Top Growth Companies With Insider Ownership In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments, with the Nasdaq Composite reaching record highs and expectations rising for a Federal Reserve rate cut, investors are increasingly focused on growth stocks that continue to outperform their value counterparts. In this environment, companies with high insider ownership can be particularly appealing as they often indicate confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

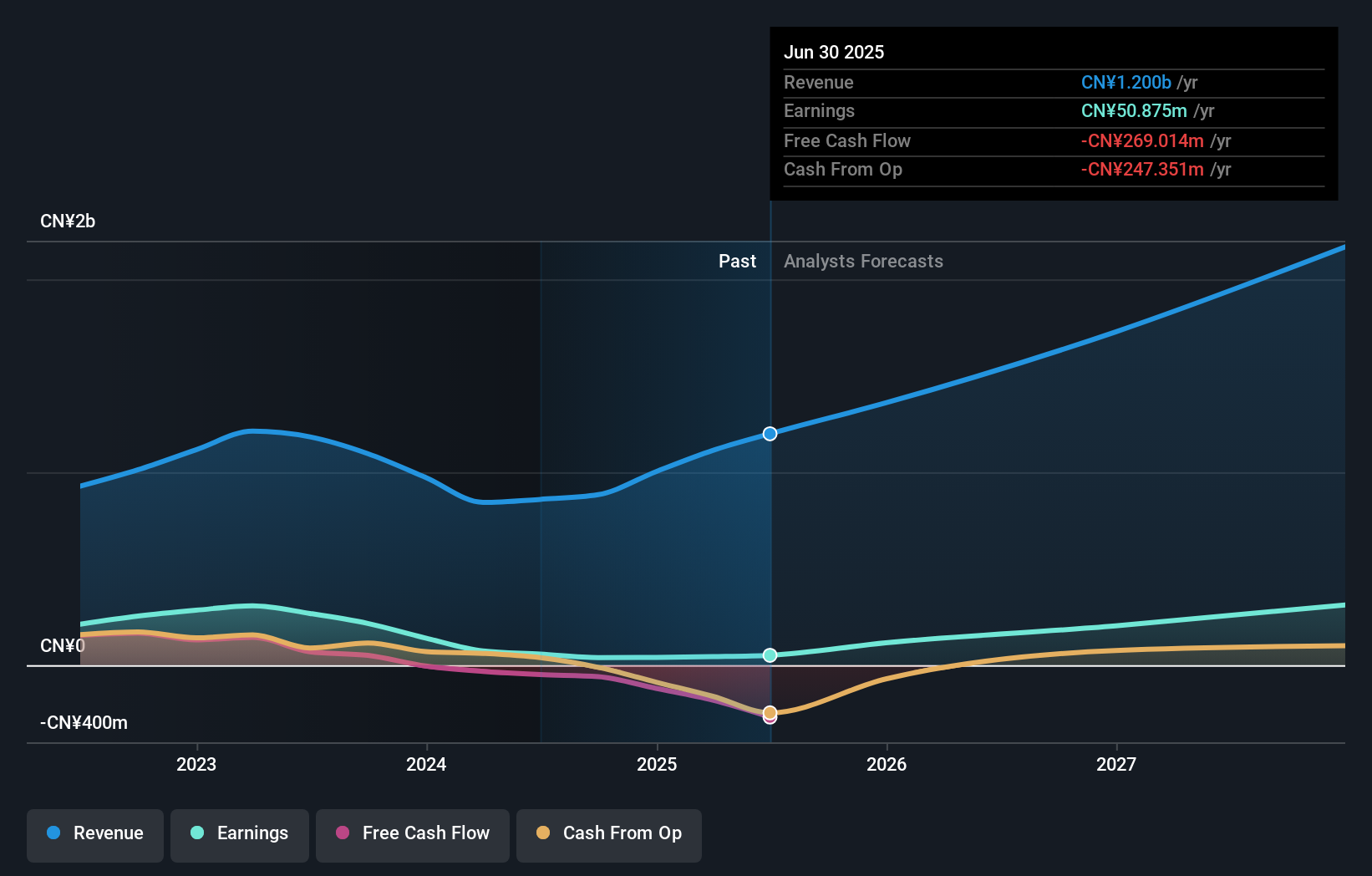

Suzhou Oriental Semiconductor (SHSE:688261)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Oriental Semiconductor Company Limited is a semiconductor technology company based in China with a market capitalization of CN¥5.66 billion.

Operations: The company's revenue is primarily derived from its semiconductors segment, amounting to CN¥883.40 million.

Insider Ownership: 33.4%

Earnings Growth Forecast: 61.3% p.a.

Suzhou Oriental Semiconductor shows potential as a growth company with high insider ownership. Despite recent declines in sales and net income, the company is forecasted to achieve significant earnings growth of 61.3% annually, outpacing the broader Chinese market. Revenue is also expected to grow at 22.7% per year, exceeding market averages. However, profit margins have decreased significantly from last year and share price volatility remains high, presenting challenges for investors seeking stability.

- Navigate through the intricacies of Suzhou Oriental Semiconductor with our comprehensive analyst estimates report here.

- The analysis detailed in our Suzhou Oriental Semiconductor valuation report hints at an inflated share price compared to its estimated value.

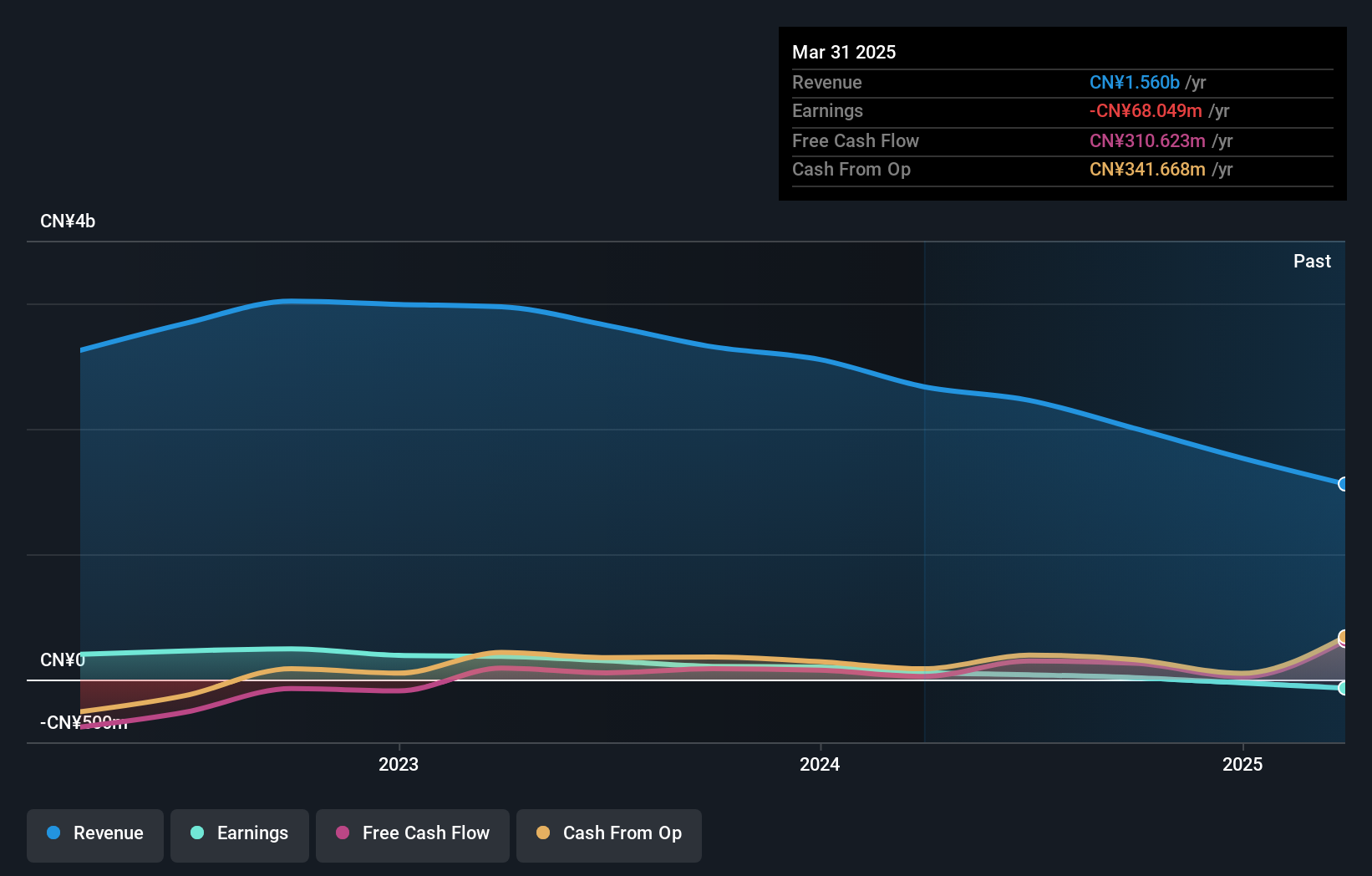

Sichuan Tianyi Comheart Telecom (SZSE:300504)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Tianyi Comheart Telecom Co., Ltd. operates in the telecommunications industry and has a market cap of CN¥4.93 billion.

Operations: Sichuan Tianyi Comheart Telecom Co., Ltd. generates its revenue from various segments within the telecommunications industry.

Insider Ownership: 26.9%

Earnings Growth Forecast: 64.1% p.a.

Sichuan Tianyi Comheart Telecom demonstrates potential with substantial insider ownership, despite a recent decline in sales and net income. Forecasts suggest significant annual earnings growth of 64.1%, surpassing the Chinese market average, while revenue is expected to grow at 17.7% annually, also beating market trends. However, challenges include high share price volatility and reduced profit margins from 4% to 0.8%, alongside a low forecasted return on equity of 7.8%.

- Dive into the specifics of Sichuan Tianyi Comheart Telecom here with our thorough growth forecast report.

- According our valuation report, there's an indication that Sichuan Tianyi Comheart Telecom's share price might be on the expensive side.

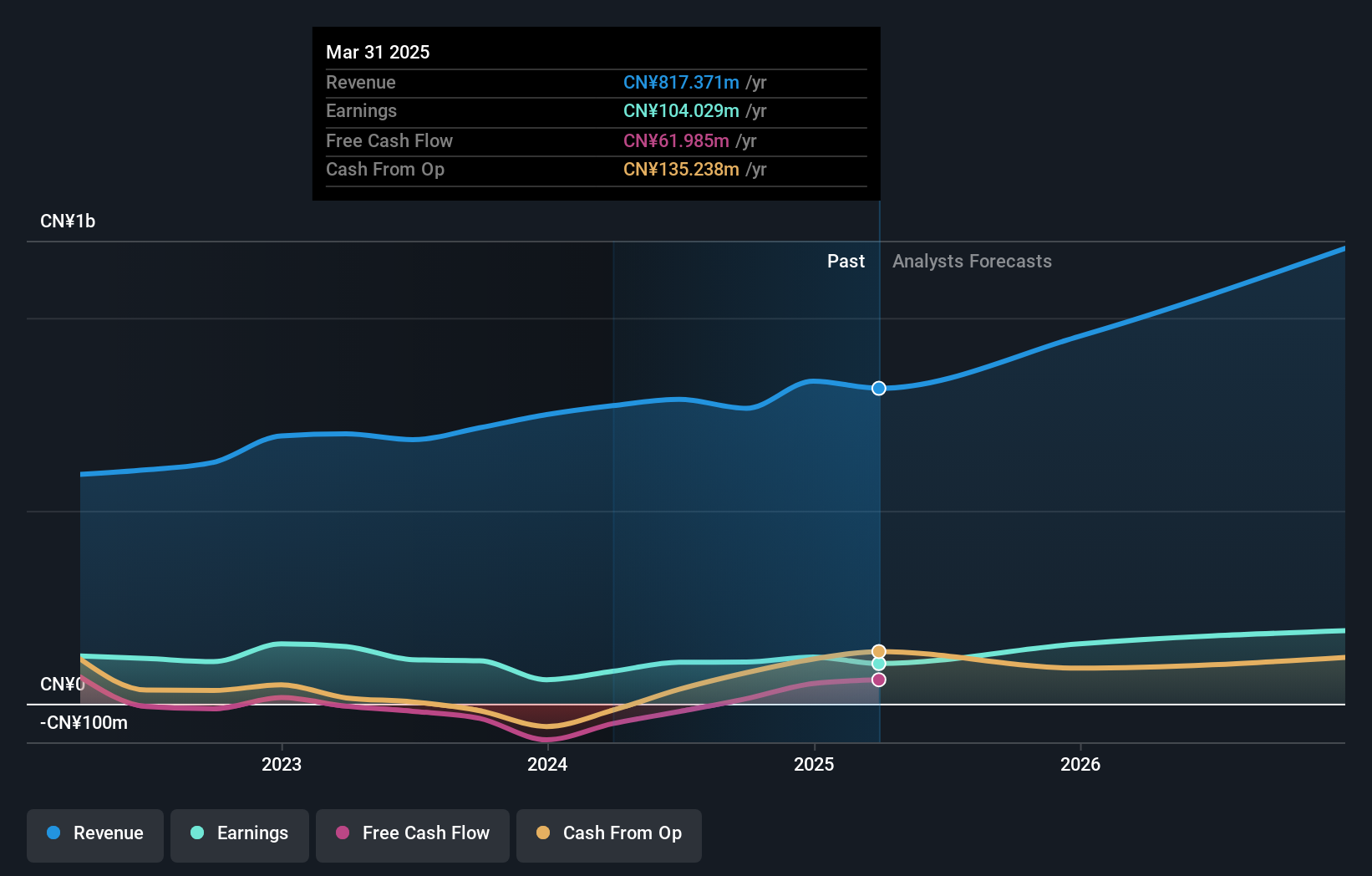

Pansoft (SZSE:300996)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pansoft Company Limited offers enterprise management information solutions and IT integrated services in China, with a market cap of CN¥4.14 billion.

Operations: Pansoft generates revenue from enterprise management information solutions and IT integrated services in China.

Insider Ownership: 39.2%

Earnings Growth Forecast: 32% p.a.

Pansoft shows potential with high insider ownership and a positive earnings turnaround, reporting CNY 14.93 million in net income for the first nine months of 2024, compared to a loss last year. Revenue growth is expected at 22.8% annually, outpacing the Chinese market average, while earnings are forecasted to grow significantly at 32% per year. Despite its volatile share price and low return on equity forecast of 13.5%, its price-to-earnings ratio remains competitive within the industry.

- Delve into the full analysis future growth report here for a deeper understanding of Pansoft.

- Our valuation report unveils the possibility Pansoft's shares may be trading at a premium.

Summing It All Up

- Delve into our full catalog of 1516 Fast Growing Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300996

Pansoft

Provides management information solutions and IT integrated services for large enterprises in China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives