Three Stocks That May Be Trading Below Estimated Value In November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of policy shifts under the Trump 2.0 administration, investors are witnessing significant movements across various sectors, with financials and energy gaining from deregulation hopes while healthcare and electric vehicle stocks face pressure. Amidst these changes, identifying stocks that may be trading below their estimated value becomes crucial for investors seeking opportunities in a market characterized by volatility and sector-specific fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiwan Union Technology (TPEX:6274) | NT$156.50 | NT$311.70 | 49.8% |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.67 | CN¥76.93 | 49.7% |

| Giant Biogene Holding (SEHK:2367) | HK$48.90 | HK$97.74 | 50% |

| Wistron (TWSE:3231) | NT$114.00 | NT$227.50 | 49.9% |

| SISB (SET:SISB) | THB31.75 | THB63.42 | 49.9% |

| ConvaTec Group (LSE:CTEC) | £2.43 | £4.85 | 49.9% |

| Shoei (TSE:7839) | ¥2360.00 | ¥4718.51 | 50% |

| EnomotoLtd (TSE:6928) | ¥1475.00 | ¥2946.42 | 49.9% |

| TF Bank (OM:TFBANK) | SEK312.00 | SEK621.04 | 49.8% |

| Credit Clear (ASX:CCR) | A$0.355 | A$0.71 | 50% |

Below we spotlight a couple of our favorites from our exclusive screener.

Applus Services (BME:APPS)

Overview: Applus Services, S.A. operates in the testing, inspection, and certification industry through its subsidiaries and has a market capitalization of approximately €1.64 billion.

Operations: The company's revenue is primarily derived from its Energy & Industry segment (€1.12 billion), followed by Automotive (€394.94 million), IDIADA (€353.83 million), and Laboratories (€278.31 million).

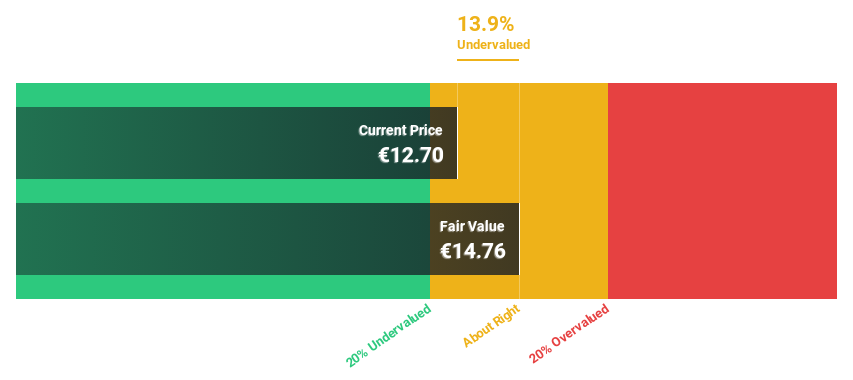

Estimated Discount To Fair Value: 14.4%

Applus Services is trading at €12.7, approximately 14.4% below its estimated fair value of €14.83, suggesting it may be undervalued based on cash flows. Although the company has a high level of debt and slower revenue growth than the Spanish market, earnings are projected to grow significantly at over 50% annually. Furthermore, Applus is expected to achieve profitability within three years with a strong forecasted return on equity of 24.3%.

- Insights from our recent growth report point to a promising forecast for Applus Services' business outlook.

- Take a closer look at Applus Services' balance sheet health here in our report.

Pluk Phak Praw Rak Mae (SET:OKJ)

Overview: Pluk Phak Praw Rak Mae Public Company Limited specializes in cultivating organic vegetables and fruits in Thailand, with a market cap of THB93.79 billion.

Operations: The company generates revenue primarily from its restaurant business, amounting to THB2.25 billion.

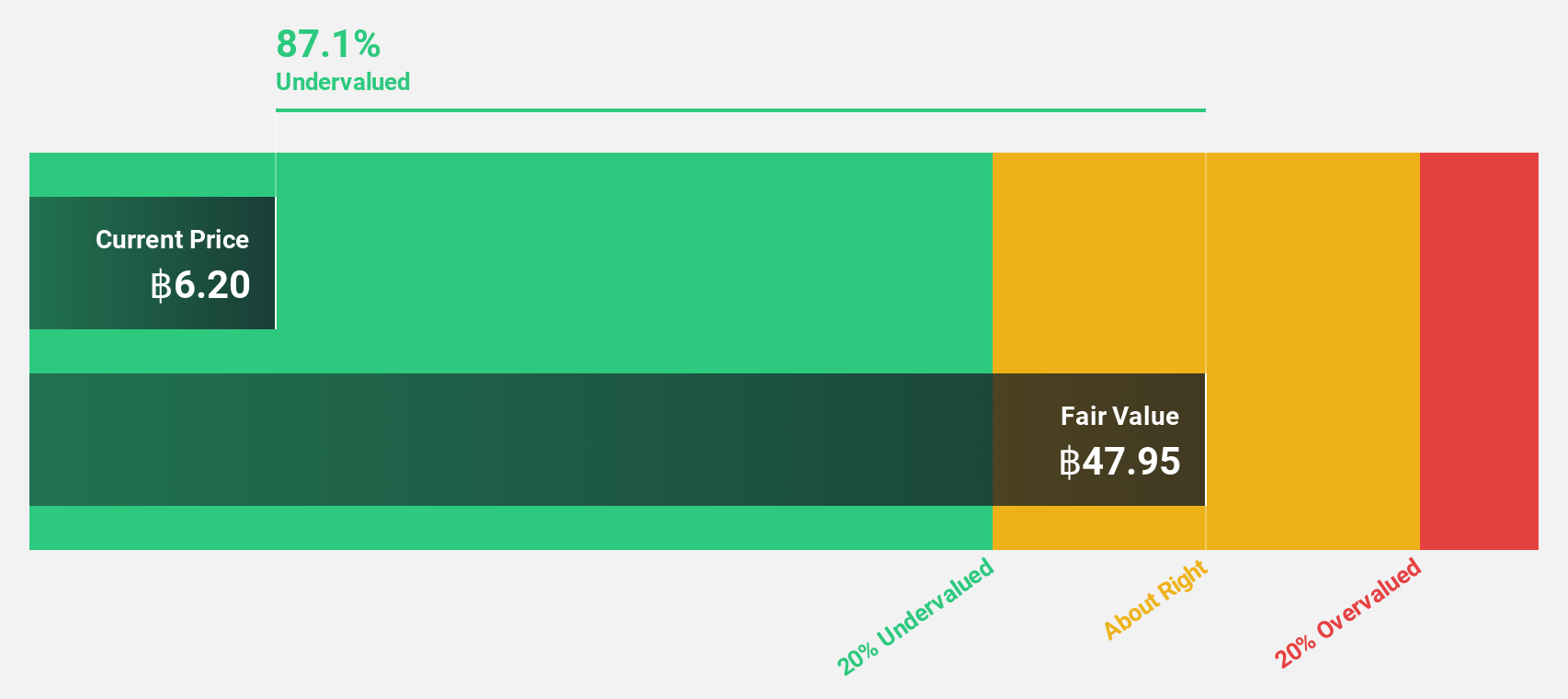

Estimated Discount To Fair Value: 46.2%

Pluk Phak Praw Rak Mae, following its recent IPO raising THB 1.07 billion, is trading at THB 16.6, significantly below its estimated fair value of THB 30.86, highlighting potential undervaluation based on cash flows. The company anticipates robust revenue growth of 22.6% annually and earnings growth of 23.5%, outpacing the Thai market's average growth rates, despite a lower forecasted return on equity of 15.7% in three years.

- Our comprehensive growth report raises the possibility that Pluk Phak Praw Rak Mae is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Pluk Phak Praw Rak Mae.

Ficont Industry (Beijing) (SHSE:605305)

Overview: Ficont Industry (Beijing) Co., Ltd. manufactures and supplies wind turbine tower internals and safety systems for wind turbine manufacturers in China and internationally, with a market cap of CN¥6.04 billion.

Operations: The company generates revenue of CN¥1.34 billion from its Construction Machinery & Equipment segment.

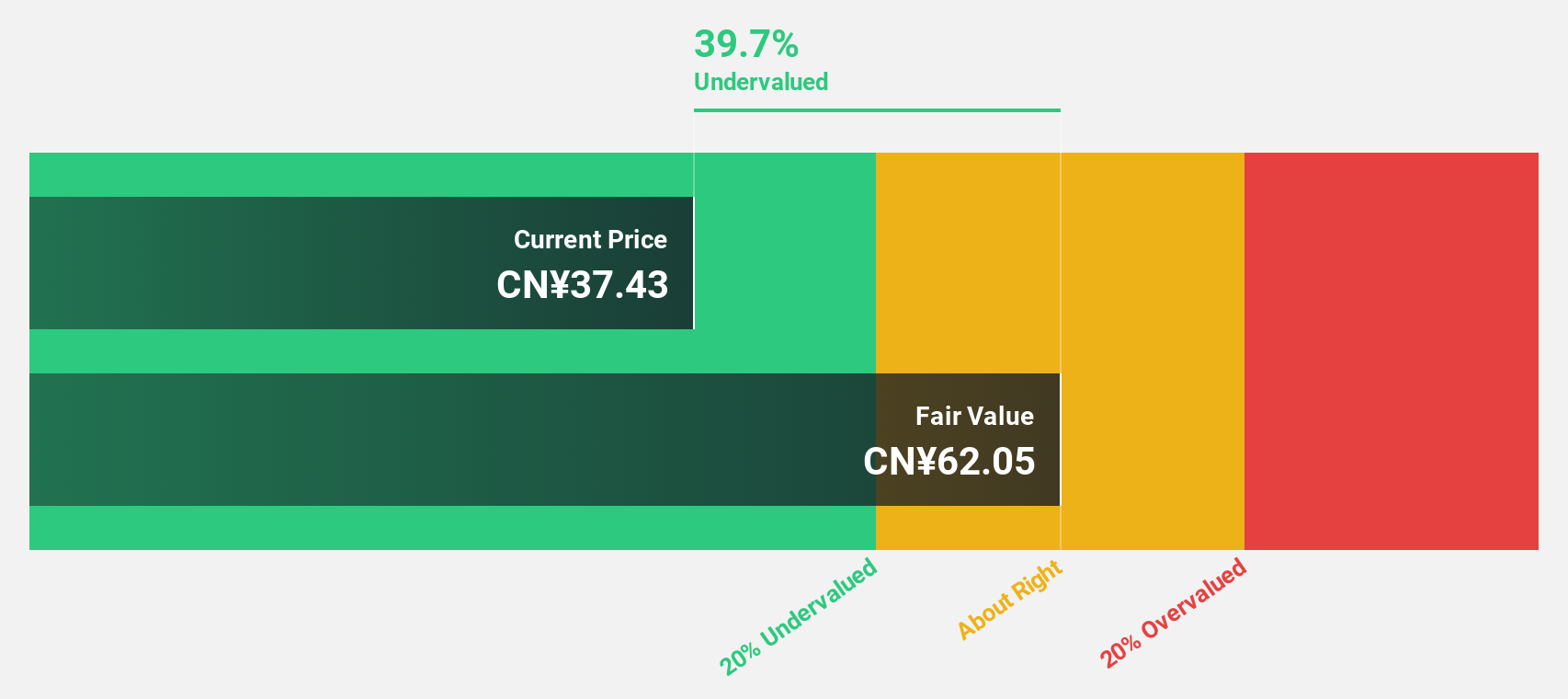

Estimated Discount To Fair Value: 49%

Ficont Industry (Beijing) Co., Ltd. is trading at CNY 28.52, well below its estimated fair value of CNY 55.91, suggesting potential undervaluation based on cash flows. The company reported strong earnings growth of 130.5% over the past year, with future revenue expected to grow at 24.8% annually, surpassing the Chinese market average of 13.9%. However, its return on equity is forecasted to be relatively low at 16.5% in three years.

- Our earnings growth report unveils the potential for significant increases in Ficont Industry (Beijing)'s future results.

- Click here to discover the nuances of Ficont Industry (Beijing) with our detailed financial health report.

Turning Ideas Into Actions

- Delve into our full catalog of 935 Undervalued Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605305

Ficont Industry (Beijing)

Engages in the manufacture and supply of wind turbine tower internals and safety systems for wind turbine manufactures in China and internationally.

Flawless balance sheet and undervalued.