- China

- /

- Construction

- /

- SHSE:603929

3 Reliable Dividend Stocks Offering Up To 5.2% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rate cuts from the ECB and SNB, alongside expectations for further easing by the Federal Reserve, investors are observing mixed performances across major indices. In this environment of economic uncertainty and fluctuating market dynamics, dividend stocks stand out as a potential source of steady income due to their ability to provide consistent yields even when broader market conditions are volatile.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.26% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.00% | ★★★★★★ |

| Shaanxi International TrustLtd (SZSE:000563) | 3.16% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.25% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

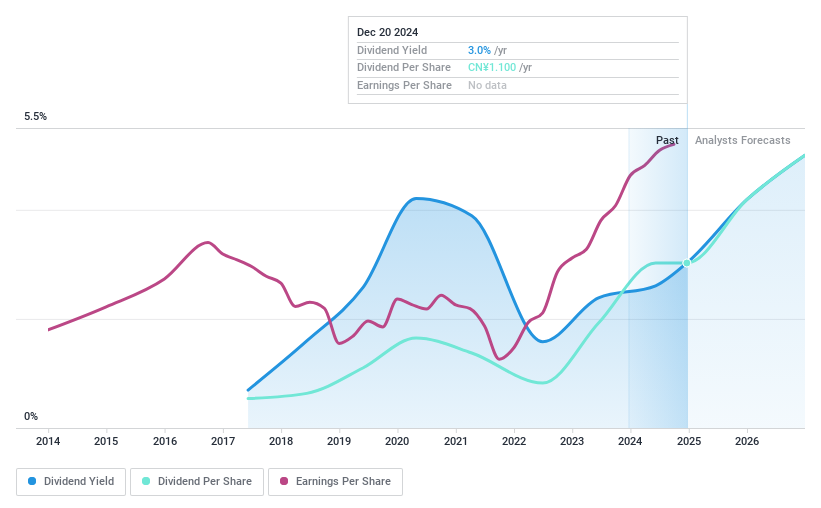

Hexing ElectricalLtd (SHSE:603556)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hexing Electrical Co., Ltd. offers electrical equipment and related solutions to power utilities globally, with a market cap of CN¥18.35 billion.

Operations: Hexing Electrical Co., Ltd. generates revenue through its electrical equipment and solutions provided to power utilities across the globe.

Dividend Yield: 3%

Hexing Electrical Ltd. presents a mixed outlook for dividend investors. The company has shown strong earnings growth, with net income rising to CNY 791.44 million for the first nine months of 2024, and maintains a reasonable payout ratio of 48.5%. Despite this, its dividend history is unstable over the past eight years, though it offers a competitive yield at 3.03%, surpassing the CN market average of 2.07%.

- Click here and access our complete dividend analysis report to understand the dynamics of Hexing ElectricalLtd.

- In light of our recent valuation report, it seems possible that Hexing ElectricalLtd is trading behind its estimated value.

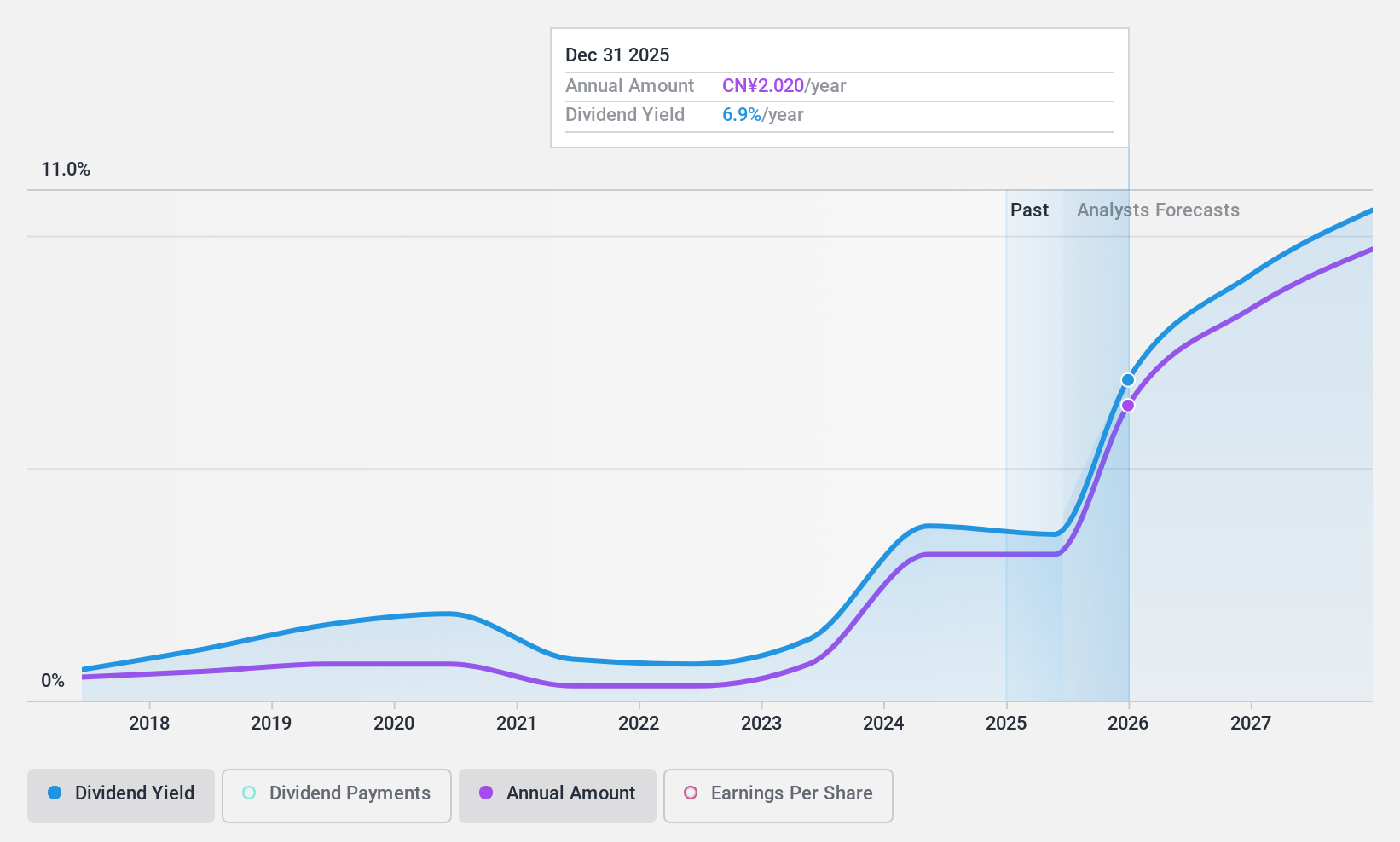

L&K Engineering (Suzhou)Ltd (SHSE:603929)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: L&K Engineering (Suzhou) Co., Ltd. offers specialized engineering technical services in China, with a market cap of CN¥5.75 billion.

Operations: L&K Engineering (Suzhou) Co., Ltd.'s revenue segments include specialized engineering technical services within China.

Dividend Yield: 3.7%

L&K Engineering (Suzhou) Ltd. offers a compelling dividend profile with a low cash payout ratio of 21.6%, ensuring dividends are well-covered by cash flows and earnings, which have grown significantly over the past year. Despite trading at 45.1% below estimated fair value, the company's dividend history is volatile, having been paid for only eight years with fluctuations exceeding 20%. Its current yield of 3.66% ranks among the top in China.

- Dive into the specifics of L&K Engineering (Suzhou)Ltd here with our thorough dividend report.

- Our valuation report unveils the possibility L&K Engineering (Suzhou)Ltd's shares may be trading at a discount.

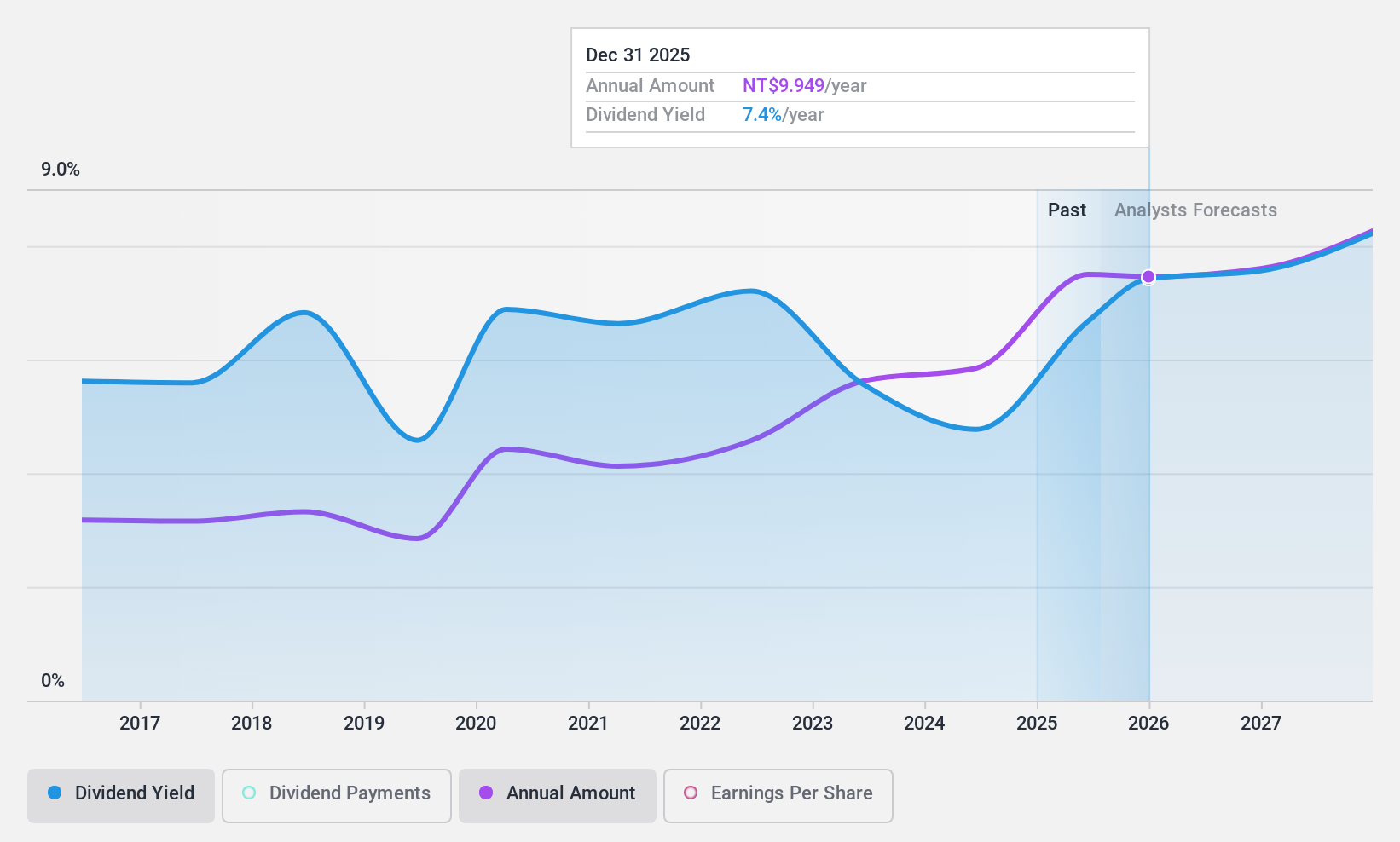

Chicony Electronics (TWSE:2385)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Chicony Electronics Co., Ltd. is involved in the manufacture and sale of electronic parts and components both in Taiwan and internationally, with a market cap of NT$106.24 billion.

Operations: Chicony Electronics Co., Ltd.'s revenue from computer peripherals amounts to NT$99.67 billion.

Dividend Yield: 5.2%

Chicony Electronics offers a strong dividend profile with a 5.2% yield, placing it in the top 25% of Taiwan's market. The dividends are well-covered by earnings and cash flows, with payout ratios at 65.1% and 64.3%, respectively, indicating sustainability. Over the past decade, Chicony's dividends have been stable and reliably growing, supported by recent earnings growth of TWD 6.63 billion for nine months in 2024 compared to TWD 5.39 billion previously.

- Delve into the full analysis dividend report here for a deeper understanding of Chicony Electronics.

- The analysis detailed in our Chicony Electronics valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Reveal the 1970 hidden gems among our Top Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603929

L&K Engineering (Suzhou)Ltd

Provides specialized engineering technical services in China.

Flawless balance sheet, undervalued and pays a dividend.