- China

- /

- Aerospace & Defense

- /

- SHSE:688287

With A 25% Price Drop For Guandian Defense Technology Co.,Ltd. (SHSE:688287) You'll Still Get What You Pay For

Guandian Defense Technology Co.,Ltd. (SHSE:688287) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 40% in that time.

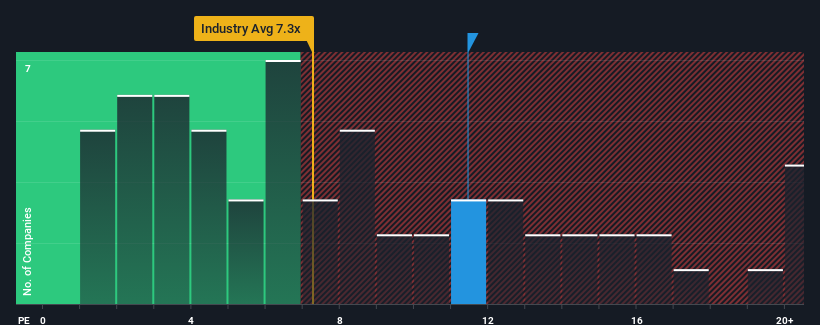

In spite of the heavy fall in price, you could still be forgiven for thinking Guandian Defense TechnologyLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 11.4x, considering almost half the companies in China's Aerospace & Defense industry have P/S ratios below 7.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Guandian Defense TechnologyLtd

What Does Guandian Defense TechnologyLtd's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Guandian Defense TechnologyLtd's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guandian Defense TechnologyLtd.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Guandian Defense TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 25%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 22% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 111% during the coming year according to the sole analyst following the company. That's shaping up to be materially higher than the 34% growth forecast for the broader industry.

In light of this, it's understandable that Guandian Defense TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Guandian Defense TechnologyLtd's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Guandian Defense TechnologyLtd shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 4 warning signs for Guandian Defense TechnologyLtd you should be aware of, and 1 of them is significant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688287

Guandian Defense TechnologyLtd

Engages in the research, development, production, and sale of unmanned aerial vehicle (UAV) systems and intelligent defense equipment for anti-drug applications in China.

Adequate balance sheet very low.

Market Insights

Community Narratives