- China

- /

- Oil and Gas

- /

- SZSE:000571

Yangzijiang Financial Holding Leads 3 Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, with recent interest rate cuts by the Federal Reserve and political uncertainties contributing to volatility. Amid these fluctuations, investors often seek opportunities in lesser-known areas such as penny stocks, which despite their vintage label, still hold potential for growth when backed by strong financials. These smaller or newer companies can offer unique value propositions at lower price points, making them intriguing options for those looking to uncover hidden gems in the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.555 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,831 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Yangzijiang Financial Holding (SGX:YF8)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Financial Holding Ltd. is an investment holding company involved in investment-related activities in the People's Republic of China and Singapore, with a market capitalization of SGD1.39 billion.

Operations: The company generates revenue of SGD303.66 million from its investment business.

Market Cap: SGD1.39B

Yangzijiang Financial Holding Ltd. presents a mixed picture in the realm of penny stocks, with significant short-term assets (SGD2.4 billion) exceeding both short and long-term liabilities, indicating solid financial footing. Despite trading at 43% below estimated fair value and having more cash than debt, its earnings have declined by 20.7% annually over the past five years, coupled with low return on equity (3.7%). Recent share buyback initiatives suggest confidence in undervaluation but are tempered by negative earnings growth and a less experienced board averaging 1.6 years tenure, impacting strategic stability moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Yangzijiang Financial Holding.

- Gain insights into Yangzijiang Financial Holding's future direction by reviewing our growth report.

Shanghai Guangdian Electric Group (SHSE:601616)

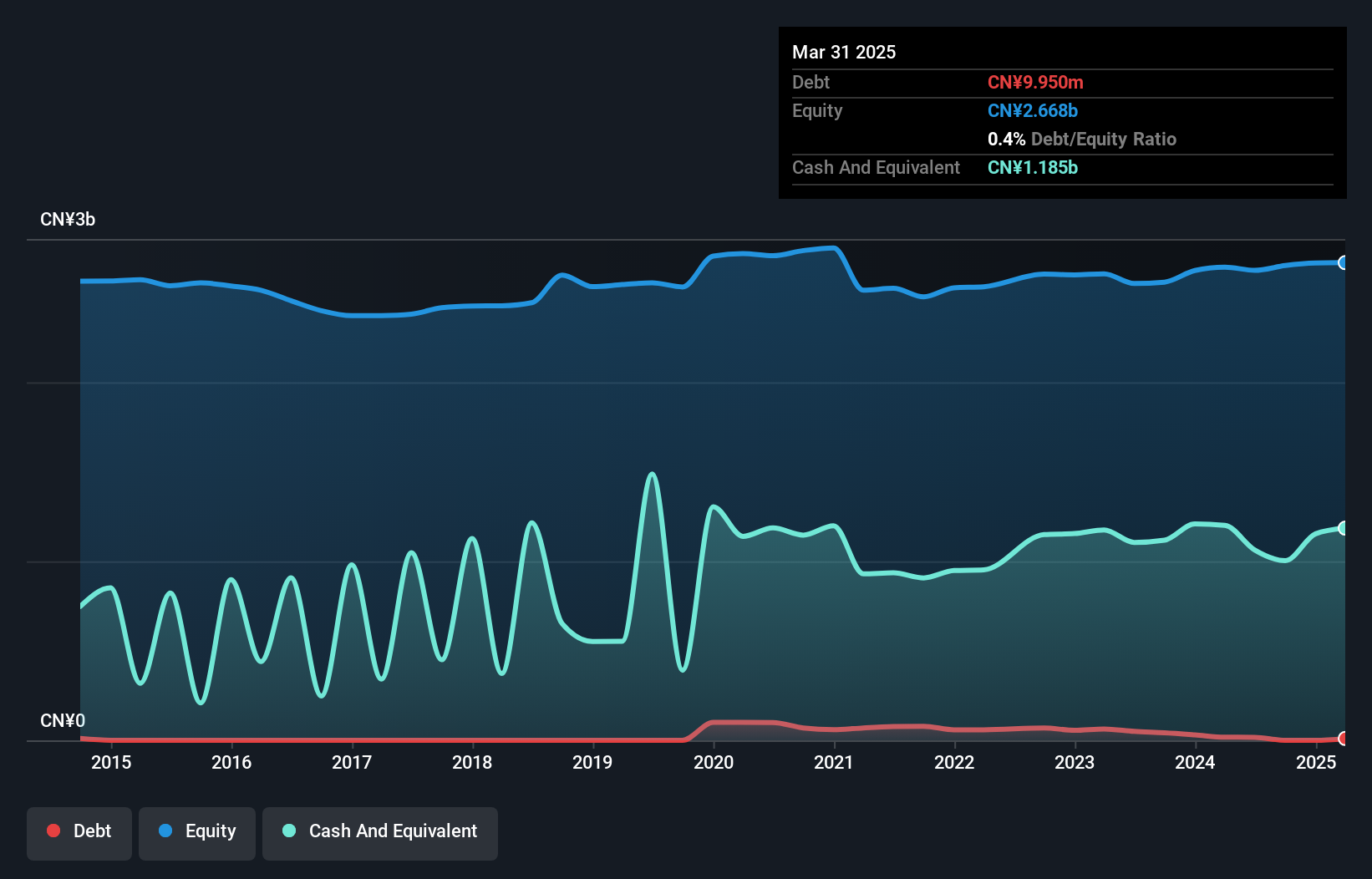

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Guangdian Electric Group Co., Ltd. operates in the electrical equipment industry and has a market cap of approximately CN¥3.24 billion.

Operations: The company generates revenue of CN¥935.54 million from its Transmission and Distribution and Control Equipment Manufacturing segment.

Market Cap: CN¥3.24B

Shanghai Guangdian Electric Group Co., Ltd. demonstrates a strong financial position with no debt and short-term assets of CN¥1.7 billion surpassing both short and long-term liabilities. The company has achieved significant earnings growth over the past year, driven by a very large 1568% increase, although this includes a substantial one-off gain of CN¥15.6 million. Despite low return on equity at 2.7%, its net profit margins have improved to 5%. Recent earnings reports show increased revenue to CN¥736.19 million for the first nine months of 2024, reflecting solid operational performance in its core segment amidst stable volatility levels.

- Jump into the full analysis health report here for a deeper understanding of Shanghai Guangdian Electric Group.

- Examine Shanghai Guangdian Electric Group's past performance report to understand how it has performed in prior years.

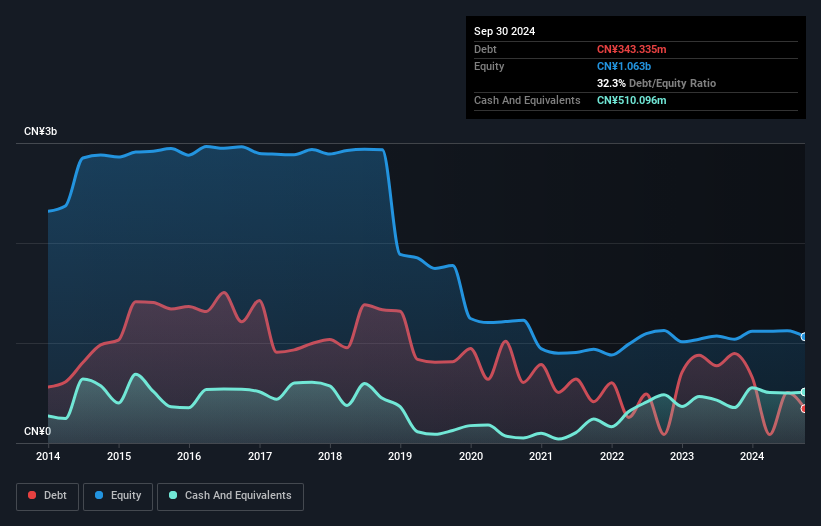

Sundiro Holding (SZSE:000571)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sundiro Holding Co., Ltd. operates in the coal industry both in China and internationally, with a market cap of CN¥2.74 billion.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CN¥2.74B

Sundiro Holding Co., Ltd. has faced challenges with declining sales, reporting CN¥571.71 million for the first nine months of 2024 compared to CN¥818.9 million in the previous year, alongside a net loss of CN¥78.06 million. Despite being unprofitable, it has reduced losses at a significant rate over five years and maintains a positive cash runway exceeding three years due to growing free cash flow. The company's debt situation has improved with more cash than total debt and reduced debt-to-equity ratio from 45.8% to 32.3%. However, short-term liabilities exceed short-term assets by CN¥424.5 million, indicating liquidity concerns.

- Click here to discover the nuances of Sundiro Holding with our detailed analytical financial health report.

- Assess Sundiro Holding's previous results with our detailed historical performance reports.

Where To Now?

- Discover the full array of 5,831 Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000571

Sundiro Holding

Operates in the coal industry in China and internationally.

Excellent balance sheet minimal.