- China

- /

- Electrical

- /

- SHSE:601567

3 Stocks That Investors Might Be Undervaluing By Up To 47.7%

Reviewed by Simply Wall St

As global markets experience a rebound, with cooling inflation and strong bank earnings propelling major U.S. stock indexes higher, investors are increasingly focused on identifying opportunities within undervalued sectors. In this context, value stocks have outperformed growth shares significantly, suggesting that careful analysis of fundamentals could reveal stocks that the market might be undervaluing by a notable margin.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.61 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1114.10 | ₹2219.85 | 49.8% |

| Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267) | CN¥36.77 | CN¥70.86 | 48.1% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.02 | 49.9% |

| Solum (KOSE:A248070) | ₩18960.00 | ₩37393.72 | 49.3% |

| GemPharmatech (SHSE:688046) | CN¥13.54 | CN¥26.07 | 48.1% |

| ReadyTech Holdings (ASX:RDY) | A$3.14 | A$6.19 | 49.3% |

| Zhejiang Juhua (SHSE:600160) | CN¥26.20 | CN¥50.53 | 48.1% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5880.00 | ¥11700.97 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems both in China and internationally, with a market cap of CN¥40.89 billion.

Operations: The company's revenue segments include the manufacture and sale of power distribution and utilization systems, serving both domestic and international markets.

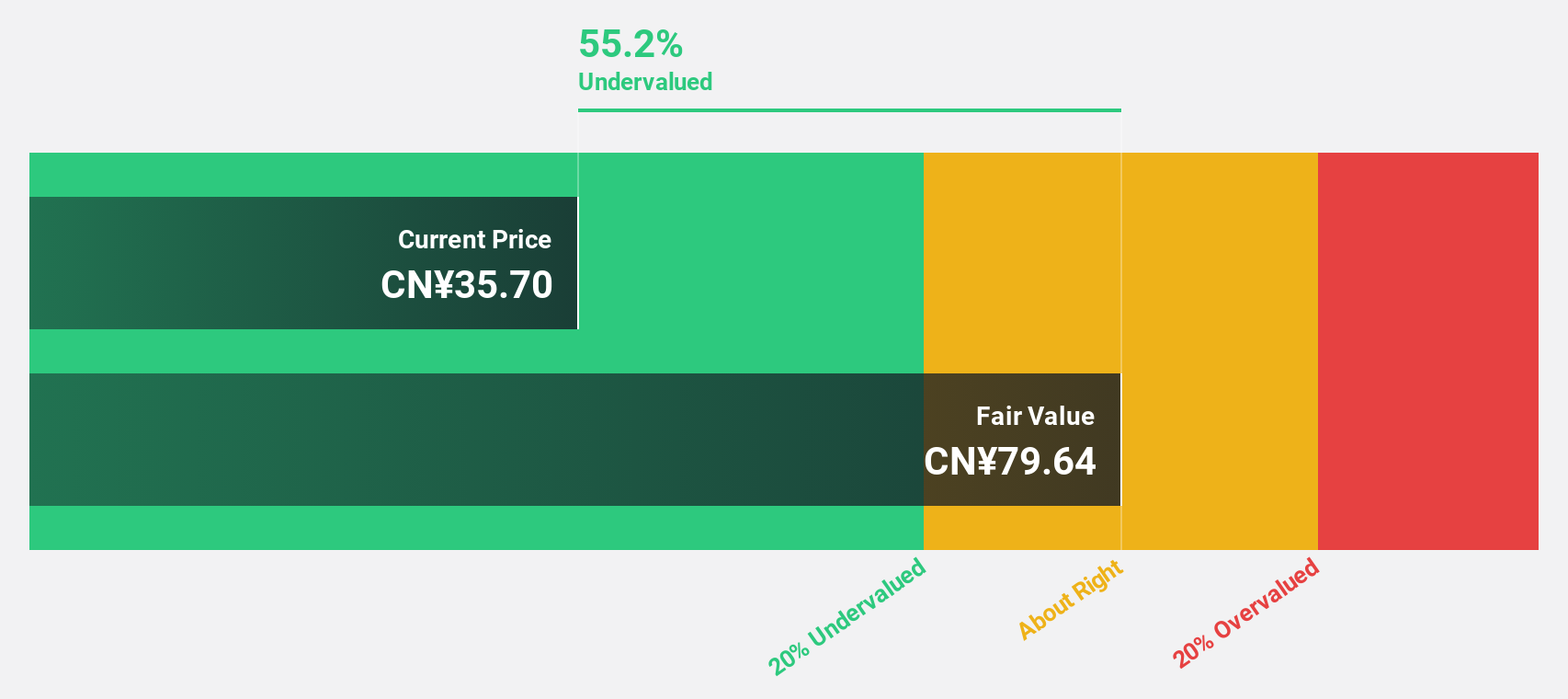

Estimated Discount To Fair Value: 47.7%

Ningbo Sanxing Medical Electric Ltd. appears undervalued, trading 47.8% below its estimated fair value of CNY 55.57, with a current price of CNY 28.98. Despite earnings growth forecasted at 21.3% annually, slightly below the CN market average, revenue is expected to outpace the market at 21.1% per year. Recent results show sales and net income increases over last year, supporting its potential for strong cash flow valuation despite an unstable dividend history.

- Our expertly prepared growth report on Ningbo Sanxing Medical ElectricLtd implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Ningbo Sanxing Medical ElectricLtd's balance sheet by reading our health report here.

Suzhou Shihua New Material Technology (SHSE:688093)

Overview: Suzhou Shihua New Material Technology Co., Ltd. (SHSE:688093) operates in the new material technology sector with a market capitalization of approximately CN¥4.83 billion.

Operations: Revenue segment details for Suzhou Shihua New Material Technology Co., Ltd. are not provided in the text.

Estimated Discount To Fair Value: 35.8%

Suzhou Shihua New Material Technology is trading at CNY 18.52, significantly below its estimated fair value of CNY 30.2, suggesting it may be undervalued based on cash flows. The company reported a rise in sales and net income for the first nine months of 2024, with earnings per share increasing from the previous year. Despite low forecasted return on equity and an unsustainable dividend yield of 1.94%, robust revenue growth projections bolster its valuation case.

- Our growth report here indicates Suzhou Shihua New Material Technology may be poised for an improving outlook.

- Navigate through the intricacies of Suzhou Shihua New Material Technology with our comprehensive financial health report here.

Dongfang Electronics (SZSE:000682)

Overview: Dongfang Electronics Co., Ltd. specializes in energy management system solutions through research, development, manufacturing, and technical services across various regions globally, with a market cap of CN¥12.80 billion.

Operations: Revenue Segments (in millions of CN¥):

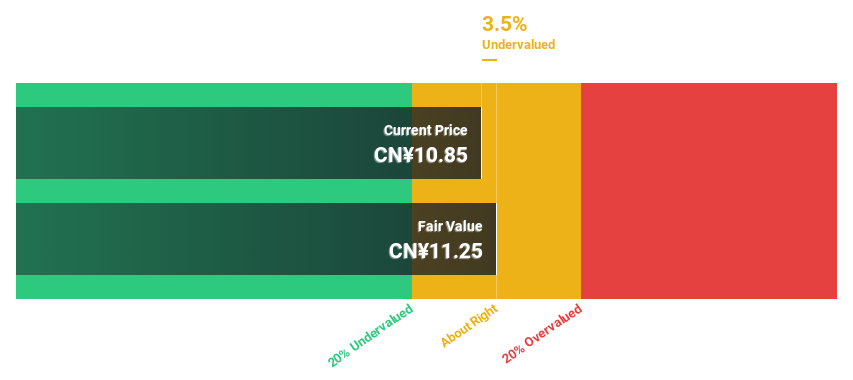

Estimated Discount To Fair Value: 11.8%

Dongfang Electronics is trading at CN¥9.71, below its estimated fair value of CN¥11.01, indicating potential undervaluation based on cash flows. The company reported increased sales of CN¥4.63 billion and net income of CN¥421.19 million for the first nine months of 2024, with earnings per share rising from the previous year. Despite an unstable dividend history and low forecasted return on equity, revenue growth projections remain strong at 21.5% annually.

- The growth report we've compiled suggests that Dongfang Electronics' future prospects could be on the up.

- Take a closer look at Dongfang Electronics' balance sheet health here in our report.

Taking Advantage

- Embark on your investment journey to our 877 Undervalued Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Sanxing Medical ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601567

Ningbo Sanxing Medical ElectricLtd

Manufactures and sells power distribution and utilization systems in China and internationally.

Very undervalued with flawless balance sheet and pays a dividend.