- China

- /

- Electrical

- /

- SHSE:601179

After Leaping 27% China XD Electric Co., Ltd (SHSE:601179) Shares Are Not Flying Under The Radar

China XD Electric Co., Ltd (SHSE:601179) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 68% in the last year.

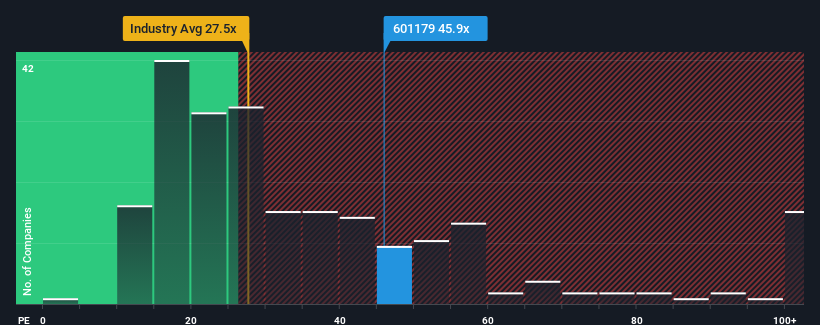

After such a large jump in price, China XD Electric's price-to-earnings (or "P/E") ratio of 45.9x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 28x and even P/E's below 17x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, China XD Electric has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for China XD Electric

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like China XD Electric's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 35% last year. The strong recent performance means it was also able to grow EPS by 145% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 28% per year as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 19% each year, which is noticeably less attractive.

With this information, we can see why China XD Electric is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From China XD Electric's P/E?

Shares in China XD Electric have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that China XD Electric maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for China XD Electric that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601179

China XD Electric

Engages in the research, development, design, manufacture, sale, and test of high-voltage power transmission and distribution products in China.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives