Top Growth Companies With Insider Ownership For January 2025

Reviewed by Simply Wall St

As global markets experience a boost from easing inflation and strong bank earnings, major indices like the S&P 500 and Dow Jones Industrial Average have recorded significant gains. Amidst this backdrop, identifying growth companies with high insider ownership can be particularly appealing to investors seeking alignment between company leadership and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 35.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Ningbo Deye Technology Group (SHSE:605117)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ningbo Deye Technology Group Co., Ltd. specializes in producing and selling heat exchangers, inverters, and dehumidifiers across various international markets, with a market cap of CN¥55.75 billion.

Operations: The company's revenue is derived from the production and sales of heat exchangers, inverters, and dehumidifiers across China, the United Kingdom, the United States, Germany, India, and other international markets.

Insider Ownership: 23.1%

Revenue Growth Forecast: 30% p.a.

Ningbo Deye Technology Group demonstrates strong growth potential with earnings forecasted to increase by 27.18% annually, outpacing the Chinese market's 25.2%. Recent earnings reports show significant revenue and net income growth, reflecting its robust performance. The company trades at a good value compared to peers and is priced 32.4% below fair value estimates. Insider ownership remains high without substantial insider selling over the past three months, indicating confidence in its future prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Ningbo Deye Technology Group.

- Our valuation report here indicates Ningbo Deye Technology Group may be undervalued.

Shenzhen Envicool Technology (SZSE:002837)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Envicool Technology Co., Ltd. produces and sells temperature control solutions and products in China, with a market cap of CN¥28.82 billion.

Operations: The company generates revenue from its Precision Temperature Control Energy Saving Equipment segment, amounting to CN¥4.33 billion.

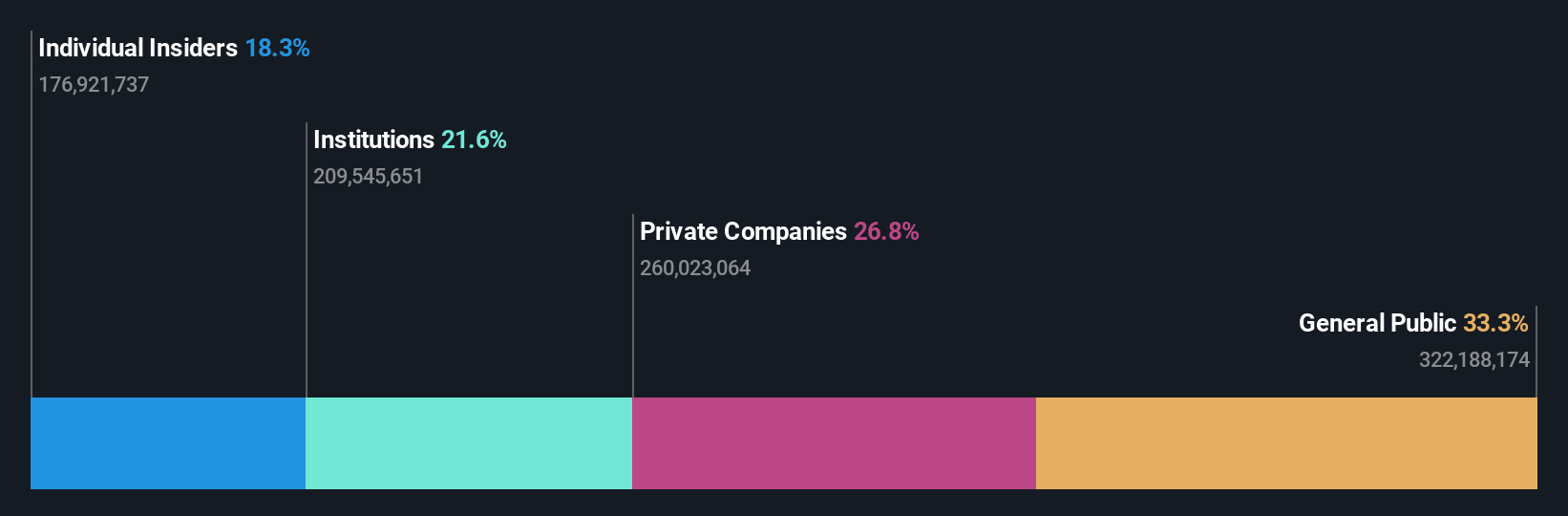

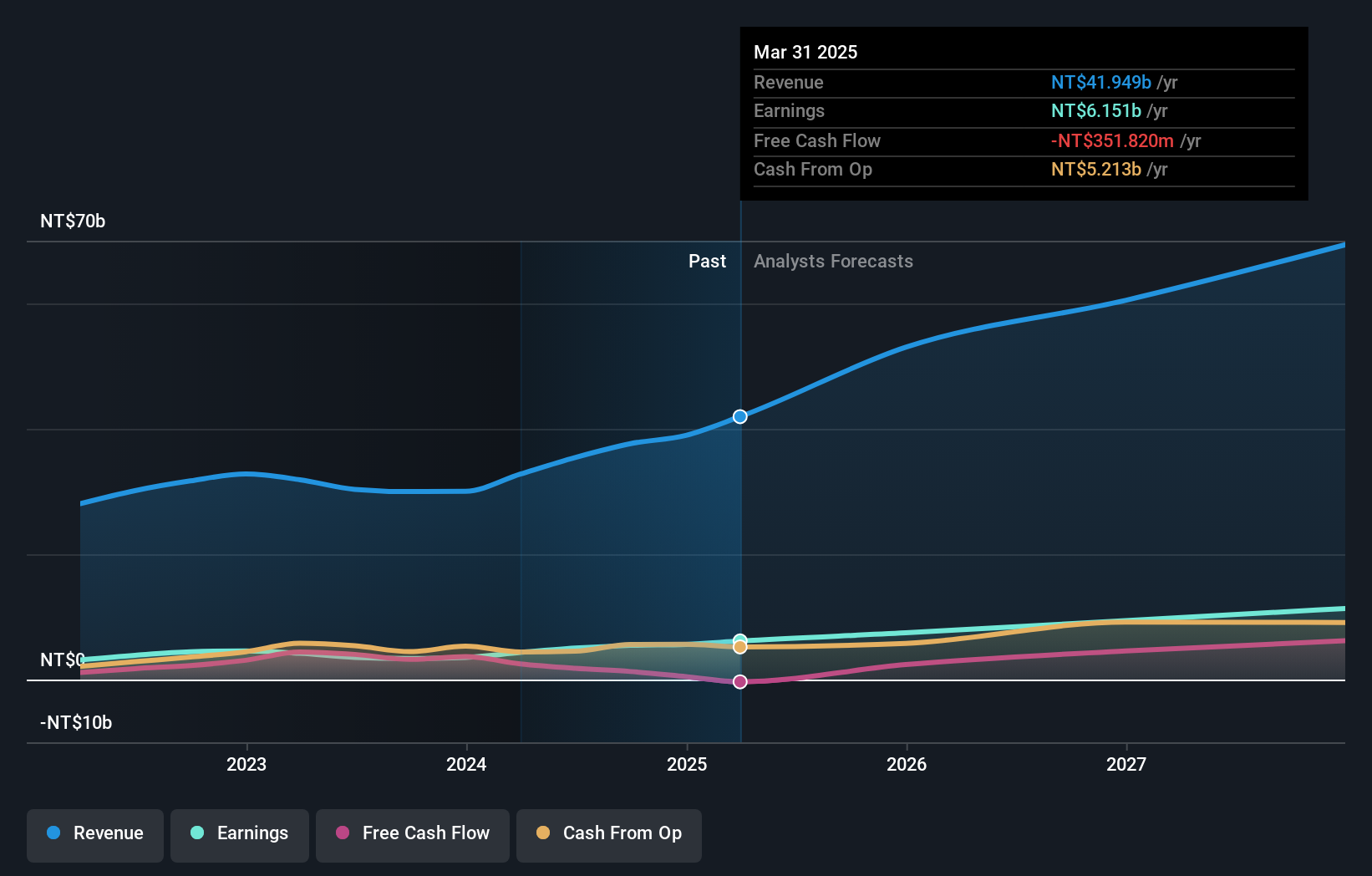

Insider Ownership: 18.3%

Revenue Growth Forecast: 27.9% p.a.

Shenzhen Envicool Technology's revenue and earnings are forecast to grow significantly, at 27.9% and 29.9% annually, respectively, surpassing the Chinese market averages. Recent earnings reports highlight substantial growth with sales reaching CNY 2.87 billion and net income at CNY 352.76 million for the first nine months of 2024. No substantial insider trading activity has been noted recently, suggesting stability in insider sentiment regarding the company's growth trajectory.

- Get an in-depth perspective on Shenzhen Envicool Technology's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Shenzhen Envicool Technology's share price might be too optimistic.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gold Circuit Electronics Ltd. is a Taiwanese company that designs, manufactures, processes, and distributes multilayer printed circuit boards with a market cap of NT$103.18 billion.

Operations: The company generates revenue of NT$37.63 billion from its manufacturing and sales of printed circuit boards segment.

Insider Ownership: 31.4%

Revenue Growth Forecast: 14.9% p.a.

Gold Circuit Electronics exhibits promising growth, with earnings forecast to rise 19.5% annually, outpacing the TW market. Recent results show strong performance, with Q3 sales at TWD 10.46 billion and net income at TWD 1.60 billion, reflecting year-over-year increases. The stock trades below analyst price targets and has a favorable Price-To-Earnings ratio of 19.5x compared to the market's 20.3x, although its share price has been volatile recently without significant insider trading activity noted.

- Navigate through the intricacies of Gold Circuit Electronics with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Gold Circuit Electronics implies its share price may be lower than expected.

Taking Advantage

- Click here to access our complete index of 1477 Fast Growing Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002837

Shenzhen Envicool Technology

Produces and sells temperature control and energy savings solutions and products in China.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives