Discover Tengda Construction Group And 2 More Promising Penny Stocks

Reviewed by Simply Wall St

As global markets continue to reach new highs, with indices like the Dow Jones and S&P 500 hitting record levels, investors are exploring diverse opportunities across various market segments. Penny stocks, a term that may seem outdated but remains relevant, refer to smaller or less-established companies that can offer unique value propositions. By focusing on those with strong financial foundations and potential for growth, investors might find promising opportunities in this often-overlooked sector.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.245 | £845.83M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.13 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.335 | £431.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

Click here to see the full list of 5,688 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Tengda Construction Group (SHSE:600512)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tengda Construction Group Co., Ltd. operates in the construction industry in China with a market capitalization of CN¥4.06 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥3.80 billion.

Market Cap: CN¥4.06B

Tengda Construction Group, operating in China's construction sector, has a market capitalization of CN¥4.06 billion and reported sales of CN¥2.35 billion for the first nine months of 2024, down from CN¥2.61 billion the previous year. Despite being debt-free with short-term assets exceeding liabilities, the company faces challenges with declining earnings over five years and low return on equity at 0.5%. The recent earnings report showed a slight increase in net income to CN¥156.16 million from CN¥147.09 million last year, but profit margins have decreased to 1.5% from 8.3%.

- Click here and access our complete financial health analysis report to understand the dynamics of Tengda Construction Group.

- Explore historical data to track Tengda Construction Group's performance over time in our past results report.

Zhejiang Jihua Group (SHSE:603980)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Jihua Group Co., Ltd. operates in the dyestuff industry and has a market cap of approximately CN¥3.13 billion.

Operations: Zhejiang Jihua Group Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥3.13B

Zhejiang Jihua Group, with a market cap of CN¥3.13 billion, operates in the dyestuff industry and reported sales of CN¥1.16 billion for the first nine months of 2024, down from CN¥1.28 billion last year. The company achieved a net income of CN¥128.2 million compared to a net loss previously, reflecting improved profitability despite historical earnings declines averaging 66.2% annually over five years. Its financial position is strong with cash exceeding total debt and short-term assets covering both short- and long-term liabilities comfortably. However, challenges remain as it is currently unprofitable with negative return on equity at -1.41%.

- Get an in-depth perspective on Zhejiang Jihua Group's performance by reading our balance sheet health report here.

- Evaluate Zhejiang Jihua Group's historical performance by accessing our past performance report.

Xiamen Hexing Packaging Printing (SZSE:002228)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xiamen Hexing Packaging Printing Co., Ltd. operates in the packaging and printing industry, with a market cap of CN¥3.70 billion.

Operations: The company generates CN¥11.63 billion in revenue from its packaging manufacturing industry segment.

Market Cap: CN¥3.7B

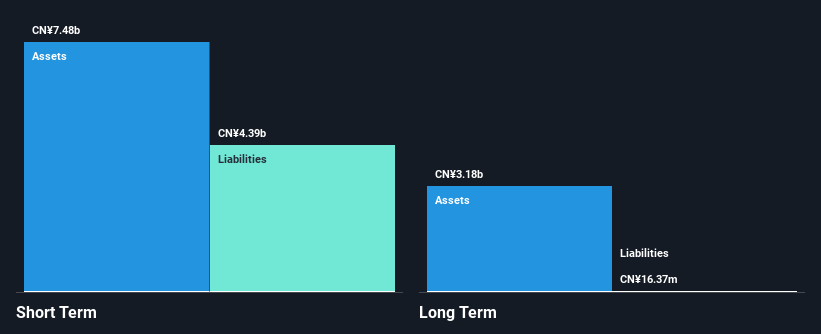

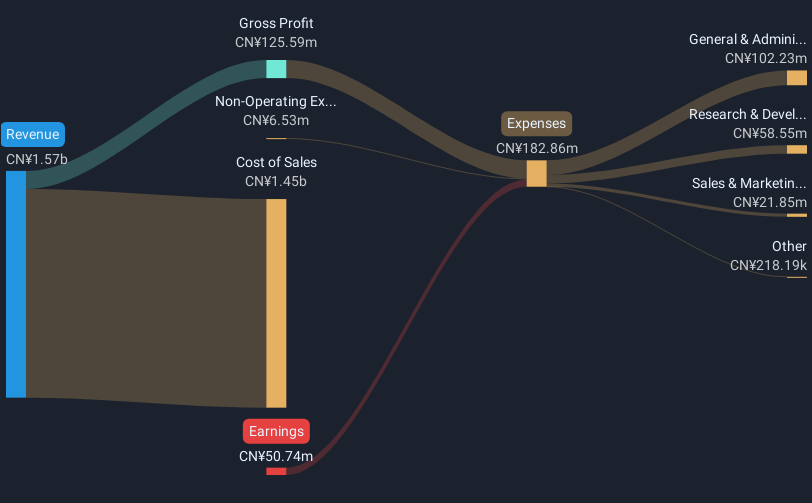

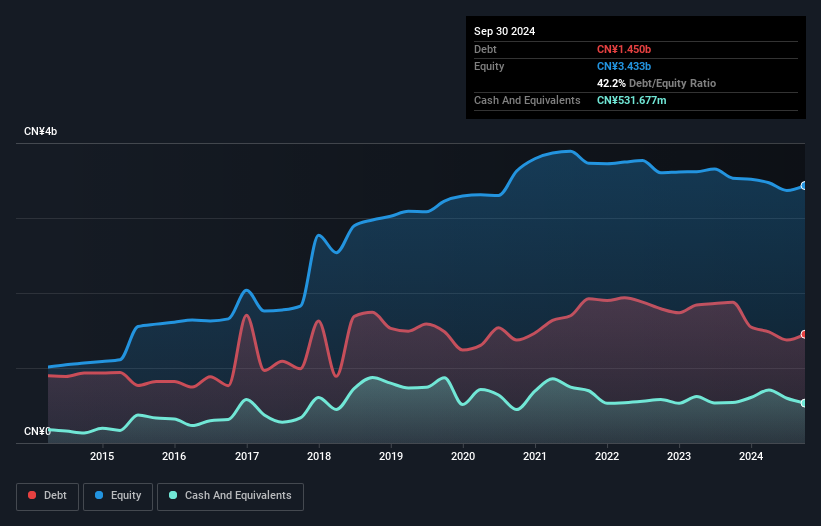

Xiamen Hexing Packaging Printing Co., Ltd. has a market cap of CN¥3.70 billion and reported revenue of CN¥8.59 billion for the first nine months of 2024, a decrease from the previous year, yet net income rose to CN¥144.42 million. The company's financial health is robust with short-term assets exceeding both short- and long-term liabilities, and its debt is well covered by operating cash flow. Despite trading significantly below estimated fair value, challenges include low return on equity at 3.5% and a dividend not fully supported by earnings, though earnings growth outpaced industry averages recently.

- Take a closer look at Xiamen Hexing Packaging Printing's potential here in our financial health report.

- Explore Xiamen Hexing Packaging Printing's analyst forecasts in our growth report.

Summing It All Up

- Navigate through the entire inventory of 5,688 Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002228

Xiamen Hexing Packaging Printing

Xiamen Hexing Packaging Printing Co., Ltd.

Flawless balance sheet established dividend payer.