- China

- /

- Commercial Services

- /

- SZSE:300847

Undiscovered Gems in Global Markets for July 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape of record highs in major U.S. indices and robust job growth, smaller-cap stocks have shown impressive performance, with indexes like the S&P MidCap 400 and Russell 2000 leading gains. In this environment, identifying promising small-cap companies can be particularly rewarding as these undiscovered gems often thrive by capitalizing on niche opportunities and adapting swiftly to economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hubei Three Gorges Tourism Group | 11.24% | -15.32% | 17.90% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 8.20% | 44.45% | ★★★★★★ |

| Qingdao Eastsoft Communication TechnologyLtd | NA | 5.88% | -20.71% | ★★★★★★ |

| Jiangsu Lianfa TextileLtd | 26.67% | 2.17% | -26.08% | ★★★★★☆ |

| Techshine ElectronicsLtd | 8.66% | 23.58% | 16.34% | ★★★★★☆ |

| KNJ | 80.14% | 9.45% | 44.19% | ★★★★★☆ |

| Firich Enterprises | 32.65% | -1.31% | 35.54% | ★★★★★☆ |

| Anhui Wanyi Science and TechnologyLtd | 12.18% | 14.34% | -21.44% | ★★★★★☆ |

| Guangdong Delian Group | 28.18% | 5.07% | -36.51% | ★★★★★☆ |

| Sinomag Technology | 68.80% | 16.08% | 3.66% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Xinya Electronic (SHSE:605277)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xinya Electronic Co., Ltd. is a company that manufactures and sells wires and cables both in China and internationally, with a market capitalization of CN¥5.99 billion.

Operations: Xinya Electronic generates its revenue primarily from the sale of wire and cable products, amounting to CN¥3.72 billion. The company's net profit margin shows notable trends that could be of interest to investors analyzing financial performance.

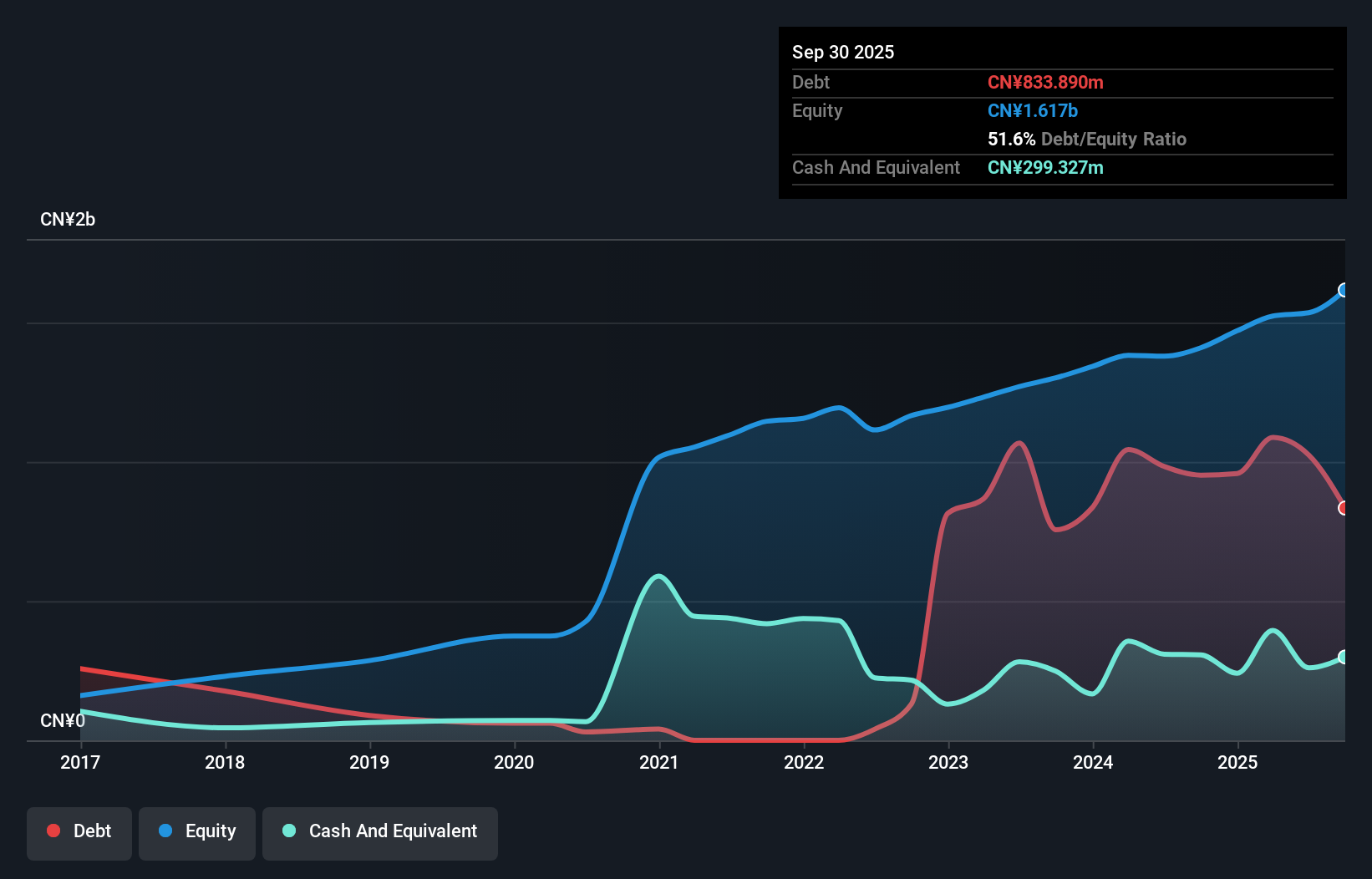

Xinya Electronic, a promising player in the electrical sector, has shown solid performance with earnings growth of 4% over the past year, outpacing the industry average of -1.5%. The company's price-to-earnings ratio stands at 41x, slightly below the industry norm of 42.1x, indicating potential value for investors. Its net debt to equity ratio is a satisfactory 34.5%, suggesting manageable leverage levels. Recent financials revealed first-quarter sales reaching CNY 881.59 million from CNY 692.02 million last year and net income climbing to CNY 47.27 million from CNY 39.78 million previously, highlighting robust operational progress.

- Navigate through the intricacies of Xinya Electronic with our comprehensive health report here.

Explore historical data to track Xinya Electronic's performance over time in our Past section.

Forest Packaging GroupLtd (SHSE:605500)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Forest Packaging Group Co., Ltd. is engaged in the manufacturing and sale of paper packaging products both in China and internationally, with a market capitalization of CN¥3.75 billion.

Operations: Forest Packaging Group generates revenue primarily through the sale of paper packaging products. The company's cost structure includes raw materials and manufacturing expenses, which influence its profitability. Notably, the net profit margin for recent periods has shown a varied trend, highlighting fluctuations in operational efficiency and cost management.

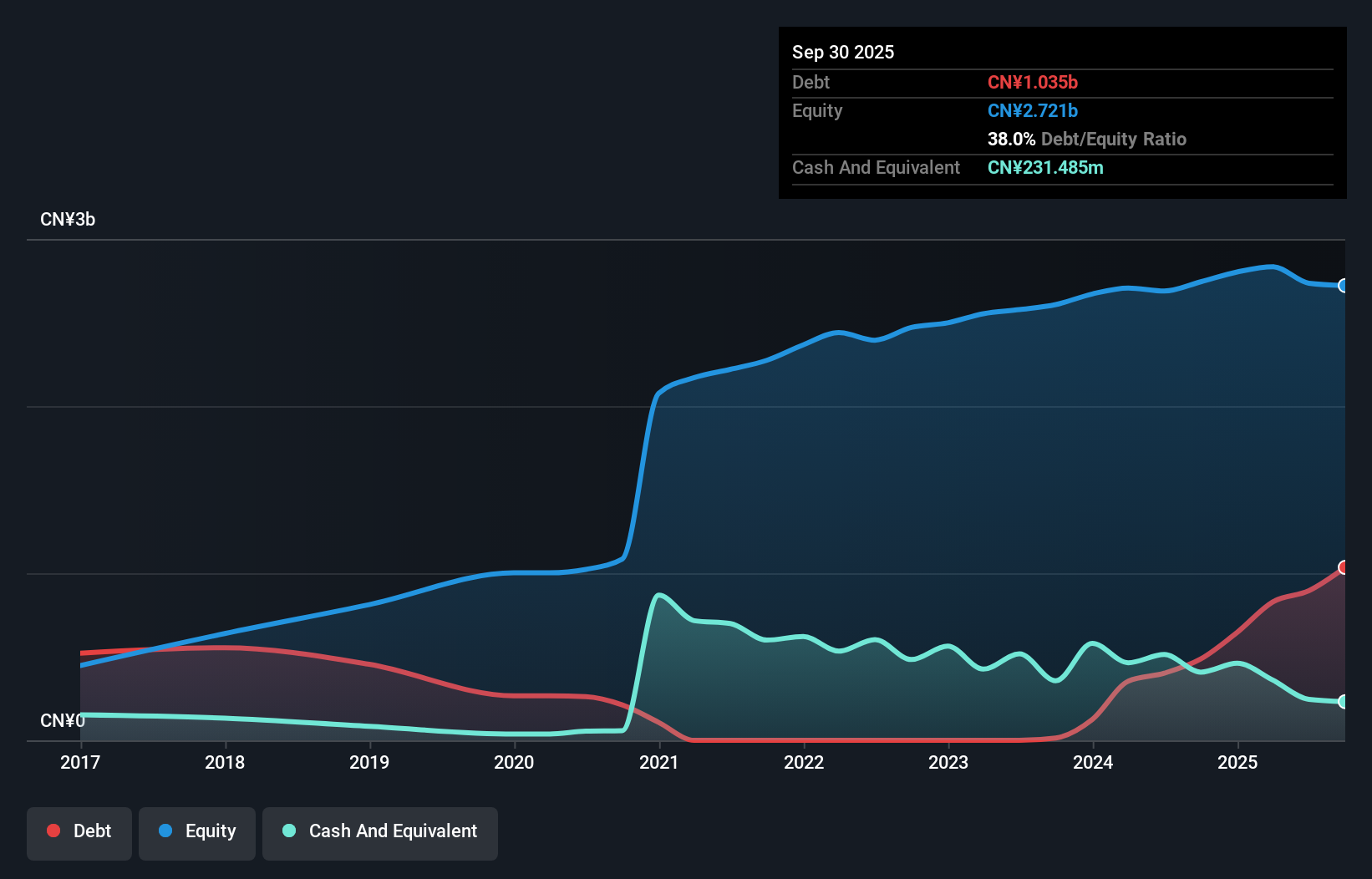

Forest Packaging Group, a relatively smaller player in the packaging industry, has demonstrated resilience with its earnings growing by 7.6% over the past year, outpacing the industry's 3.2%. Despite a net debt to equity ratio of 16.5%, which is satisfactory by market standards, its debt to equity ratio rose from 26.6% to 29.2% in five years, indicating some financial leverage increase. The company announced an annual dividend of CNY 0.15 per share payable on June 20, reflecting steady shareholder returns amid a slight dip in first-quarter sales and net income compared to last year’s figures of CNY 487 million and CNY 36 million respectively.

HG Technologies (SZSE:300847)

Simply Wall St Value Rating: ★★★★★★

Overview: HG Technologies Co., Ltd. focuses on the research, development, production, and sale of electrostatic imaging special information products in China with a market cap of CN¥5.20 billion.

Operations: HG Technologies generates revenue through the sale of electrostatic imaging special information products. The company's market capitalization stands at CN¥5.20 billion.

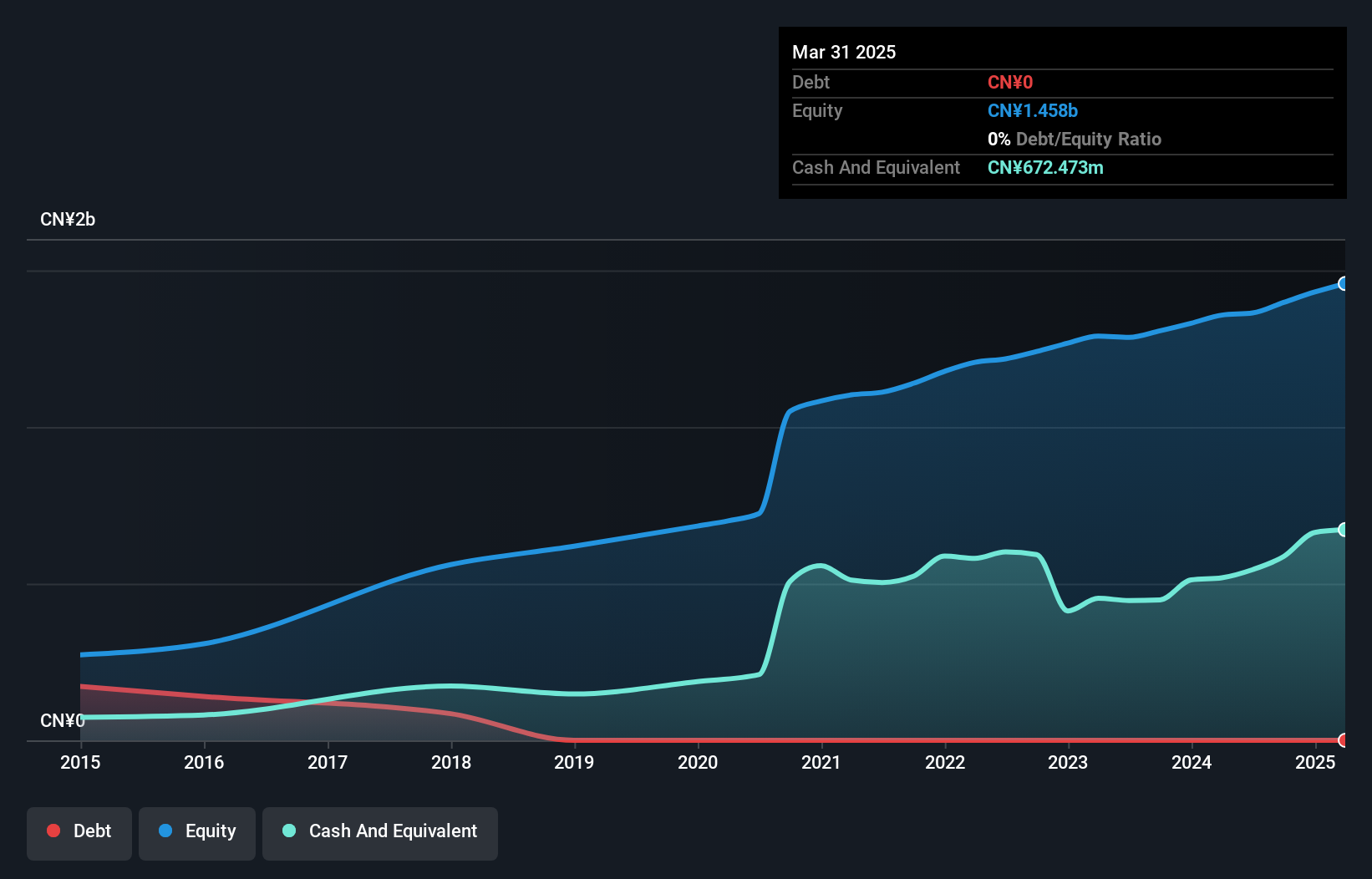

HG Technologies, a nimble player in its field, posted an impressive 26.6% earnings growth last year, outpacing the Commercial Services industry’s modest 0.9%. With no debt on its books for five years, financial flexibility is a hallmark of this company. Recent results show sales climbing to CNY 293.95 million in Q1 2025 from CNY 272.82 million the previous year, with net income reaching CNY 26 million from CNY 25.06 million. The firm’s high-quality earnings and positive free cash flow reinforce its robust financial health amidst ongoing dividend distributions and strategic profitability focus.

- Click here to discover the nuances of HG Technologies with our detailed analytical health report.

Gain insights into HG Technologies' past trends and performance with our Past report.

Make It Happen

- Get an in-depth perspective on all 3166 Global Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HG Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300847

HG Technologies

Engages in the research and development, production, and sale of printing and copying electrostatic imaging consumables and imaging equipment in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)