- China

- /

- Electrical

- /

- SHSE:688388

Even after rising 7.2% this past week, Guangdong Jiayuan TechnologyLtd (SHSE:688388) shareholders are still down 83% over the past three years

While it may not be enough for some shareholders, we think it is good to see the Guangdong Jiayuan Technology Co.,Ltd. (SHSE:688388) share price up 29% in a single quarter. But the last three years have seen a terrible decline. The share price has sunk like a leaky ship, down 83% in that time. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the stock has risen 7.2% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Guangdong Jiayuan TechnologyLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

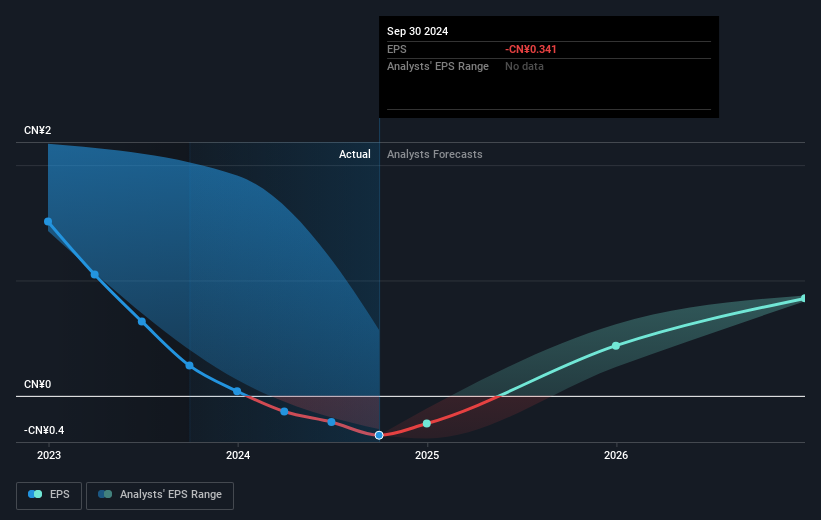

Over the three years that the share price declined, Guangdong Jiayuan TechnologyLtd's earnings per share (EPS) dropped significantly, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Guangdong Jiayuan TechnologyLtd's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 18% in the last year, Guangdong Jiayuan TechnologyLtd shareholders lost 20% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Guangdong Jiayuan TechnologyLtd , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688388

Guangdong Jiayuan TechnologyLtd

Engages in the research, development, manufacture, and sale of electrolytic copper foils.

High growth potential and fair value.