Top Growth Companies With Insider Ownership In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors have witnessed a mixed performance across sectors, with financials and energy benefiting from deregulation hopes while healthcare faces challenges. Amidst this backdrop, identifying growth companies with high insider ownership can be particularly appealing, as such ownership often signals confidence in a company's potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

We'll examine a selection from our screener results.

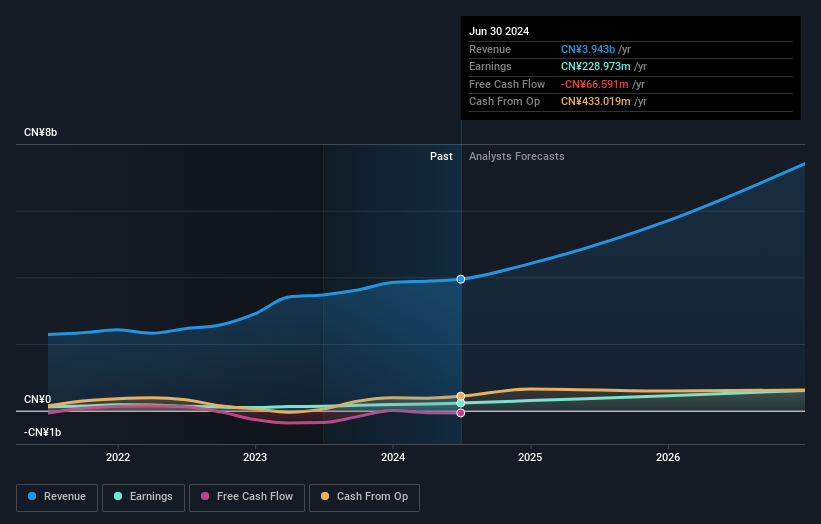

JiangSu Zhenjiang New Energy Equipment (SHSE:603507)

Simply Wall St Growth Rating: ★★★★★☆

Overview: JiangSu Zhenjiang New Energy Equipment Co., Ltd. operates in the new energy sector and has a market cap of CN¥4.98 billion.

Operations: JiangSu Zhenjiang New Energy Equipment Co., Ltd. generates its revenue from various segments in the new energy sector.

Insider Ownership: 29.1%

JiangSu Zhenjiang New Energy Equipment is experiencing robust growth, with earnings projected to rise significantly at 38.71% annually, surpassing the CN market average. The company recently announced a CNY 60 million share repurchase program aimed at enhancing employee incentives and promoting long-term development. Despite a low dividend yield of 1.11%, its price-to-earnings ratio of 22.5x suggests it trades at good value relative to the broader CN market average of 35.9x.

- Delve into the full analysis future growth report here for a deeper understanding of JiangSu Zhenjiang New Energy Equipment.

- The analysis detailed in our JiangSu Zhenjiang New Energy Equipment valuation report hints at an deflated share price compared to its estimated value.

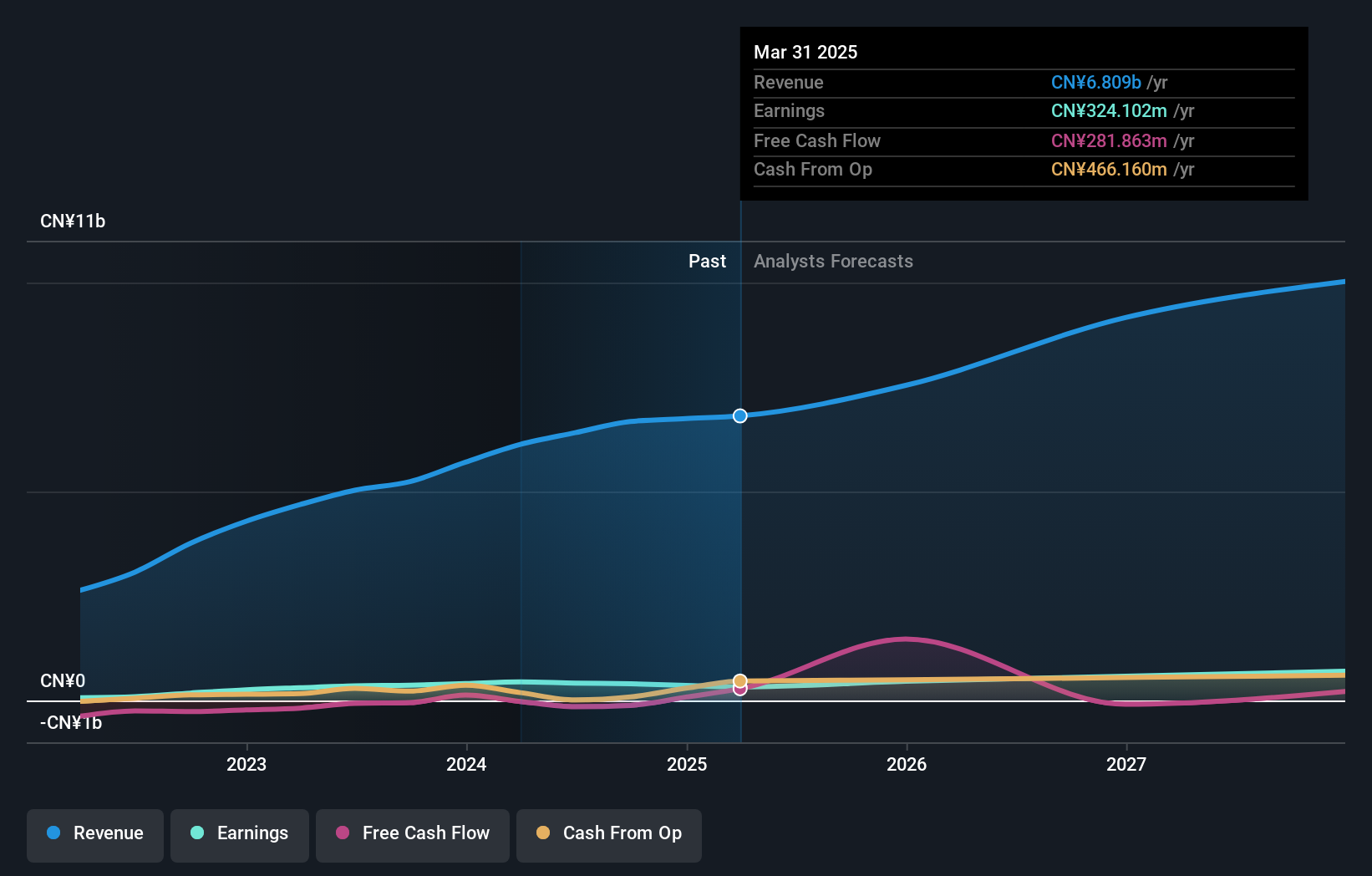

Lucky Harvest (SZSE:002965)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lucky Harvest Co., Ltd. operates in China, focusing on the research, development, production, and sale of precision stamping dies and structural metal parts, with a market cap of CN¥6.44 billion.

Operations: Revenue Segments (in millions of CN¥): Lucky Harvest Co., Ltd. generates revenue through its core activities in precision stamping dies and structural metal parts.

Insider Ownership: 33.1%

Lucky Harvest demonstrates strong growth potential with forecasted earnings expansion of 29.23% annually, outpacing the CN market's average. Despite a recent dip in net income to CNY 269.17 million for the nine months ending September 2024, sales increased significantly to CNY 4,878.27 million from the previous year. The company trades at a favorable price-to-earnings ratio of 16x compared to the broader CN market's average of 35.9x, indicating good value amidst high insider ownership stability.

- Navigate through the intricacies of Lucky Harvest with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Lucky Harvest implies its share price may be lower than expected.

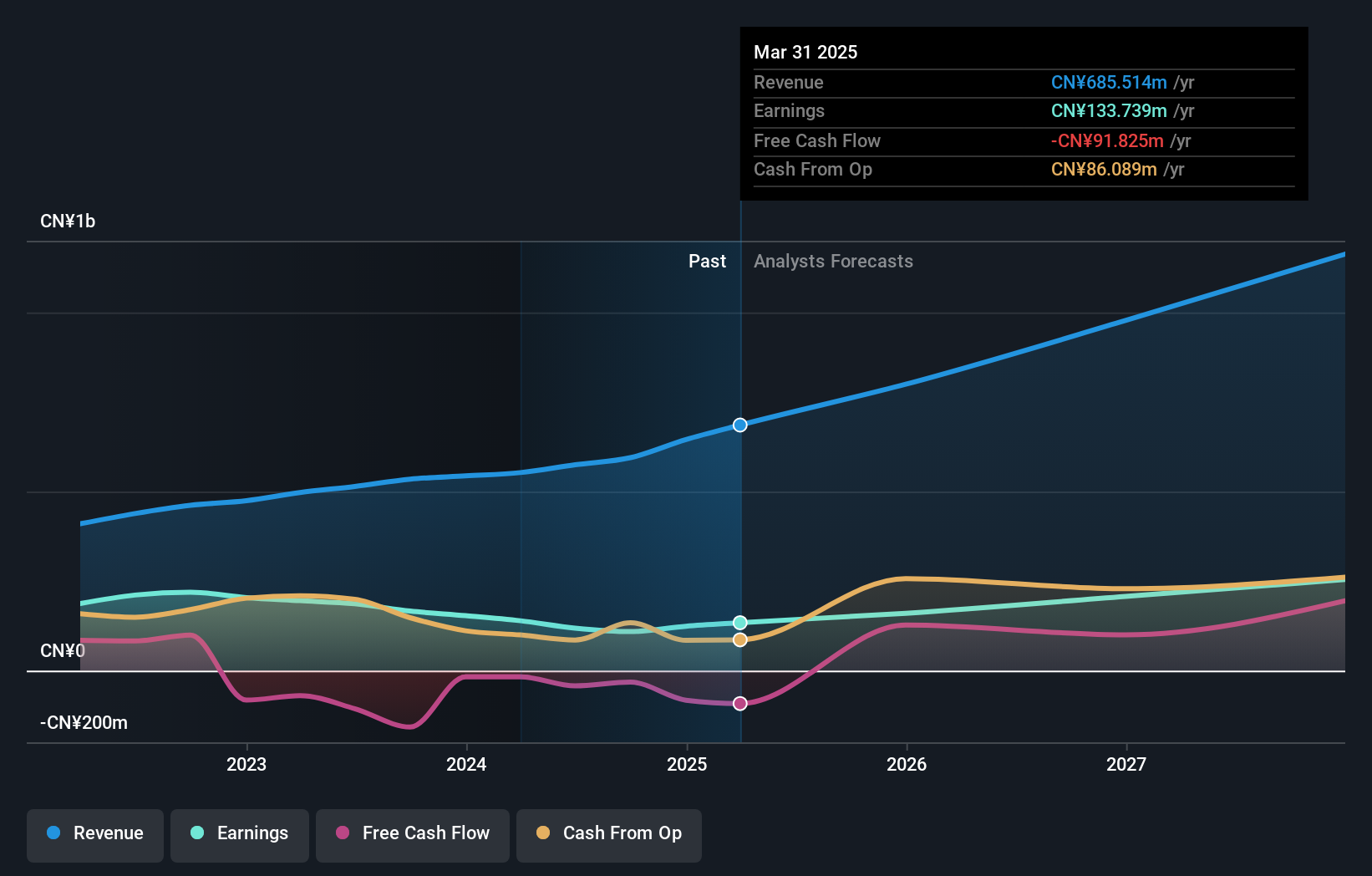

AcrobiosystemsLtd (SZSE:301080)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Acrobiosystems Co., Ltd. develops and manufactures recombinant proteins, antibodies, and other biological reagents for pharmaceutical and biotechnology companies as well as scientific research institutions, with a market cap of CN¥5.56 billion.

Operations: The company generates revenue primarily from Research and Experimental Development, amounting to CN¥583.70 million.

Insider Ownership: 37.3%

Acrobiosystems Ltd. shows potential for growth with forecasted earnings expansion of 29.9% annually, surpassing the CN market's average. Despite a decline in net income to CNY 83.49 million for the nine months ending September 2024, sales rose to CNY 463.49 million from the previous year. The company is trading at a discount to its estimated fair value and has initiated a share repurchase program worth up to CNY 40 million, reflecting confidence in its future prospects amidst high insider ownership stability.

- Get an in-depth perspective on AcrobiosystemsLtd's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that AcrobiosystemsLtd's share price might be on the cheaper side.

Seize The Opportunity

- Investigate our full lineup of 1538 Fast Growing Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002965

Lucky Harvest

Engages in the research, development, production, and sale of precision stamping dies and structural metal parts in China.

Flawless balance sheet with reasonable growth potential.