- China

- /

- Auto Components

- /

- SZSE:300432

3 Asian Growth Companies With Insider Ownership Expecting 44% Revenue Growth

Reviewed by Simply Wall St

Amid escalating trade tensions and fluctuating global markets, Asian economies are navigating a complex landscape with mixed performances across indices. Despite these challenges, growth companies in Asia with high insider ownership continue to capture attention for their potential resilience and strategic positioning, particularly those anticipating significant revenue growth.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| WinWay Technology (TWSE:6515) | 22.1% | 21.4% |

| AcrelLtd (SZSE:300286) | 40% | 34.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| UTour Group (SZSE:002707) | 23.5% | 32.7% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Here's a peek at a few of the choices from the screener.

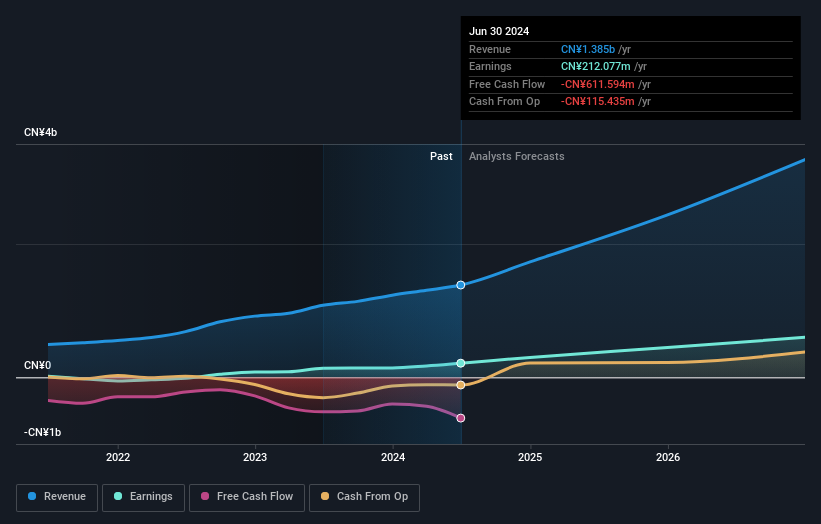

InnoScience (Suzhou) Technology Holding (SEHK:2577)

Simply Wall St Growth Rating: ★★★★★☆

Overview: InnoScience (Suzhou) Technology Holding Co., Ltd. operates in the technology sector with a market capitalization of approximately HK$33.69 billion.

Operations: The company generates revenue from the sales of GaN power semiconductor products, totaling CN¥828.46 million.

Insider Ownership: 12.9%

Revenue Growth Forecast: 37.2% p.a.

InnoScience (Suzhou) Technology Holding is poised for significant growth, with revenue expected to increase by 37.2% annually, outpacing the Hong Kong market. Recent strategic alliances, such as the partnership with STMicroelectronics on GaN technology, enhance its competitive edge in power solutions. Despite a net loss of CNY 1.05 billion in 2024, the company is forecasted to become profitable within three years, driven by innovations like their new 1200V GaN product and strong insider ownership stability.

- Click here to discover the nuances of InnoScience (Suzhou) Technology Holding with our detailed analytical future growth report.

- Our valuation report here indicates InnoScience (Suzhou) Technology Holding may be overvalued.

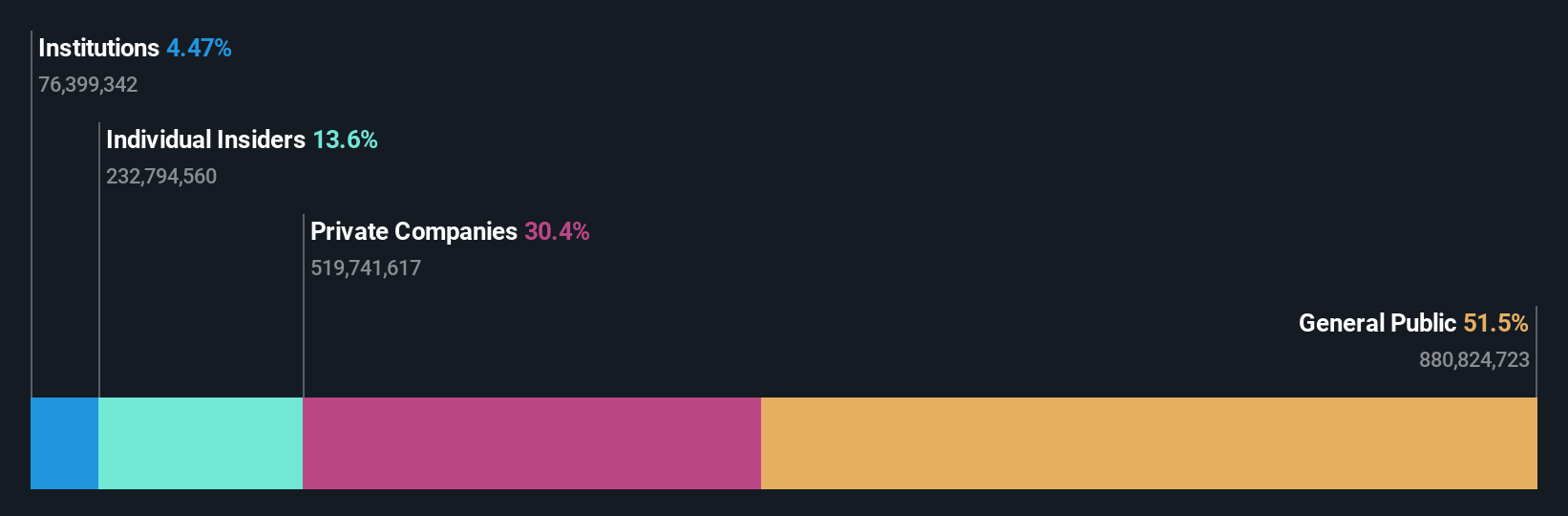

Xi'an Bright Laser TechnologiesLtd (SHSE:688333)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xi'an Bright Laser Technologies Co., Ltd. provides metal additive manufacturing and repair solutions in China, with a market cap of CN¥17.72 billion.

Operations: Xi'an Bright Laser Technologies Co., Ltd. generates revenue through its provision of metal additive manufacturing and repair solutions in the People's Republic of China.

Insider Ownership: 24.6%

Revenue Growth Forecast: 41.6% p.a.

Xi'an Bright Laser Technologies is set for substantial growth, with revenue projected to rise by 41.6% annually, surpassing the Chinese market. Despite a decline in net income to CNY 75.08 million in 2024 from CNY 141.59 million the previous year, earnings are forecasted to grow significantly at 69.21% per year. The company recently completed a share buyback of CNY 73.21 million, indicating confidence in its future prospects despite volatile share prices and low return on equity forecasts.

- Get an in-depth perspective on Xi'an Bright Laser TechnologiesLtd's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Xi'an Bright Laser TechnologiesLtd shares in the market.

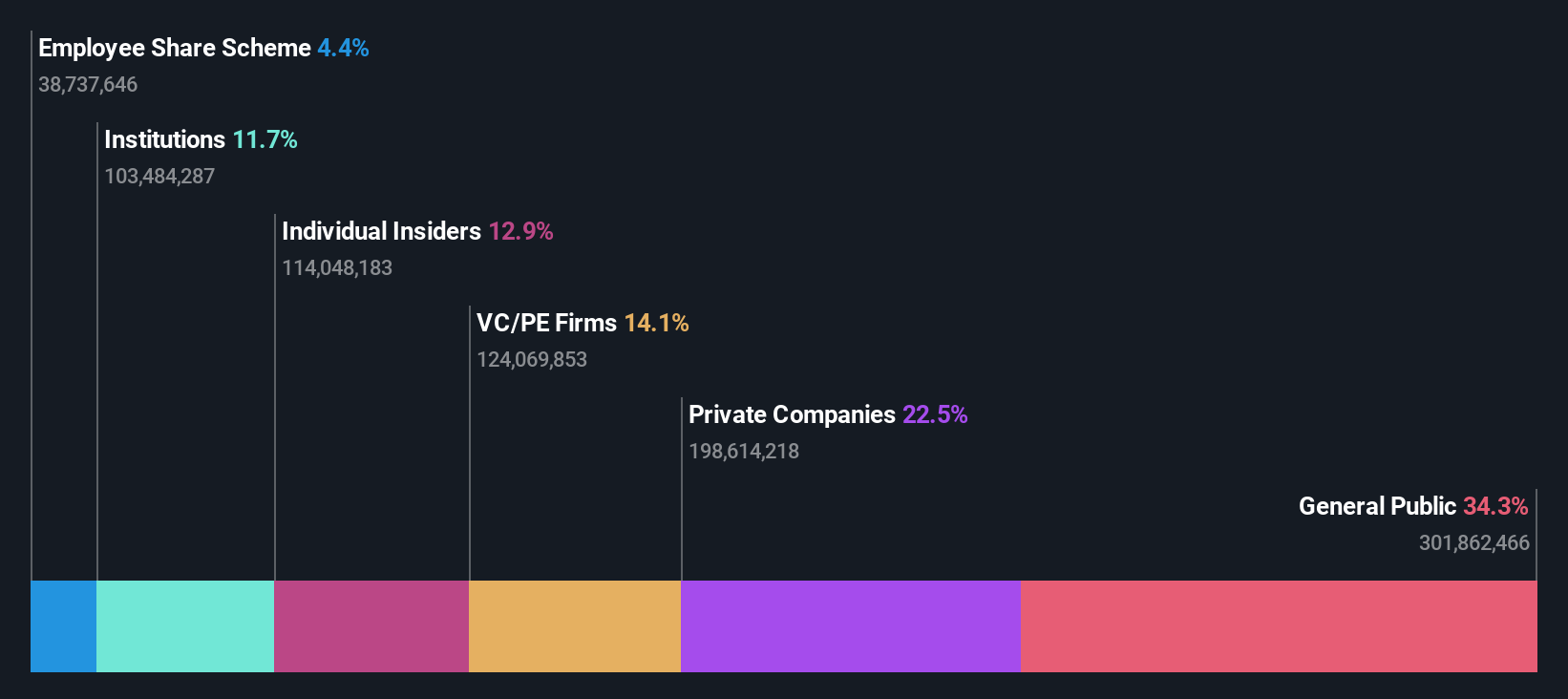

Fulin Precision (SZSE:300432)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fulin Precision Co., Ltd. is involved in the research, development, manufacture, and sale of automotive engine parts in China with a market cap of CN¥22.17 billion.

Operations: Fulin Precision Co., Ltd.'s revenue is derived from its activities in the research, development, manufacturing, and sale of automotive engine components within China.

Insider Ownership: 13.6%

Revenue Growth Forecast: 44.2% p.a.

Fulin Precision is poised for significant growth, with earnings expected to increase by 74.72% annually, outpacing the Chinese market's growth rate. Revenue is also forecasted to grow robustly at 44.2% per year, well above the market average. Despite recent share price volatility and a high level of non-cash earnings, the company became profitable this year and anticipates a strong return on equity of 22.9% in three years.

- Take a closer look at Fulin Precision's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Fulin Precision is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 654 Fast Growing Asian Companies With High Insider Ownership now.

- Searching for a Fresh Perspective? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300432

Fulin Precision

Engages in the research and development, manufacture, and sale of automotive engine parts in China.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives