Amidst the backdrop of reescalating U.S.-China trade tensions and mixed performances in global markets, Asian stocks have shown resilience, with particular interest in companies demonstrating robust growth potential. In this environment, stocks characterized by high insider ownership often attract attention as they can indicate strong confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 33.2% | 84.7% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's uncover some gems from our specialized screener.

OKE Precision Cutting Tools (SHSE:688308)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OKE Precision Cutting Tools Co., Ltd. specializes in the research, development, production, and sale of CNC tools and cemented carbide products, with a market cap of CN¥3.88 billion.

Operations: The company's revenue primarily comes from its Machinery & Industrial Equipment segment, amounting to CN¥1.15 billion.

Insider Ownership: 26.4%

Earnings Growth Forecast: 99.1% p.a.

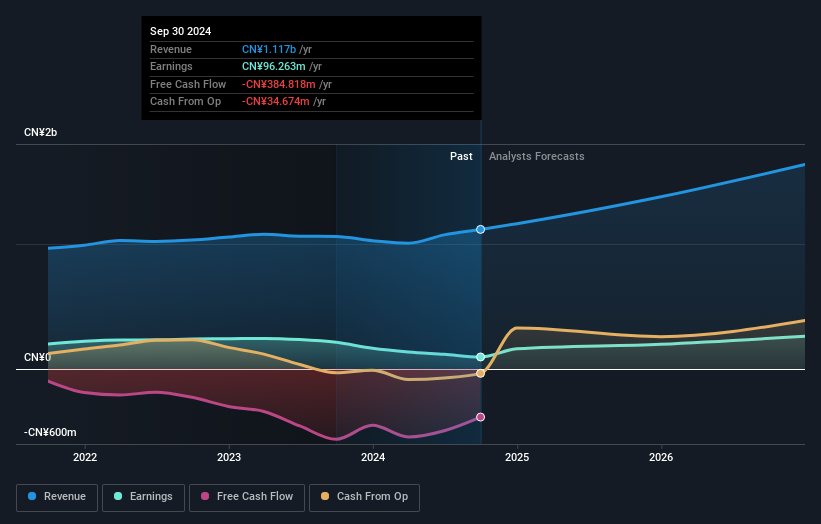

OKE Precision Cutting Tools, with substantial insider ownership, is poised for growth in Asia. Despite a recent dip in net income to CNY 0.78 million from CNY 60.09 million, revenue increased to CNY 603.48 million year-on-year. Earnings are forecasted to grow significantly at 99.06% annually over the next three years, outpacing market averages and indicating potential profitability within this period despite slower revenue growth projections of 14.7% per year compared to the sector's benchmark.

- Delve into the full analysis future growth report here for a deeper understanding of OKE Precision Cutting Tools.

- The valuation report we've compiled suggests that OKE Precision Cutting Tools' current price could be inflated.

Qingdao NovelBeam TechnologyLtd (SHSE:688677)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qingdao NovelBeam Technology Co., Ltd. is involved in the research, development, production, and sales of medical endoscopic instruments and optical products globally, with a market cap of CN¥6.18 billion.

Operations: The company generates revenue of CN¥488.02 million from the sales and maintenance of endoscopes and optical-related products.

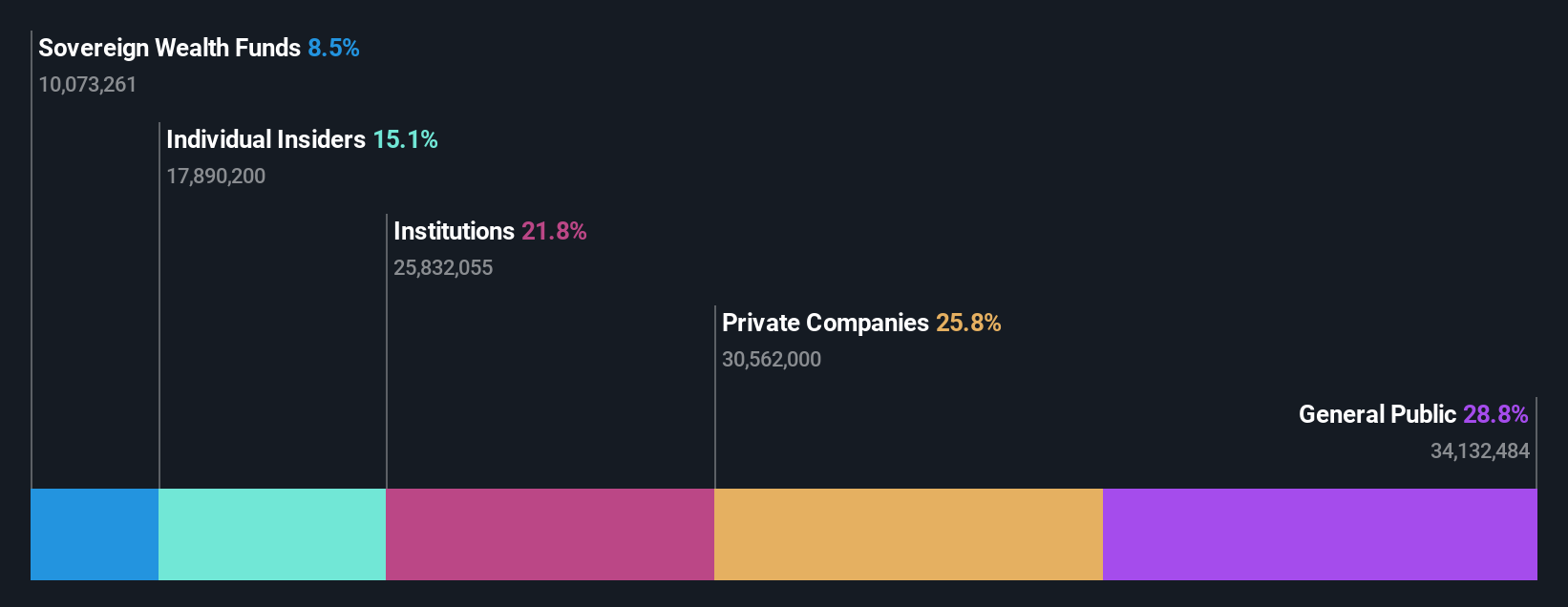

Insider Ownership: 15.1%

Earnings Growth Forecast: 25.1% p.a.

Qingdao NovelBeam Technology Ltd. demonstrates potential for growth in Asia, with insider ownership and a recent increase in revenue to CNY 265.61 million from CNY 220.42 million year-on-year. Earnings are projected to grow at 25.1% annually over the next three years, supported by robust revenue growth forecasts of 20.8% per year, surpassing the market average of 13.9%. However, its return on equity is expected to remain low at 15.9%, and its dividend yield of 1.15% isn't well covered by free cash flows.

- Dive into the specifics of Qingdao NovelBeam TechnologyLtd here with our thorough growth forecast report.

- The analysis detailed in our Qingdao NovelBeam TechnologyLtd valuation report hints at an inflated share price compared to its estimated value.

Shenzhen Batian Ecotypic Engineering (SZSE:002170)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Batian Ecotypic Engineering Co., Ltd. operates in the agricultural industry, focusing on ecological engineering solutions, with a market cap of approximately CN¥10.76 billion.

Operations: The company's revenue is primarily derived from phosphate mining, contributing CN¥1.52 billion, and chemical fertilizer manufacturing, which accounts for CN¥2.75 billion.

Insider Ownership: 32.9%

Earnings Growth Forecast: 28.9% p.a.

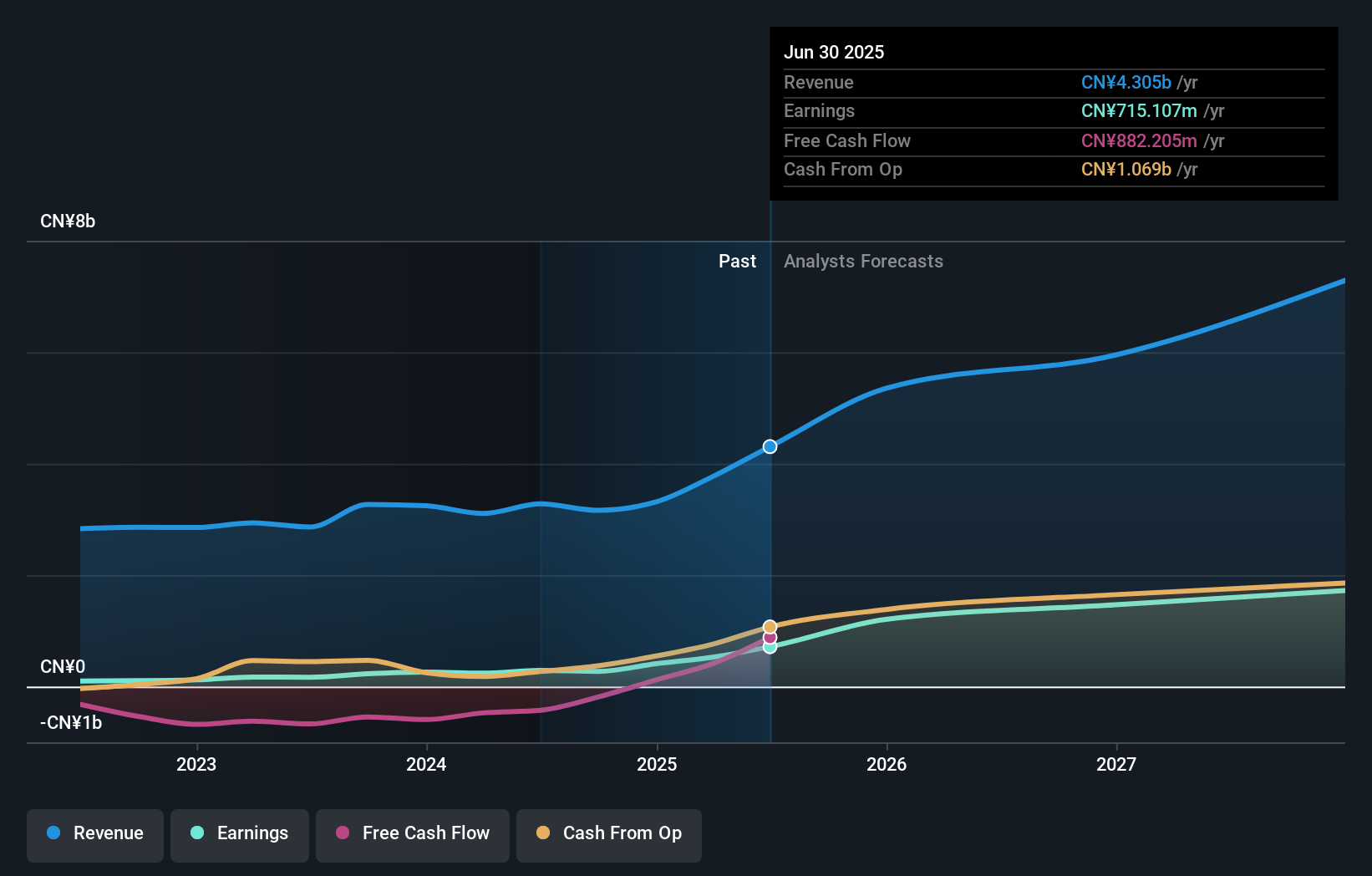

Shenzhen Batian Ecotypic Engineering shows strong growth potential in Asia, with earnings projected to grow significantly at 28.9% annually, outpacing the market average. Recent revenue and net income figures reflect substantial year-on-year growth, while its return on equity is forecasted to reach a high of 27.9% in three years. Despite trading at a considerable discount to its estimated fair value, the company has an unstable dividend track record and recent board changes could impact governance dynamics.

- Click to explore a detailed breakdown of our findings in Shenzhen Batian Ecotypic Engineering's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Shenzhen Batian Ecotypic Engineering shares in the market.

Seize The Opportunity

- Reveal the 618 hidden gems among our Fast Growing Asian Companies With High Insider Ownership screener with a single click here.

- Want To Explore Some Alternatives? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688308

OKE Precision Cutting Tools

Engages in the research, development, production, and sale of CNC tool and cemented carbide products.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives