- China

- /

- Construction

- /

- SZSE:002457

Undiscovered Gems To Explore This January 2025

Reviewed by Simply Wall St

As global markets show signs of optimism with cooling inflation and strong earnings propelling stocks higher, small-cap indices like the S&P MidCap 400 and Russell 2000 have seen notable gains, reflecting renewed investor confidence. In this environment, identifying promising small-cap stocks requires a focus on companies with robust fundamentals and the ability to capitalize on current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Dalian Huarui Heavy Industry Group (SZSE:002204)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dalian Huarui Heavy Industry Group Co., Ltd. operates in the special-purpose equipment manufacturing sector and has a market cap of CN¥9.58 billion.

Operations: The primary revenue stream for Dalian Huarui Heavy Industry Group is special-purpose equipment manufacturing, generating CN¥12.93 billion.

Dalian Huarui Heavy Industry Group, a relatively smaller player in the machinery sector, boasts a price-to-earnings ratio of 21.6x, notably below the CN market average of 34.9x, suggesting potential undervaluation. Its earnings have surged by 20% over the past year, outpacing the industry's -0.2%, highlighting strong operational performance. Despite having more cash than total debt and covering interest payments comfortably, its debt to equity ratio has risen from 7.6% to 20.7% in five years, indicating increased leverage risk. The company completed a buyback of over 19 million shares for ¥84.61 million last year under its repurchase plan announced in January 2024.

Ningxia Qinglong Pipes Industry Group (SZSE:002457)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ningxia Qinglong Pipes Industry Group Co., Ltd. operates in China, focusing on the research, development, production, and sale of water pipelines and related products with a market capitalization of CN¥3.90 billion.

Operations: Qinglong Pipes generates revenue primarily from the sale of water pipelines and related products. The company has a market capitalization of CN¥3.90 billion, indicating its significant presence in the industry.

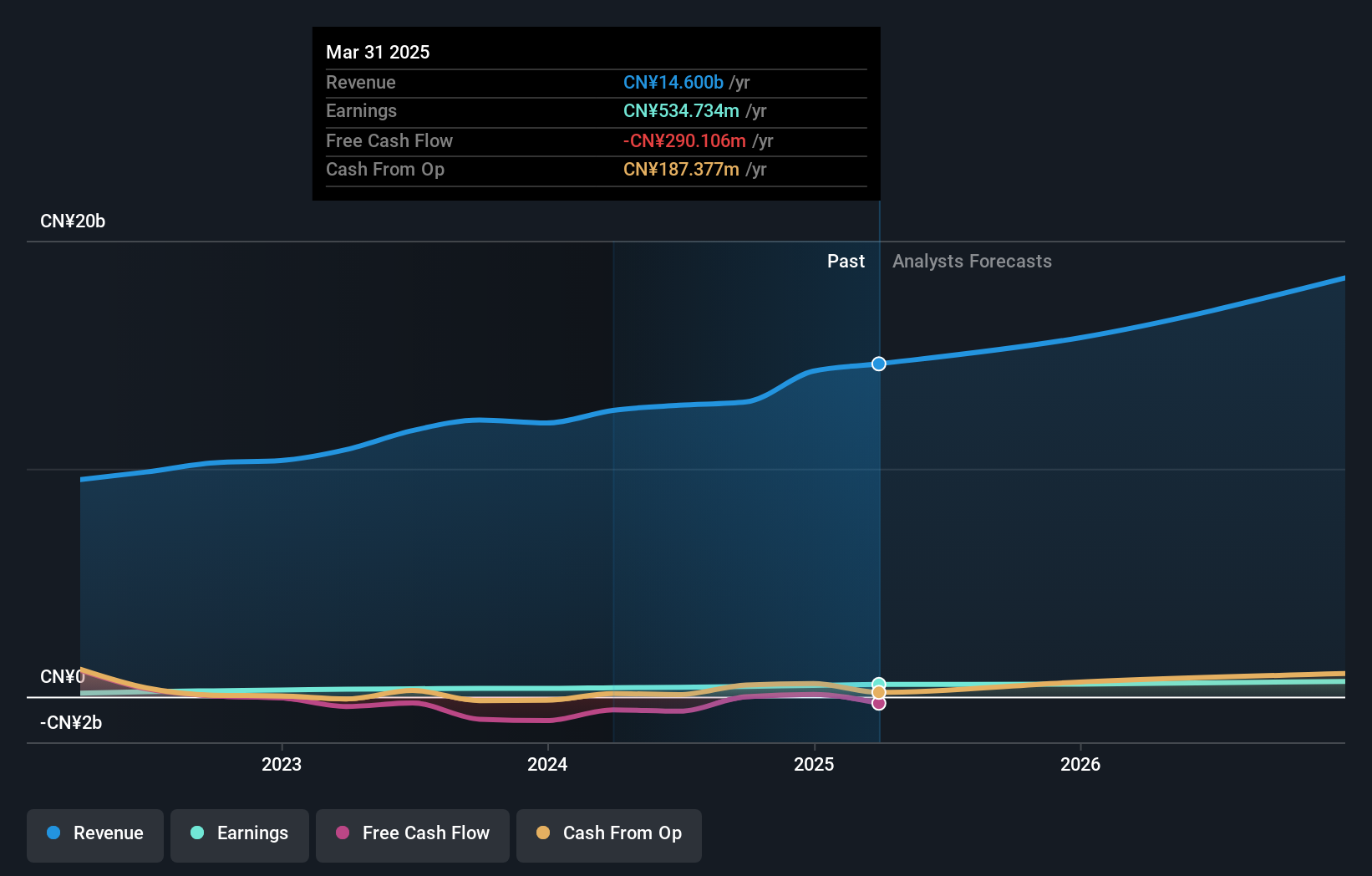

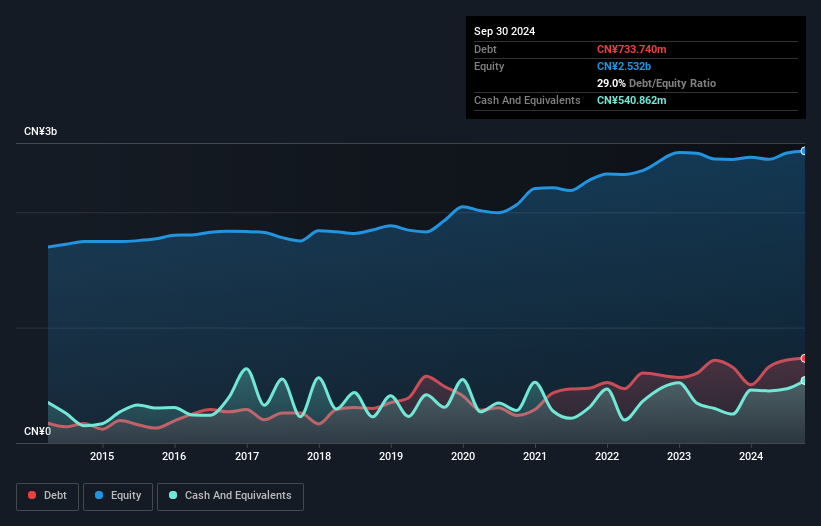

Ningxia Qinglong Pipes Industry Group, a small player in the construction sector, has shown impressive earnings growth of 37.1% over the past year, outpacing the industry’s -3.9%. Despite its debt to equity ratio rising from 25.4% to 29% over five years, its net debt to equity ratio remains satisfactory at 7.6%. The company reported sales of CNY 1.73 billion for nine months ending September 2024, up from CNY 1.22 billion a year earlier, with net income jumping to CNY 113 million from CNY 11 million previously. Trading at nearly three-quarters below estimated fair value suggests potential upside if current trends continue.

Glory (TSE:6457)

Simply Wall St Value Rating: ★★★★★☆

Overview: Glory Ltd. develops and manufactures cash handling machines and systems across Japan, the United States, Europe, and Asia with a market cap of ¥144.96 billion.

Operations: Glory Ltd. generates revenue primarily from the overseas market, contributing ¥202.10 billion, followed by the distribution/transportation market at ¥84.94 billion and financial market at ¥75.34 billion. The amusement market adds another ¥30.90 billion to its revenue streams.

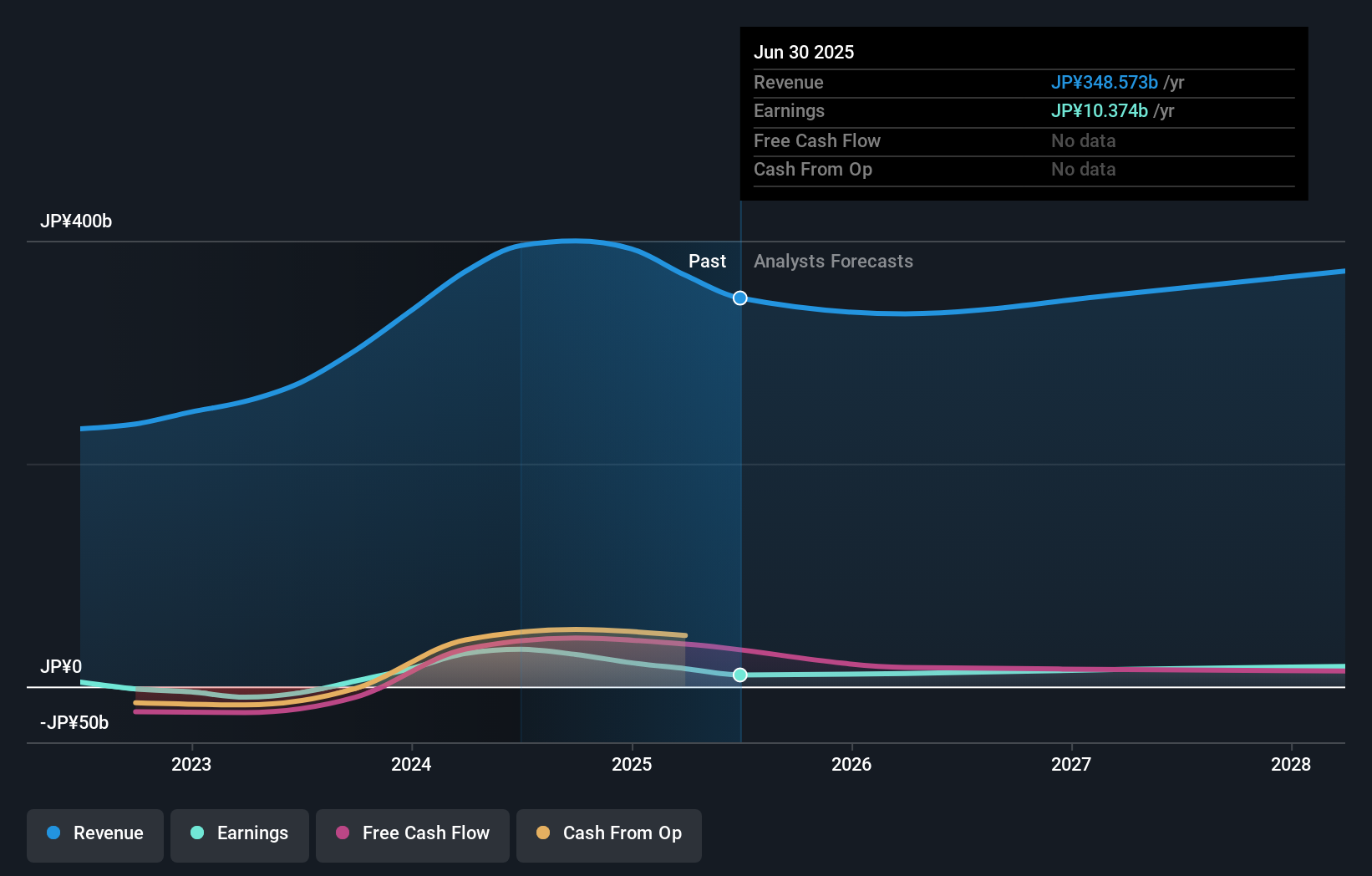

Glory, a smaller player in the machinery sector, has shown remarkable earnings growth of 479% over the past year, outpacing its industry peers. With interest payments well covered by EBIT at 25.9 times and a satisfactory net debt to equity ratio of 24%, it seems financially stable. The company is trading at an appealing value, priced 42.8% below its estimated fair value. Recent board meetings focused on share disposal and investment in Showcase Gig Inc., while dividends increased to ¥54 per share from ¥40 last year. Financial forecasts for March 2025 project net sales of ¥362 billion and net income of ¥13 billion (¥233 per share).

- Get an in-depth perspective on Glory's performance by reading our health report here.

Gain insights into Glory's past trends and performance with our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 4658 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningxia Qinglong Pipes Industry Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002457

Ningxia Qinglong Pipes Industry Group

Engages in the research and development, production, and sale of water pipelines and related products in China.

Excellent balance sheet with proven track record and pays a dividend.