company's innovative drug CBL-514, approved for pivotal Phase 3 trials in the U.S. and Canada, highlights its potential in the high-demand fat reduction market amidst volatile share price movements.

- Click to explore a detailed breakdown of our findings in Caliway Biopharmaceuticals' earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Caliway Biopharmaceuticals shares in the market.

Make It Happen

- Navigate through the entire inventory of 811 Fast Growing Global Companies With High Insider Ownership here.

- Want To Explore Some Alternatives? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688433

Farsoon Technologies

Farsoon Technologies supplies industrial plastic laser sintering and metal laser melting systems in China, North America, and Europe.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives