- Taiwan

- /

- Telecom Services and Carriers

- /

- TPEX:6561

Uncovering Hidden Potential Three Undiscovered Gems With Strong Foundations

Reviewed by Simply Wall St

In a week marked by fluctuating indices and mixed economic signals, small-cap stocks have demonstrated resilience, holding up better than their large-cap counterparts amid a busy earnings season. This environment of cautious optimism presents a unique opportunity to explore stocks with solid foundations that might be overlooked in the broader market landscape. Identifying these hidden gems involves focusing on companies with strong fundamentals and potential for growth despite current market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.39% | 3.97% | 10.23% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.32% | 13.06% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

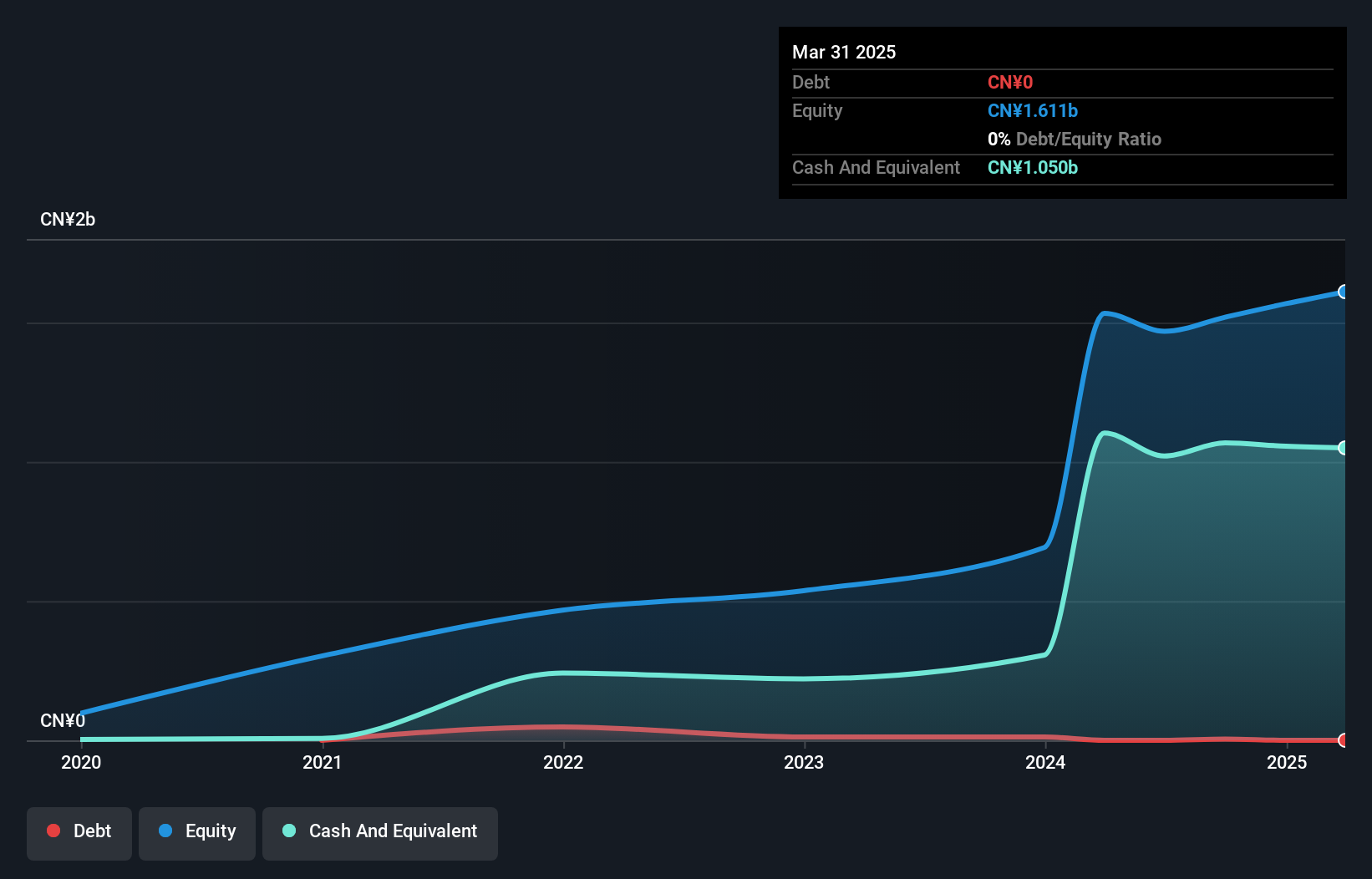

RIAMB (Beijing) Technology Development (SHSE:603082)

Simply Wall St Value Rating: ★★★★★☆

Overview: RIAMB (Beijing) Technology Development Co., Ltd. is engaged in the development and provision of intelligent logistics systems with a market cap of CN¥5.58 billion.

Operations: RIAMB generates revenue primarily from its Intelligent Logistics System segment, amounting to CN¥1.94 billion.

RIAMB Technology Development, a small player in the tech space, has been making waves with its earnings growth of 5.6% over the past year, surpassing the broader machinery industry's -0.6%. The company boasts high-quality earnings and maintains a healthy financial position with more cash than total debt. Recent figures reveal sales reaching CNY 1.45 billion for nine months ending September 2024, up from CNY 1.38 billion last year, while net income slightly increased to CNY 121.78 million from CNY 119.62 million despite EPS dropping to CNY 0.77 from CNY 0.98 a year ago.

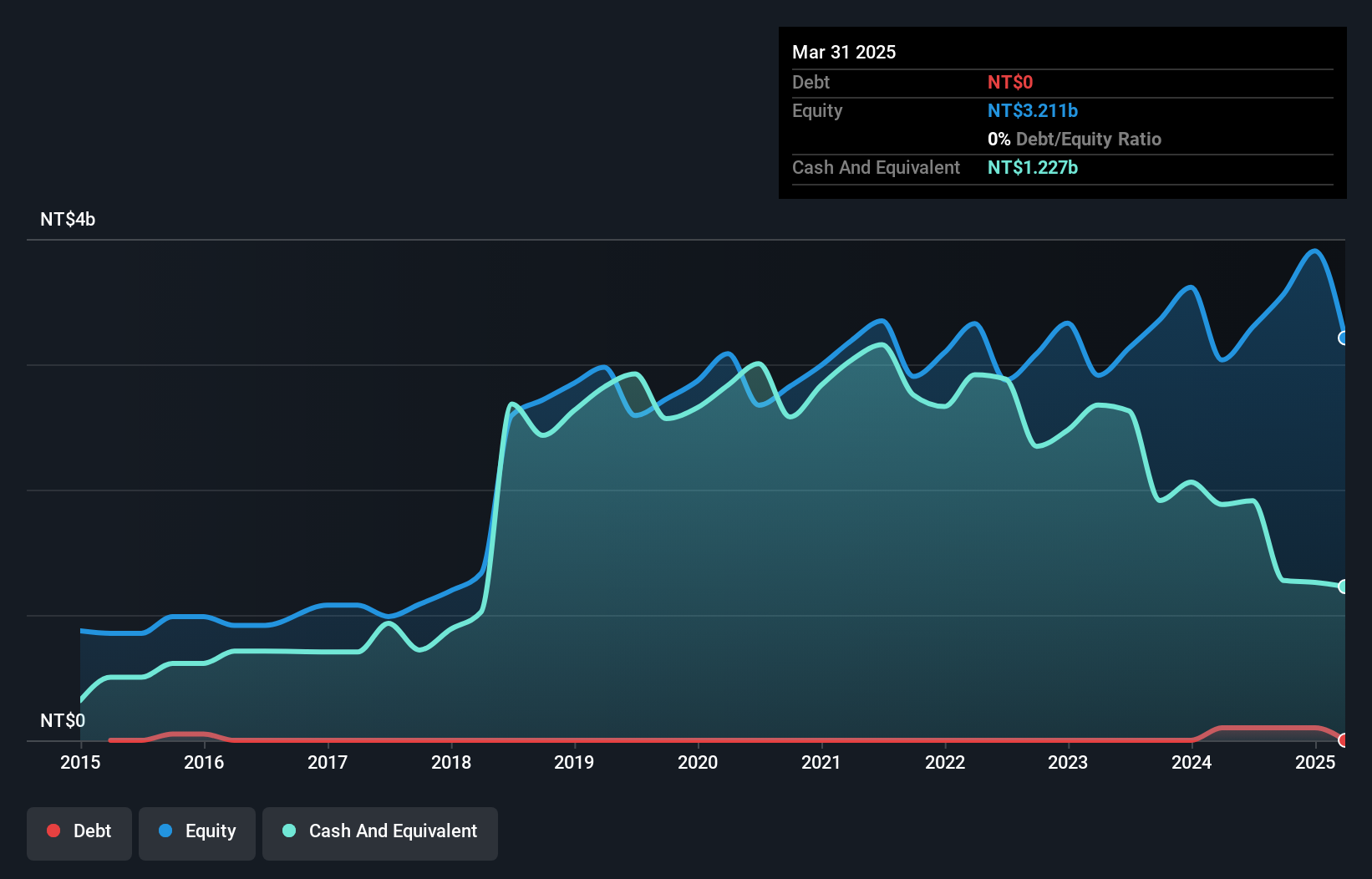

Chief Telecom (TPEX:6561)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chief Telecom Inc. offers network integration, internet data center, communications integration, and cloud application services both in Taiwan and internationally with a market capitalization of NT$37.80 billion.

Operations: Chief Telecom generates revenue primarily from its communications services segment, which reported NT$3.40 billion. The company's market capitalization stands at NT$37.80 billion, indicating its significant presence in the industry.

Chief Telecom, a dynamic player in the telecom sector, is showing promising signs with its recent financial performance. The company's net income for Q3 2024 was TWD 259 million, up from TWD 229 million the previous year, reflecting solid growth. Basic earnings per share rose to TWD 3.33 from TWD 2.94. Over nine months, sales reached TWD 2.76 billion compared to last year's TWD 2.42 billion, indicating robust demand for their services. Zettabyte's expansion at Chief Telecom's LY2 data center further enhances its position in AI infrastructure with innovative liquid cooling technology and custom hardware partnerships boosting efficiency and sustainability efforts significantly.

- Click here and access our complete health analysis report to understand the dynamics of Chief Telecom.

Explore historical data to track Chief Telecom's performance over time in our Past section.

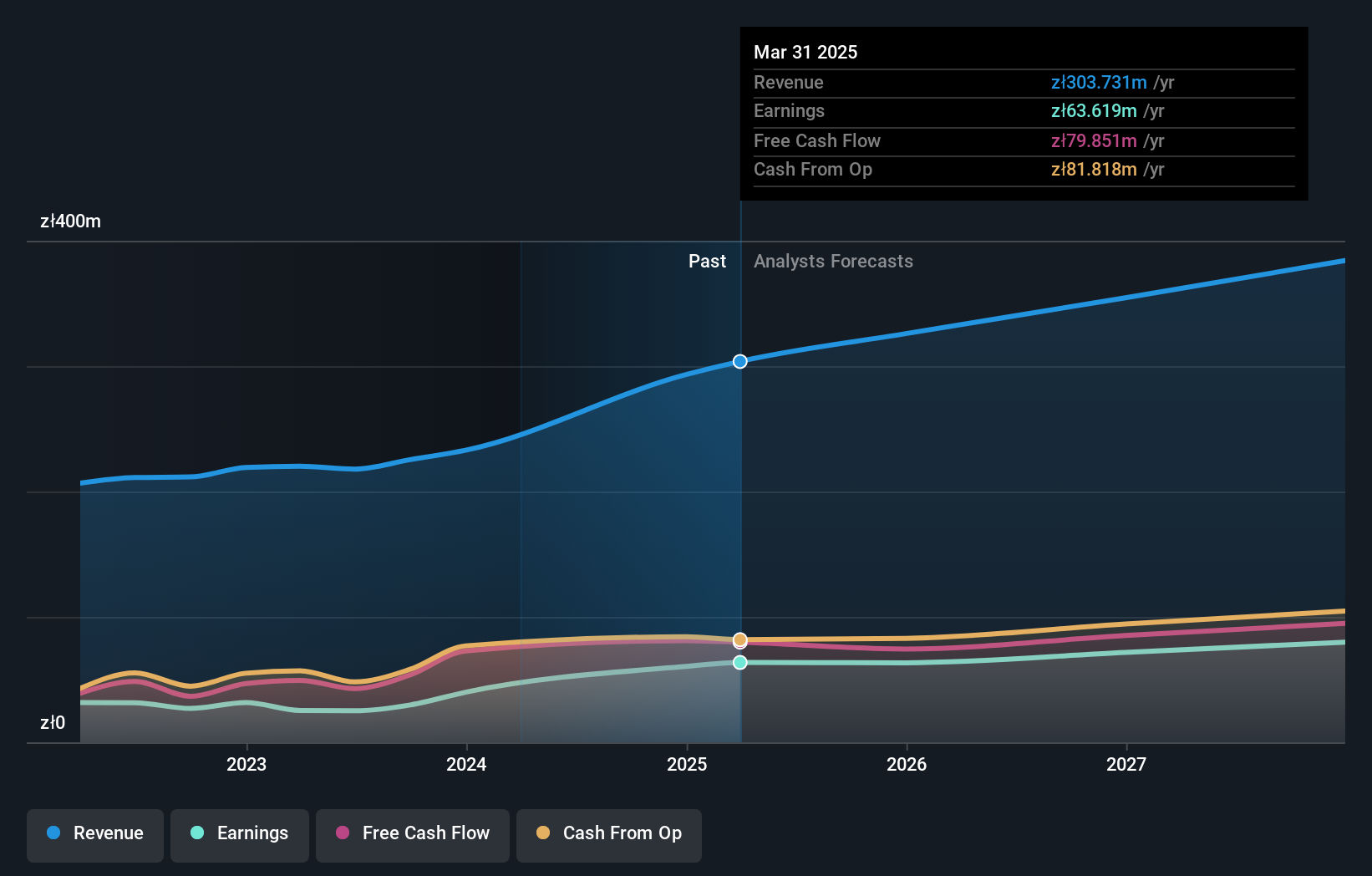

Sygnity (WSE:SGN)

Simply Wall St Value Rating: ★★★★★★

Overview: Sygnity S.A. is a company that manufactures and sells IT products and services both in Poland and internationally, with a market capitalization of PLN1.55 billion.

Operations: Sygnity generates revenue primarily from its IT segment, amounting to PLN232.96 million.

Sygnity, a promising player in the tech sector, has demonstrated robust performance with earnings growth of 26.4% over the past year, outpacing the IT industry's modest 0.06%. The company’s debt-to-equity ratio has impressively reduced from 82.5% to just 10.9% over five years, reflecting prudent financial management. Despite this progress, Sygnity's recent half-year results showed net income slightly lower at PLN 14.87 million compared to PLN 15.6 million last year, though revenue increased to PLN 131.43 million from PLN 114.23 million previously reported—indicating potential for continued expansion amidst volatility challenges in share price movements recently observed.

- Navigate through the intricacies of Sygnity with our comprehensive health report here.

Examine Sygnity's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Discover the full array of 4736 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6561

Chief Telecom

Provides network integration, internet data center, communications integration, and cloud application services in Taiwan and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives