- China

- /

- Consumer Durables

- /

- SHSE:603486

Top Chinese Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As Chinese stocks recently experienced a dip amid cautious market sentiment, investors are increasingly focusing on companies with strong growth potential and high insider ownership. In this environment, stocks that combine robust growth prospects with significant insider stakes can offer a compelling investment narrative.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 26.9% |

| Ningbo Deye Technology Group (SHSE:605117) | 23.4% | 30.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 38.8% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 42.4% |

| UTour Group (SZSE:002707) | 23% | 36.1% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

Here we highlight a subset of our preferred stocks from the screener.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Simply Wall St Growth Rating: ★★★★☆☆

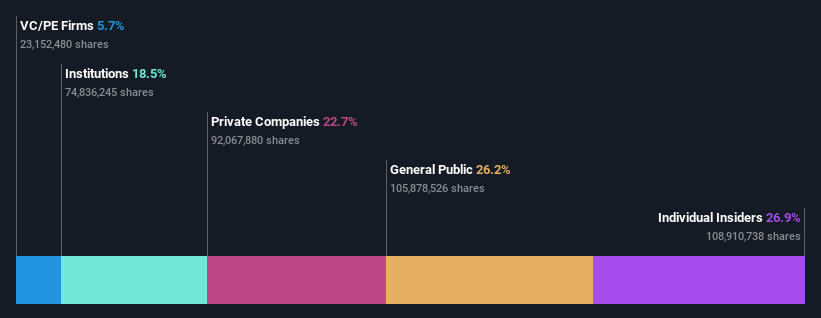

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems in China and internationally, with a market cap of CN¥43.35 billion.

Operations: The company generates revenue from the manufacturing and sale of power distribution and utilization systems both domestically and internationally.

Insider Ownership: 23.8%

Earnings Growth Forecast: 18.5% p.a.

Ningbo Sanxing Medical Electric Ltd. has demonstrated robust growth, with recent earnings showing a significant increase in revenue to CNY 6.99 billion and net income rising to CNY 1.15 billion for the half year ended June 30, 2024. The company's revenue is forecasted to grow at over 20% annually, outpacing the Chinese market average of 13.4%. Insider ownership remains high, and the stock trades at a discount relative to its estimated fair value despite no recent insider trading activity.

- Get an in-depth perspective on Ningbo Sanxing Medical ElectricLtd's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Ningbo Sanxing Medical ElectricLtd implies its share price may be lower than expected.

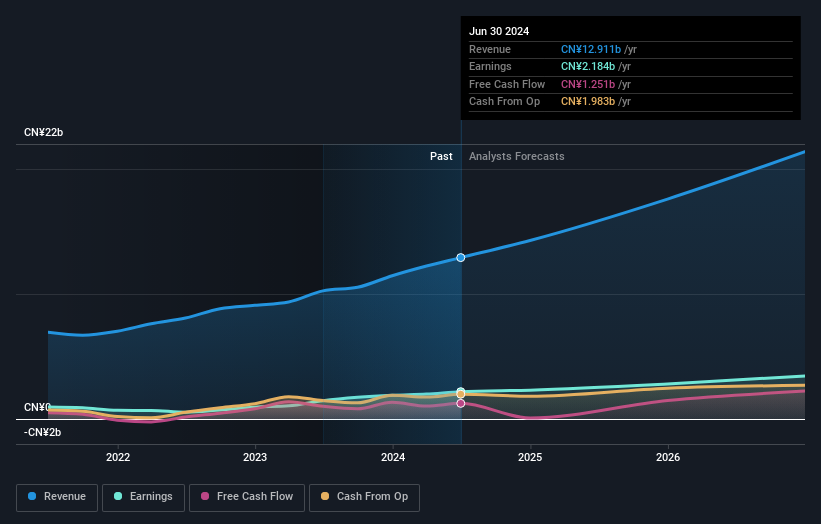

Ecovacs Robotics (SHSE:603486)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ecovacs Robotics Co., Ltd. engages in the research, development, design, manufacture, and sale of robotic products in China and has a market cap of CN¥21.73 billion.

Operations: Ecovacs Robotics generates revenue from the sale of robotic products in China.

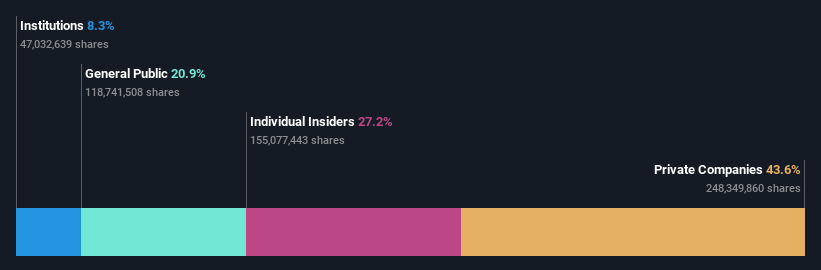

Insider Ownership: 27.1%

Earnings Growth Forecast: 36.6% p.a.

Ecovacs Robotics has seen a decline in profit margins from 10.4% to 3.7% over the past year, though its earnings are forecasted to grow significantly at 36.6% per year, outpacing the Chinese market average of 21.9%. Despite being added to the SSE 180 Index recently, revenue growth is expected to be slower than the market at 12.8%. The stock trades at a significant discount relative to its fair value with no recent insider trading activity reported.

- Unlock comprehensive insights into our analysis of Ecovacs Robotics stock in this growth report.

- The analysis detailed in our Ecovacs Robotics valuation report hints at an inflated share price compared to its estimated value.

Huakai Yibai TechnologyLtd (SZSE:300592)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Huakai Yibai Technology Co., Ltd. specializes in providing environmental art design services for indoor spaces in China and has a market cap of CN¥4.25 billion.

Operations: Revenue segments (in millions of CN¥): Huakai Yibai Technology Co., Ltd. generates revenue through environmental art design services for indoor spaces in the People’s Republic of China.

Insider Ownership: 28.6%

Earnings Growth Forecast: 28.0% p.a.

Huakai Yibai Technology Ltd. has reported a rise in sales to CNY 3.52 billion for the first half of 2024, but net income declined to CNY 134.53 million from CNY 207.96 million a year ago, reflecting lower profit margins and earnings per share. Despite these challenges, the company is forecasted to grow its earnings by 28% annually and revenue by 21.2%, outpacing market averages. The stock's price-to-earnings ratio of 16.4x indicates it is undervalued compared to the broader CN market (26x).

- Click here and access our complete growth analysis report to understand the dynamics of Huakai Yibai TechnologyLtd.

- Our valuation report unveils the possibility Huakai Yibai TechnologyLtd's shares may be trading at a premium.

Next Steps

- Discover the full array of 379 Fast Growing Chinese Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ecovacs Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603486

Ecovacs Robotics

Engages in the research, development, design, manufacture, and sale of robotic products in China.

Excellent balance sheet and fair value.