- China

- /

- Semiconductors

- /

- SHSE:688662

December 2024's Leading Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate adjustments and mixed economic signals, growth stocks continue to capture investor attention with their potential for substantial returns. In this environment, companies with high insider ownership can be particularly appealing, as they often signal confidence in the business's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We'll examine a selection from our screener results.

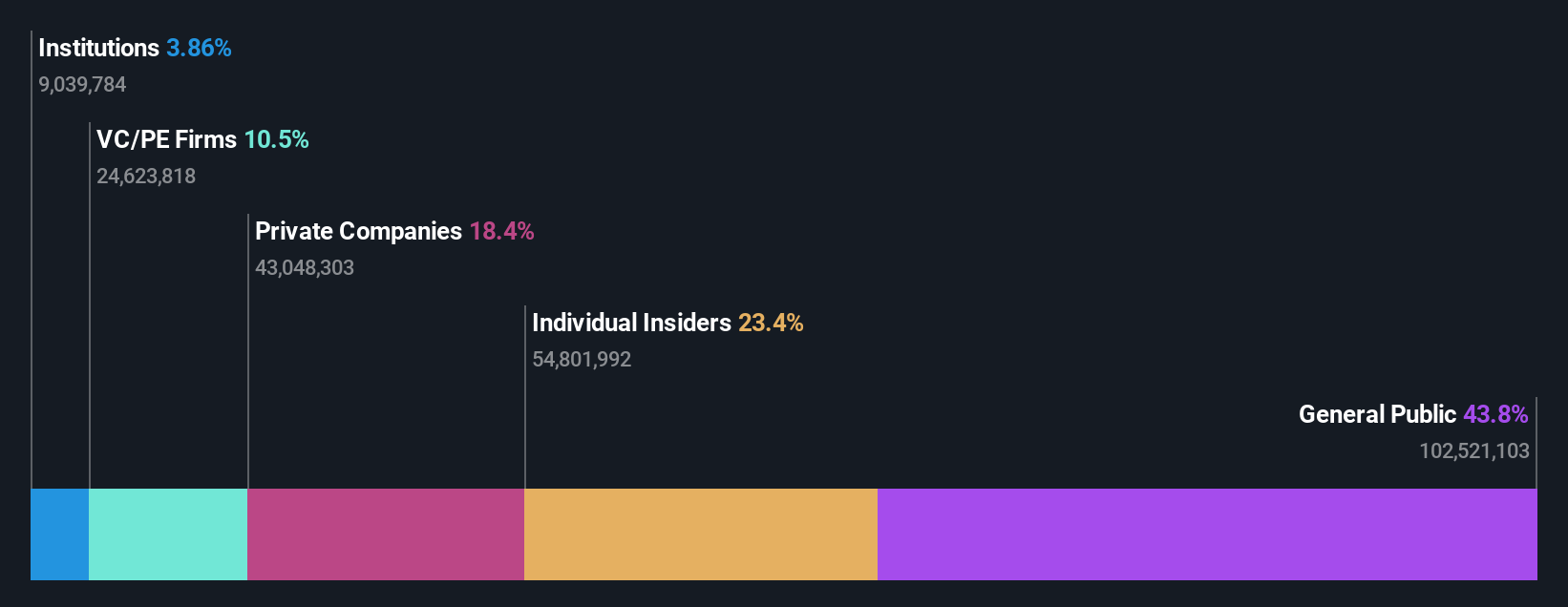

Dioo Microcircuits Jiangsu (SHSE:688381)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dioo Microcircuits Jiangsu is a Chinese company specializing in the research, development, design, and manufacture of high-performance analog chips, with a market cap of CN¥4.78 billion.

Operations: Unfortunately, the provided text does not include specific revenue segments or figures for Dioo Microcircuits Jiangsu, so I am unable to summarize them. If you can provide additional details or data on their revenue breakdown, I'd be happy to assist further.

Insider Ownership: 23.3%

Earnings Growth Forecast: 69.3% p.a.

Dioo Microcircuits Jiangsu exhibits strong growth potential with earnings expected to increase significantly, outpacing the Chinese market's average. Despite a recent dip in profit margins from 11.5% to 0.1%, revenue is forecasted to grow at 25.5% annually, exceeding market expectations. The company has initiated multiple share repurchase programs, reflecting confidence in its future prospects and aligning with equity incentive plans, although insider trading activity remains minimal over the past three months.

- Dive into the specifics of Dioo Microcircuits Jiangsu here with our thorough growth forecast report.

- Our valuation report here indicates Dioo Microcircuits Jiangsu may be overvalued.

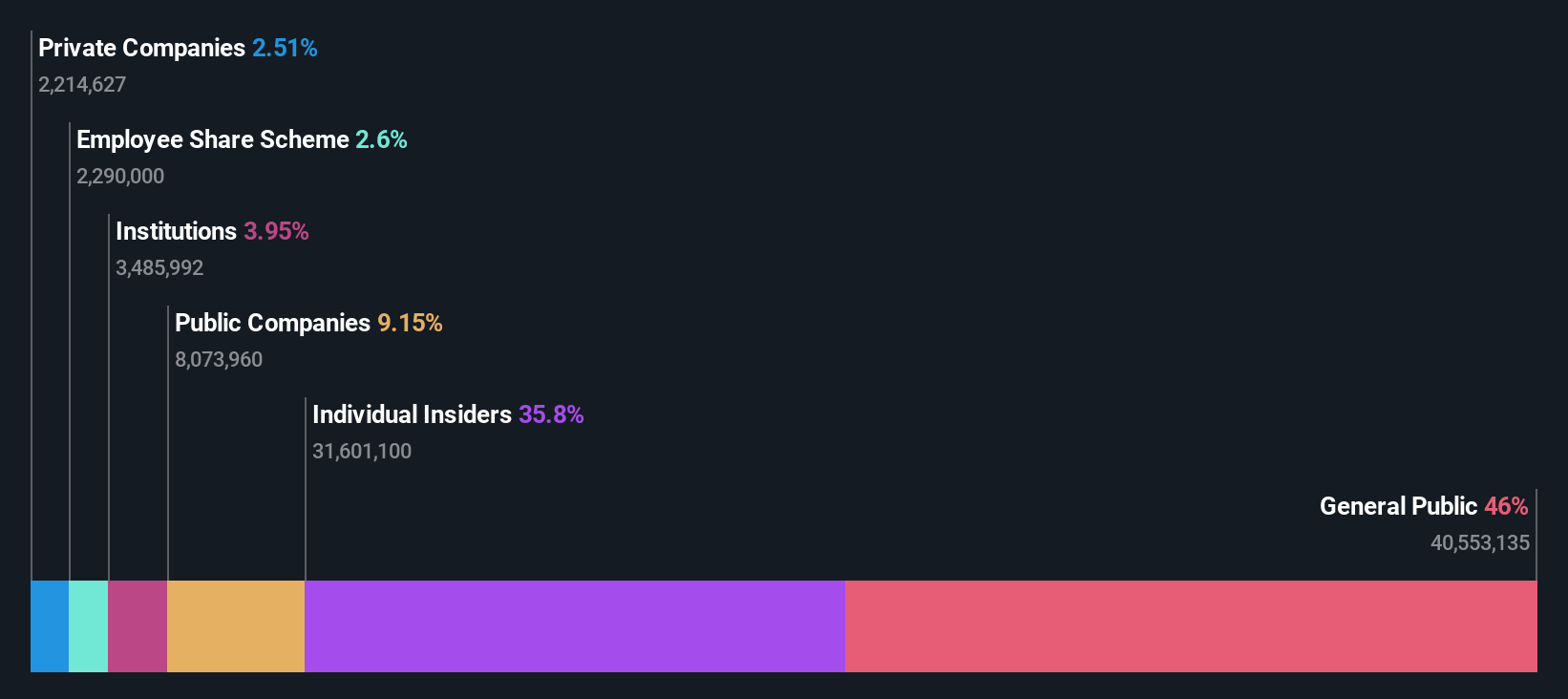

Guangdong Fuxin Technology (SHSE:688662)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Fuxin Technology Co., Ltd. engages in the research, development, production, and sale of semiconductor thermoelectric materials and has a market cap of CN¥2.91 billion.

Operations: Guangdong Fuxin Technology's revenue primarily stems from its activities in semiconductor thermoelectric materials.

Insider Ownership: 39%

Earnings Growth Forecast: 38.6% p.a.

Guangdong Fuxin Technology is experiencing robust growth, with revenue increasing to CNY 392.36 million for the first nine months of 2024 and a significant turnaround to a net income of CNY 33.29 million from a previous loss. Earnings are forecasted to grow at an impressive rate of 38.58% annually, surpassing market averages. Despite its volatile share price, the company has completed substantial share buybacks, indicating strong insider confidence in its growth trajectory and financial health.

- Click here and access our complete growth analysis report to understand the dynamics of Guangdong Fuxin Technology.

- Upon reviewing our latest valuation report, Guangdong Fuxin Technology's share price might be too optimistic.

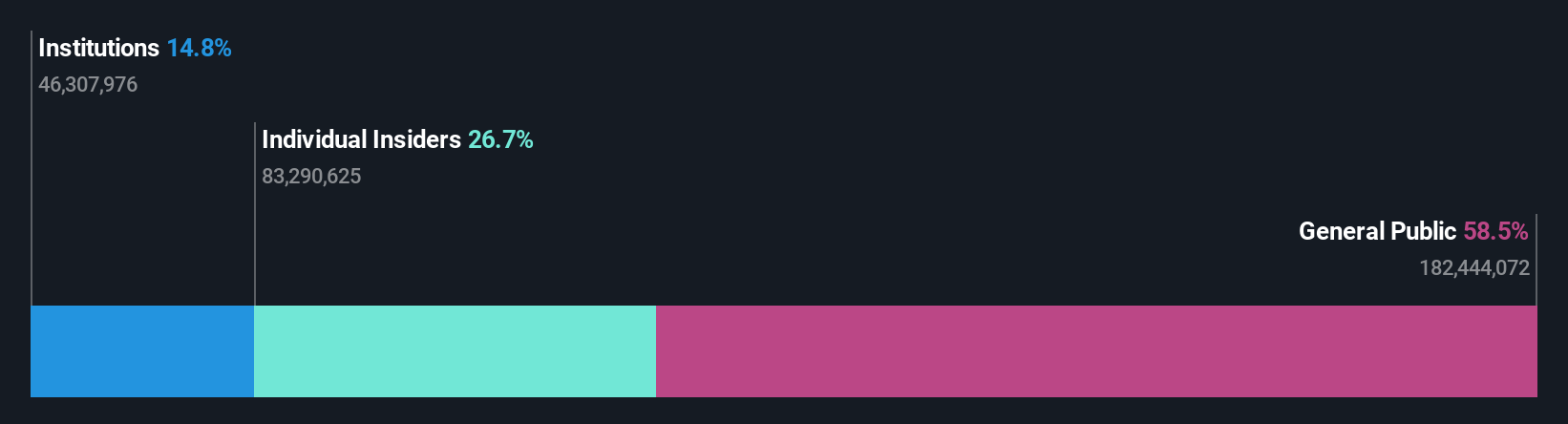

Shenzhen Sinexcel ElectricLtd (SZSE:300693)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Sinexcel Electric Co., Ltd. operates in the energy interconnection ecosystem across multiple continents, with a market cap of CN¥7.58 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 29.1%

Earnings Growth Forecast: 29.1% p.a.

Shenzhen Sinexcel Electric demonstrates strong growth potential, with earnings and revenue forecasted to grow significantly at 29.12% and 28.8% annually, respectively, outpacing the broader CN market. Despite a slight decline in net income this year, the company trades at a substantial discount to its estimated fair value. Recent share buybacks signal management's confidence in future prospects, although dividends remain inadequately covered by free cash flows.

- Click here to discover the nuances of Shenzhen Sinexcel ElectricLtd with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Shenzhen Sinexcel ElectricLtd's current price could be quite moderate.

Where To Now?

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1513 more companies for you to explore.Click here to unveil our expertly curated list of 1516 Fast Growing Companies With High Insider Ownership.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688662

Guangdong Fuxin Technology

Researches, develops, produces, and sells semiconductor thermoelectric materials.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives