As global markets grapple with economic uncertainty and inflation fears, Asian indices have shown resilience amid these challenges. In such a volatile environment, growth companies in Asia with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Jiayou International LogisticsLtd (SHSE:603871) | 19.3% | 27.3% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 24.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.6% |

| Synspective (TSE:290A) | 13.2% | 44.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Yijiahe Technology (SHSE:603666)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yijiahe Technology Co., Ltd. focuses on the research, development, design, and sale of intelligent robots in China and has a market capitalization of CN¥7.10 billion.

Operations: Yijiahe Technology Co., Ltd. generates revenue through its activities in the research, development, design, and sale of intelligent robots within China.

Insider Ownership: 28.2%

Yijiahe Technology is poised for significant growth, with revenue expected to increase by 36.5% annually, outpacing the Chinese market's average. The company is forecast to become profitable within three years, driven by its innovative AI robots and intelligent cleaning solutions. Recent product announcements highlighted proprietary technologies like the Smart Cerebellum Controller and Bionic Tactile Skin, enhancing human-robot interaction. Despite high share price volatility and low future ROE forecasts, Yijiahe remains a compelling growth story in Asia.

- Take a closer look at Yijiahe Technology's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Yijiahe Technology's current price could be inflated.

Changchun BCHT Biotechnology (SHSE:688276)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Changchun BCHT Biotechnology Co. Ltd. is a biopharmaceutical company involved in the research, development, production, and sale of human vaccines both in China and internationally, with a market cap of CN¥9.95 billion.

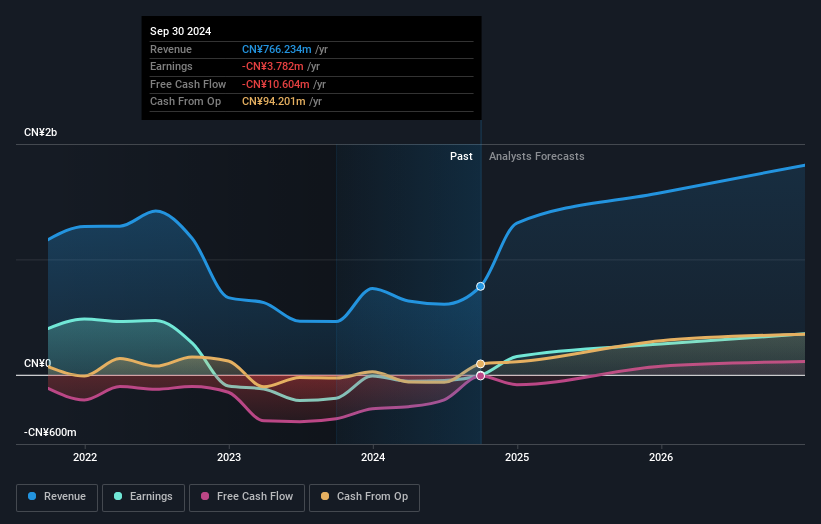

Operations: The company's revenue primarily comes from its biotechnology segment, which generated CN¥1.61 billion.

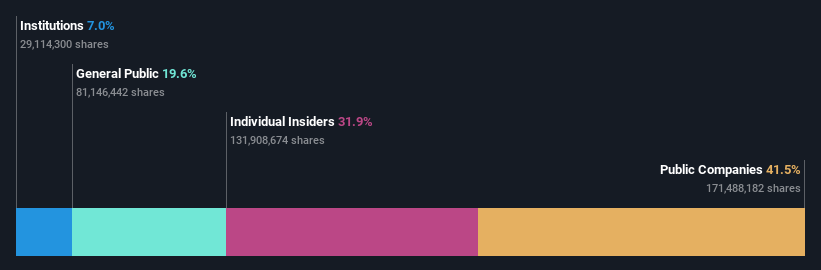

Insider Ownership: 31.9%

Changchun BCHT Biotechnology is set for robust growth, with revenue projected to rise by 27.5% annually, surpassing the Chinese market average. The company's earnings are expected to grow significantly at 35.8% per year, offering good value with a price-to-earnings ratio of 24x below the market average. Despite a low future ROE forecast of 15.2%, the stock trades favorably compared to peers and industry benchmarks, although its dividend yield of 0.62% lacks coverage from free cash flows.

- Navigate through the intricacies of Changchun BCHT Biotechnology with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Changchun BCHT Biotechnology is trading behind its estimated value.

Beijing Tieke Shougang Rail Way-Tech (SHSE:688569)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Tieke Shougang Rail Way-Tech Co., Ltd. operates in the railway technology sector and has a market cap of CN¥5.02 billion.

Operations: Beijing Tieke Shougang Rail Way-Tech Co., Ltd.'s revenue segments are not specified in the provided text.

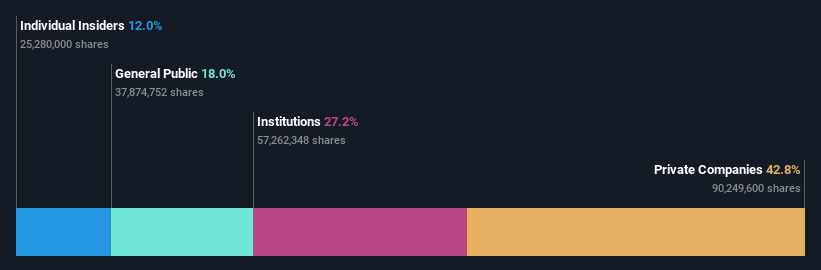

Insider Ownership: 12%

Beijing Tieke Shougang Rail Way-Tech is positioned for strong growth, with revenue expected to increase by 30.6% annually, outpacing the Chinese market. Earnings are forecasted to grow significantly at 51.2% per year, while the price-to-earnings ratio of 23.4x suggests good relative value compared to peers. Despite a recent decline in sales and net income for 2024, the company's growth potential remains compelling, although its future ROE of 17.9% is relatively low.

- Click here to discover the nuances of Beijing Tieke Shougang Rail Way-Tech with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Beijing Tieke Shougang Rail Way-Tech is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Unlock our comprehensive list of 656 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688276

Changchun BCHT Biotechnology

Changchun BCHT Biotechnology Co. Ltd., a biopharmaceutical company, engages in the research and development, production, and sale of human vaccines in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives