- China

- /

- Electrical

- /

- SHSE:601700

3 Promising Penny Stocks With Market Caps Under US$2B

Reviewed by Simply Wall St

As global markets react to easing core inflation and strong bank earnings, investors are exploring diverse opportunities beyond traditional large-cap stocks. Penny stocks, often seen as a niche investment area, continue to hold potential for those seeking growth in smaller or newer companies. These stocks can offer significant returns when backed by strong financials, making them an intriguing option for investors looking to uncover hidden value in promising companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.68 | HK$42.36B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.67 | £418.56M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Starflex (SET:SFLEX) | THB2.56 | THB1.99B | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.75M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

Click here to see the full list of 5,703 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

PostNL (ENXTAM:PNL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PostNL N.V. operates as a provider of postal and logistics services to businesses and consumers in the Netherlands, across Europe, and internationally, with a market cap of approximately €524.71 million.

Operations: There are no specific revenue segments reported for PostNL.

Market Cap: €524.71M

PostNL has shown signs of recovery, becoming profitable recently, though it faces challenges with a high net debt to equity ratio of 169.3% and short-term liabilities (€1.2B) exceeding assets (€1.1B). Despite these concerns, the company maintains stable weekly volatility and covers its interest payments comfortably. However, its dividend yield of 8.61% is not well supported by earnings, indicating potential sustainability issues. The management team and board are experienced with average tenures over four years, which may provide stability as PostNL navigates financial pressures while trading significantly below estimated fair value.

- Click here and access our complete financial health analysis report to understand the dynamics of PostNL.

- Gain insights into PostNL's future direction by reviewing our growth report.

Changshu Fengfan Power Equipment (SHSE:601700)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Changshu Fengfan Power Equipment Co., Ltd. operates in the power equipment industry and has a market capitalization of approximately CN¥4.85 billion.

Operations: Changshu Fengfan Power Equipment Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.85B

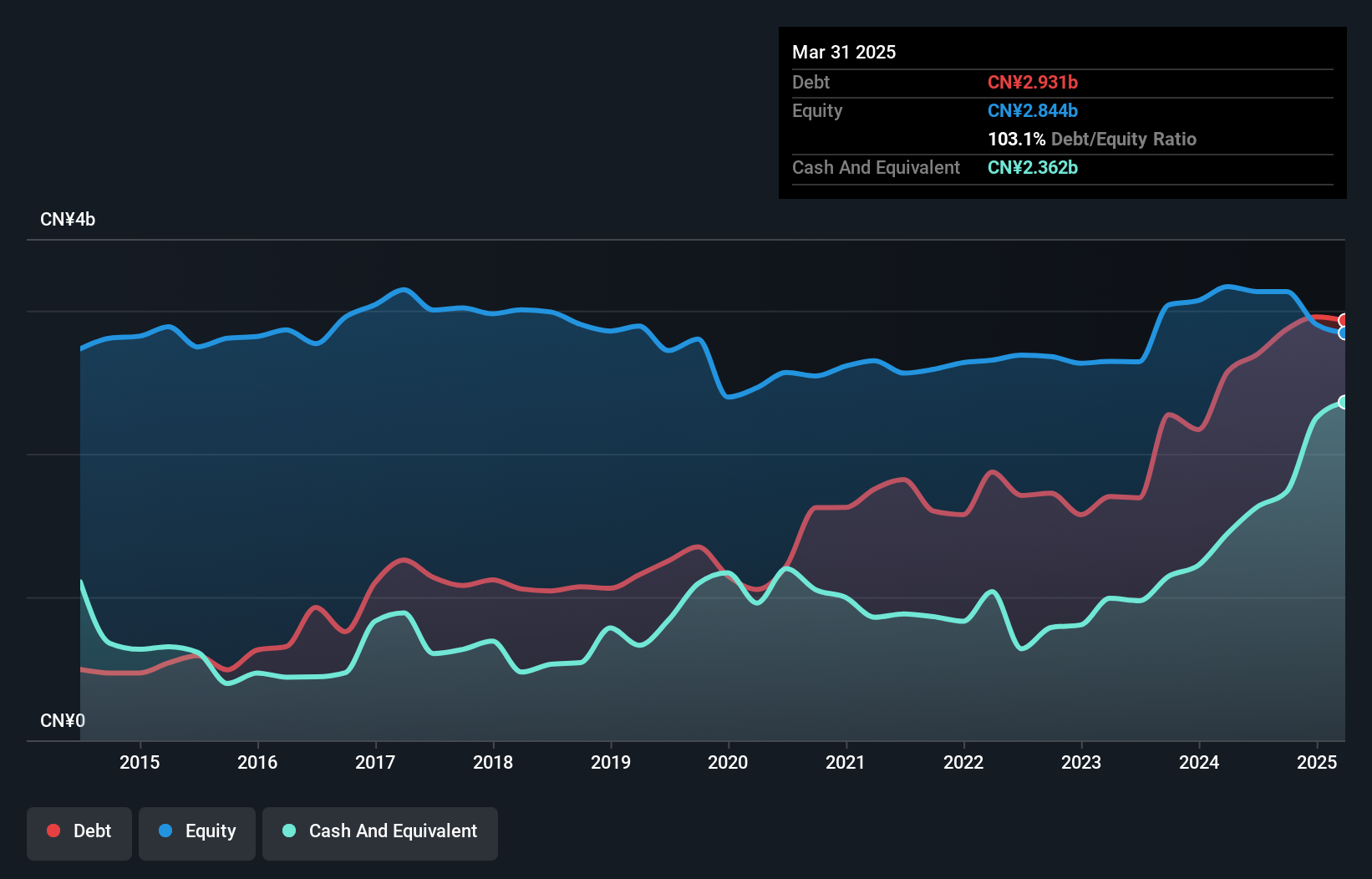

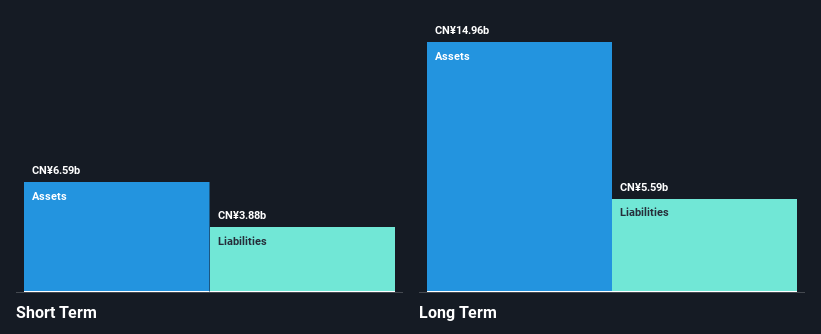

Changshu Fengfan Power Equipment shows robust earnings growth, with a significant increase of 193.2% over the past year, surpassing its five-year average. Despite this growth, the company's operating cash flow is negative, indicating potential challenges in covering debt. The company recently announced a share buyback program worth CN¥300 million to enhance employee incentives and promote long-term development. Short-term assets exceed liabilities, suggesting good liquidity management. However, its return on equity remains low at 4.9%, and while interest payments are well covered by EBIT (3.5x), the dividend yield of 1.18% lacks coverage from free cash flows.

- Navigate through the intricacies of Changshu Fengfan Power Equipment with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Changshu Fengfan Power Equipment's track record.

Guangdong Baolihua New Energy Stock (SZSE:000690)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Baolihua New Energy Stock Co., Ltd. operates in the energy sector, focusing on renewable energy solutions, with a market cap of CN¥9.05 billion.

Operations: The company's revenue from China amounts to CN¥8.68 billion.

Market Cap: CN¥9.05B

Guangdong Baolihua New Energy Stock Co., Ltd. demonstrates a mixed financial profile, with recent earnings of CN¥592.23 million for the first nine months of 2024, reflecting a slight decline from the previous year. Despite this, its profit margins have improved to 9.6%, and earnings growth over the past year outpaced industry averages at 31%. The company maintains strong liquidity, with short-term assets exceeding both short and long-term liabilities significantly. However, its return on equity remains low at 6.9%, and while debt levels have reduced over time, dividend sustainability is questionable due to inadequate free cash flow coverage.

- Click to explore a detailed breakdown of our findings in Guangdong Baolihua New Energy Stock's financial health report.

- Evaluate Guangdong Baolihua New Energy Stock's historical performance by accessing our past performance report.

Make It Happen

- Investigate our full lineup of 5,703 Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601700

Changshu Fengfan Power Equipment

Changshu Fengfan Power Equipment Co., Ltd.

Solid track record with adequate balance sheet.