- China

- /

- Specialty Stores

- /

- SZSE:002024

3 Growth Companies With High Insider Ownership And Up To 112% Earnings Growth

Reviewed by Simply Wall St

In recent weeks, global markets have experienced fluctuations driven by uncertainties surrounding the incoming Trump administration's policies, impacting various sectors and leading to notable movements in indices such as the Dow Jones and Nasdaq. Amidst these market dynamics, investors are increasingly focusing on growth companies with high insider ownership, which can offer a unique alignment of interests between shareholders and company leaders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Underneath we present a selection of stocks filtered out by our screen.

Hangzhou Jingye Intelligent Technology (SHSE:688290)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Jingye Intelligent Technology Co., Ltd. (SHSE:688290) operates in the intelligent technology sector and has a market cap of CN¥3.64 billion.

Operations: The company generates revenue from its Machinery & Industrial Equipment segment, amounting to CN¥275.65 million.

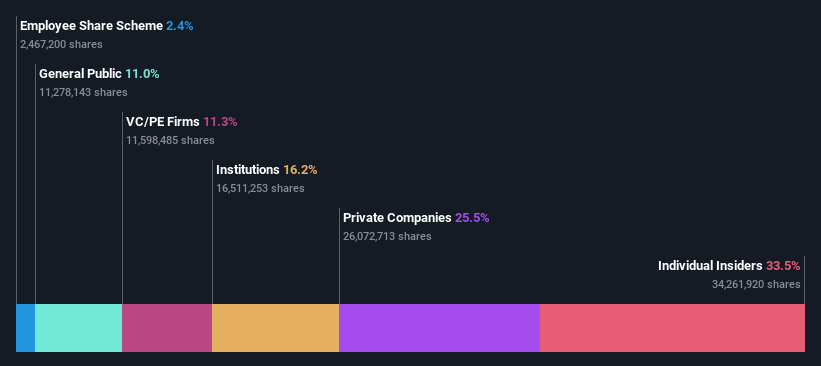

Insider Ownership: 33.5%

Earnings Growth Forecast: 58.1% p.a.

Hangzhou Jingye Intelligent Technology has demonstrated robust growth, with recent earnings showing net income rising to CNY 7.06 million from CNY 1.99 million year-over-year. Revenue increased to CNY 149.28 million, indicating strong performance despite share price volatility. Forecasts suggest significant annual earnings growth of over 58%, surpassing the market average, although expected return on equity remains modest at 12.7%. Analysts anticipate a potential stock price increase of nearly 29%.

- Navigate through the intricacies of Hangzhou Jingye Intelligent Technology with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Hangzhou Jingye Intelligent Technology is priced higher than what may be justified by its financials.

Rigol Technologies (SHSE:688337)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rigol Technologies Co., Ltd. manufactures and sells test and measurement instruments globally, with a market cap of approximately CN¥8.94 billion.

Operations: The company generates revenue of CN¥732.68 million from its electronic test and measurement instruments segment.

Insider Ownership: 22%

Earnings Growth Forecast: 40.1% p.a.

Rigol Technologies is experiencing significant growth, with earnings projected to increase by 40.13% annually, outpacing the CN market. Revenue is also expected to grow at 22.2% per year, surpassing market averages. Despite this growth, recent financial results show a decline in net income to CNY 60.13 million for the nine months ended September 2024 compared to last year. The company recently expanded its product line with advanced oscilloscopes and waveform generators, enhancing its market position in performance measurement equipment.

- Get an in-depth perspective on Rigol Technologies' performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Rigol Technologies is trading beyond its estimated value.

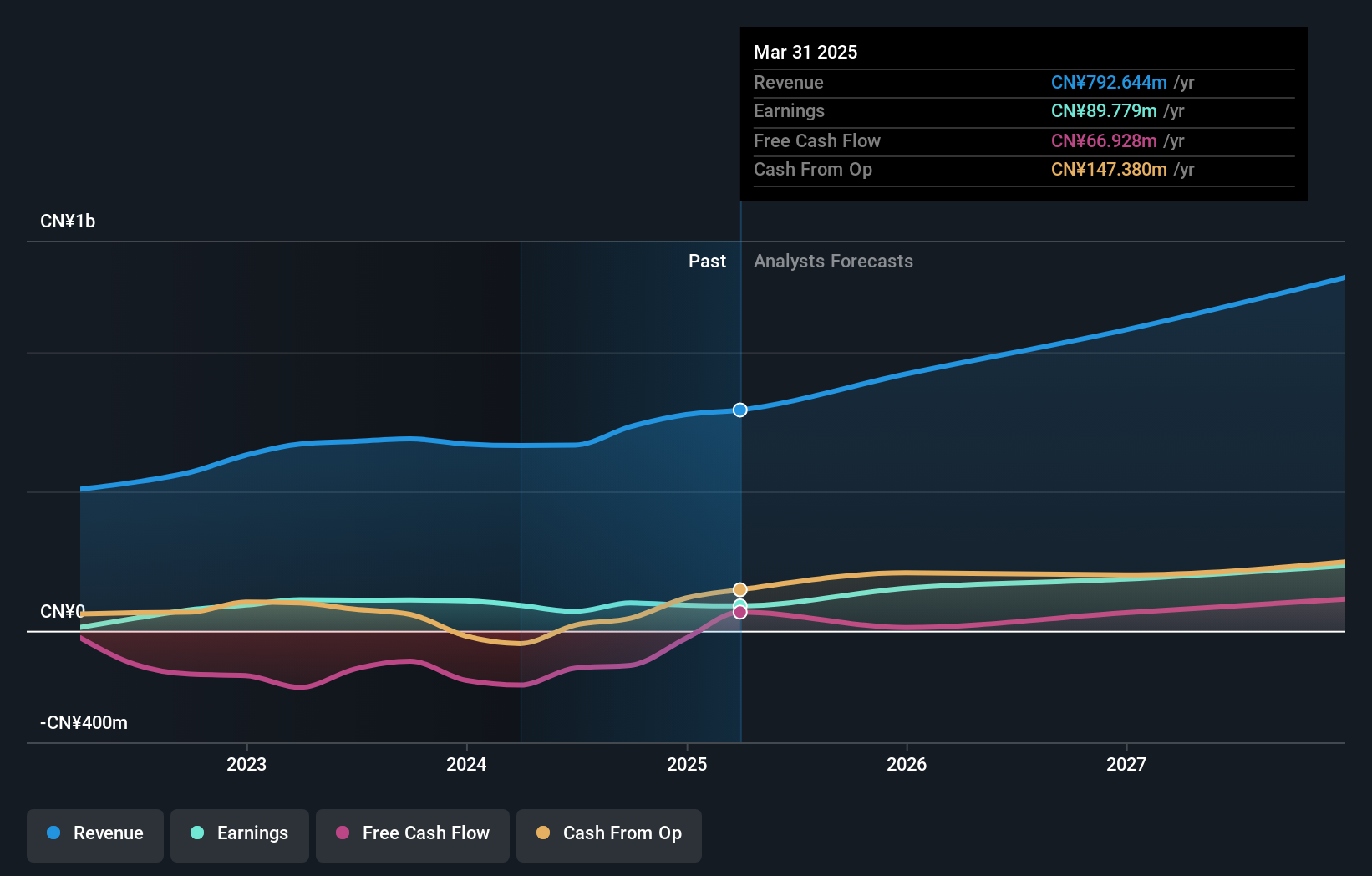

Suning.com (SZSE:002024)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suning.com Co., Ltd. operates in the retail sector in China with a market capitalization of approximately CN¥18.88 billion.

Operations: Suning.com Co., Ltd. generates its revenue primarily through its retail operations in China.

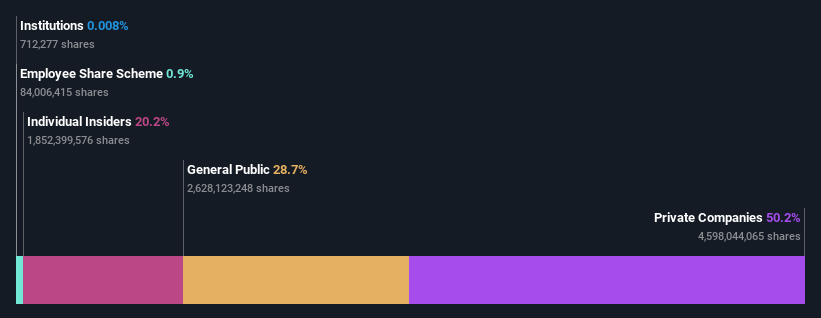

Insider Ownership: 20.2%

Earnings Growth Forecast: 112.2% p.a.

Suning.com is poised for substantial growth with earnings expected to rise by over 100% annually, outpacing market averages. Although recent sales declined to CNY 38.02 billion from CNY 48.66 billion year-on-year, the company turned a net profit of CNY 599.22 million from a previous loss, indicating improved financial health. Trading at a significant discount to fair value and with no recent insider trading activity, Suning.com remains an intriguing prospect for growth-focused investors.

- Click here and access our complete growth analysis report to understand the dynamics of Suning.com.

- According our valuation report, there's an indication that Suning.com's share price might be on the cheaper side.

Next Steps

- Navigate through the entire inventory of 1530 Fast Growing Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002024

Undervalued with high growth potential.