- China

- /

- Electrical

- /

- SHSE:603662

Optimism for Keli Sensing Technology (Ningbo)Ltd (SHSE:603662) has grown this past week, despite three-year decline in earnings

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. But when you hold the right stock for the right time period, the rewards can be truly huge. One bright shining star stock has been Keli Sensing Technology (Ningbo) Co.,Ltd. (SHSE:603662), which is 367% higher than three years ago. Better yet, the share price has risen 6.1% in the last week.

Since the stock has added CN¥1.3b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Keli Sensing Technology (Ningbo)Ltd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, Keli Sensing Technology (Ningbo)Ltd actually saw its earnings per share (EPS) drop 1.7% per year.

Companies are not always focussed on EPS growth in the short term, and looking at how the share price has reacted, we don't think EPS is the most important metric for Keli Sensing Technology (Ningbo)Ltd at the moment. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Languishing at just 0.4%, we doubt the dividend is doing much to prop up the share price. It may well be that Keli Sensing Technology (Ningbo)Ltd revenue growth rate of 3.7% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

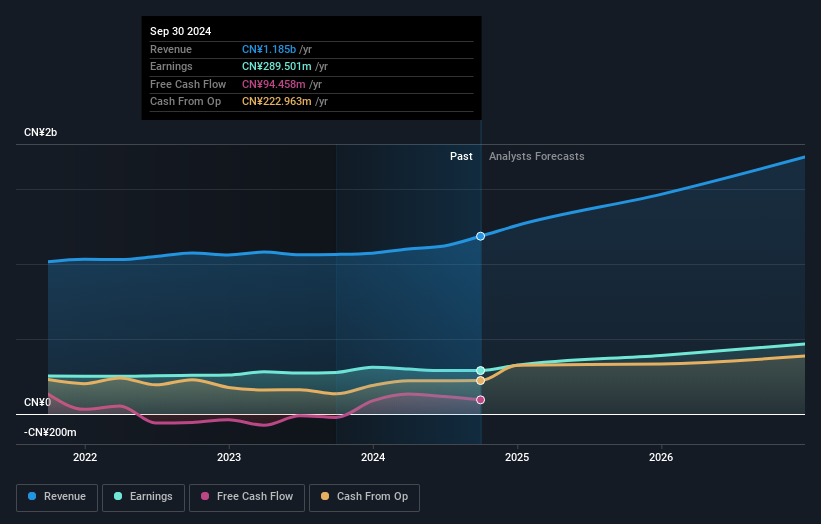

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Keli Sensing Technology (Ningbo)Ltd

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Keli Sensing Technology (Ningbo)Ltd the TSR over the last 3 years was 387%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Keli Sensing Technology (Ningbo)Ltd has rewarded shareholders with a total shareholder return of 148% in the last twelve months. Of course, that includes the dividend. That's better than the annualised return of 37% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Keli Sensing Technology (Ningbo)Ltd is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

We will like Keli Sensing Technology (Ningbo)Ltd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Keli Sensing Technology (Ningbo)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603662

Keli Sensing Technology (Ningbo)Ltd

Engages in the research and development, manufacture, and sale of various types of sensors, weighing indicators, electronic weighing systems, system integration and health scales in China and internationally.

Excellent balance sheet with moderate growth potential.