- China

- /

- Electrical

- /

- SHSE:600416

Does Xiangtan Electric Manufacturing (SHSE:600416) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Xiangtan Electric Manufacturing Co. Ltd. (SHSE:600416) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Xiangtan Electric Manufacturing

How Much Debt Does Xiangtan Electric Manufacturing Carry?

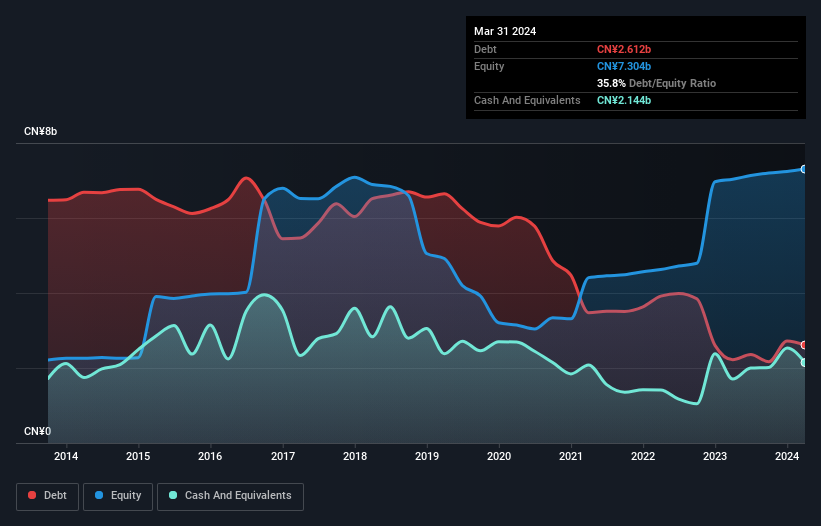

As you can see below, at the end of March 2024, Xiangtan Electric Manufacturing had CN¥2.61b of debt, up from CN¥2.22b a year ago. Click the image for more detail. However, it does have CN¥2.14b in cash offsetting this, leading to net debt of about CN¥468.4m.

A Look At Xiangtan Electric Manufacturing's Liabilities

According to the last reported balance sheet, Xiangtan Electric Manufacturing had liabilities of CN¥5.88b due within 12 months, and liabilities of CN¥1.13b due beyond 12 months. Offsetting these obligations, it had cash of CN¥2.14b as well as receivables valued at CN¥4.88b due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

This state of affairs indicates that Xiangtan Electric Manufacturing's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the CN¥12.7b company is short on cash, but still worth keeping an eye on the balance sheet.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With net debt sitting at just 1.0 times EBITDA, Xiangtan Electric Manufacturing is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 9.9 times the interest expense over the last year. The modesty of its debt load may become crucial for Xiangtan Electric Manufacturing if management cannot prevent a repeat of the 43% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Xiangtan Electric Manufacturing will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Xiangtan Electric Manufacturing saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

While Xiangtan Electric Manufacturing's conversion of EBIT to free cash flow makes us cautious about it, its track record of (not) growing its EBIT is no better. But on the brighter side of life, its interest cover leaves us feeling more frolicsome. Taking the abovementioned factors together we do think Xiangtan Electric Manufacturing's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. Over time, share prices tend to follow earnings per share, so if you're interested in Xiangtan Electric Manufacturing, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600416

Xiangtan Electric Manufacturing

Manufactures and sells electrical products in China and internationally.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives