- China

- /

- Electrical

- /

- SZSE:002706

January 2025's Leading Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate the complexities of a resilient U.S. labor market, inflation concerns, and political uncertainties, investors are increasingly seeking stability through dividend stocks. In this environment of choppy market conditions and fluctuating interest rates, selecting stocks with strong dividend yields can offer a reliable income stream while potentially mitigating volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.01% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1996 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Xiamen C&D (SHSE:600153)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen C&D Inc. operates in the supply chain and real estate development sectors both within China and internationally, with a market cap of CN¥29.03 billion.

Operations: Xiamen C&D Inc.'s revenue is primarily derived from its Supply Chain Operations Division (CN¥474.91 billion), Real Estate Business Segment (CN¥183.26 billion), and Home Furnishing Shopping Mall Operation Business Segment (CN¥8.94 billion).

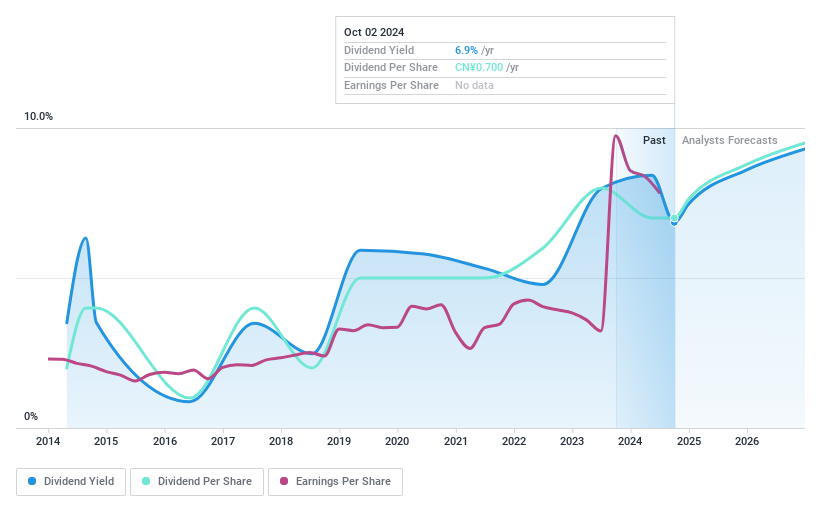

Dividend Yield: 7.0%

Xiamen C&D offers a high dividend yield of 6.95%, placing it among the top 25% in the CN market, but its dividends are not covered by free cash flow and have been volatile over the past decade. Despite an attractive price-to-earnings ratio of 10.8x, recent earnings show a significant decline with net income dropping to ¥2.06 billion from ¥12.42 billion year-on-year, highlighting potential sustainability concerns for dividend investors.

- Unlock comprehensive insights into our analysis of Xiamen C&D stock in this dividend report.

- The valuation report we've compiled suggests that Xiamen C&D's current price could be quite moderate.

Star Lake BioscienceZhaoqing Guangdong (SHSE:600866)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong manufactures and sells pharmaceutical raw materials, and food and feed additives under the Star Lake and Yue Bao brand names in China and internationally, with a market cap of CN¥10.09 billion.

Operations: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong generates revenue through the production and distribution of pharmaceutical raw materials, as well as food and feed additives, both domestically and internationally.

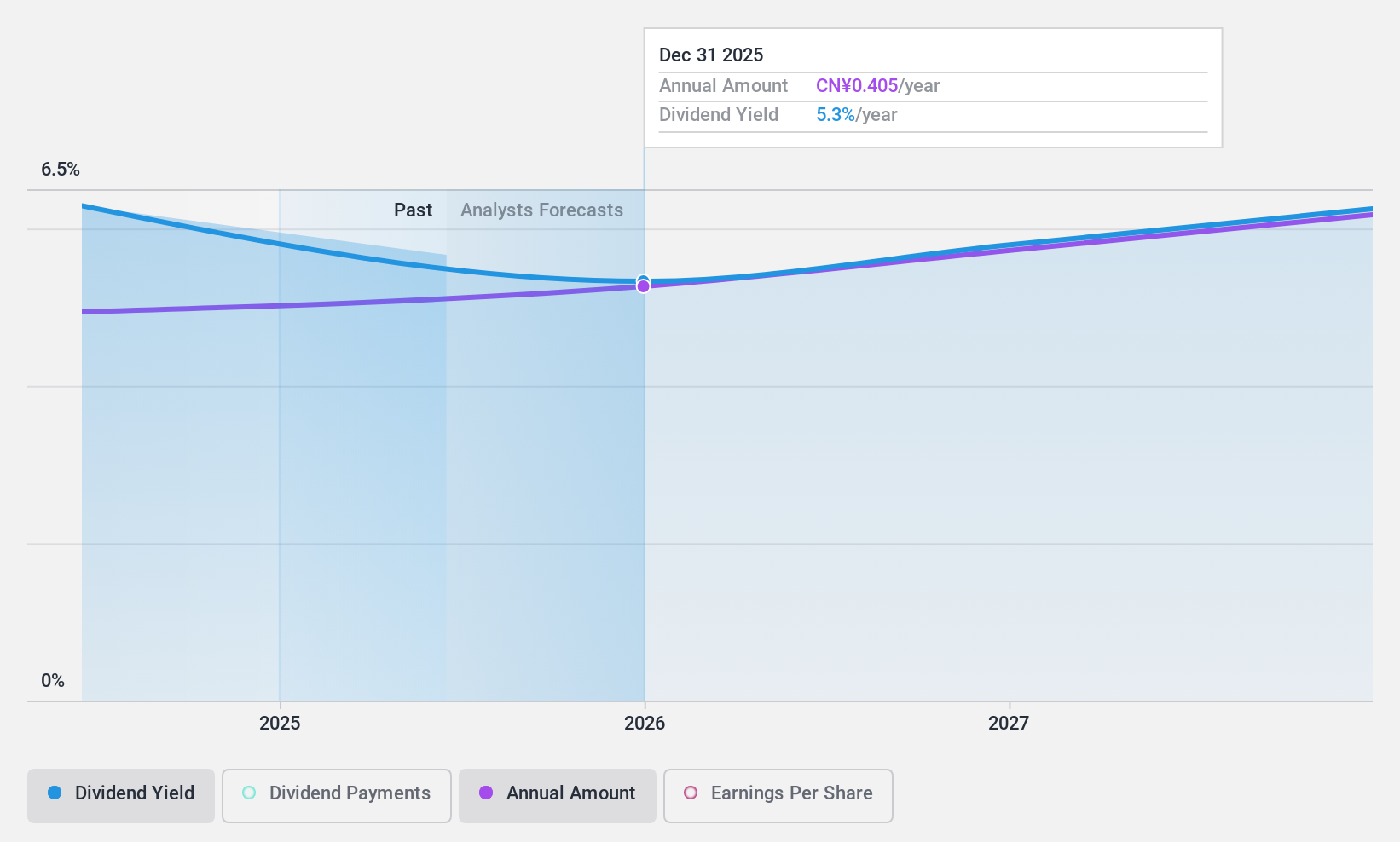

Dividend Yield: 6.2%

Star Lake Bioscience's dividend yield of 6.24% ranks in the top 25% of CN market payers, supported by a low cash payout ratio of 38.3%, indicating strong coverage by cash flows. Despite being new to dividends, earnings grew significantly by 44.9% last year and are expected to continue growing at 18.73% annually, suggesting potential for future dividend stability and growth as profitability improves further with recent net income reaching ¥677 million for nine months ended September 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Star Lake BioscienceZhaoqing Guangdong.

- Our comprehensive valuation report raises the possibility that Star Lake BioscienceZhaoqing Guangdong is priced lower than what may be justified by its financials.

Shanghai Liangxin ElectricalLTD (SZSE:002706)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Liangxin Electrical Co., LTD. researches, develops, produces, and sells low-voltage electrical apparatus in China and internationally, with a market cap of CN¥7.64 billion.

Operations: Shanghai Liangxin Electrical Co., LTD. generates revenue through its activities in the research, development, production, and sale of low-voltage electrical apparatus both domestically and internationally.

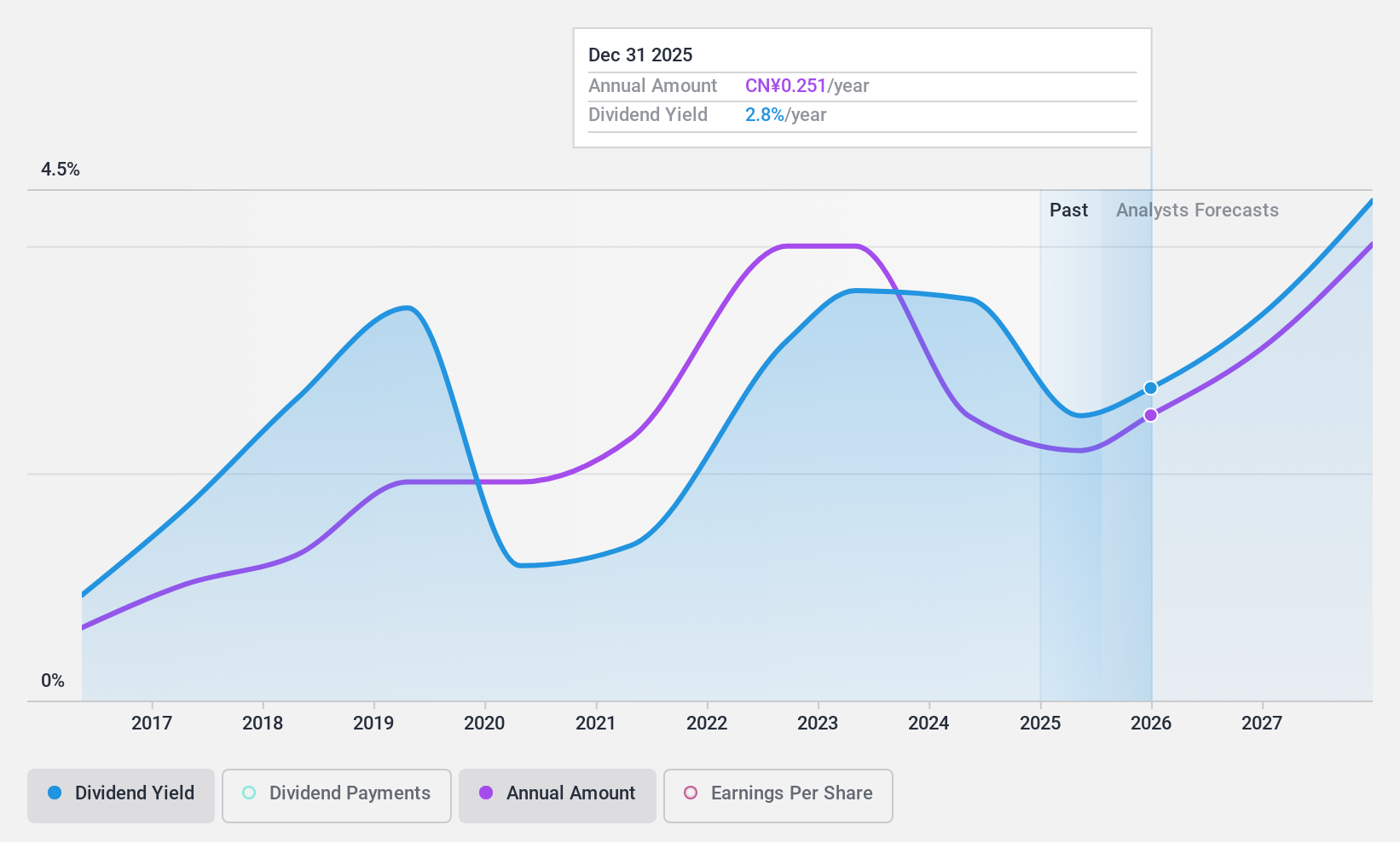

Dividend Yield: 3.7%

Shanghai Liangxin Electrical's dividend yield of 3.67% is among the top 25% in the CN market, yet its cash payout ratio of 93.1% raises concerns about coverage by free cash flows. Although dividends have increased over the past decade, they have been volatile and not consistently reliable. The company trades at a good value relative to peers and industry, with recent earnings showing a decline in net income to ¥310.64 million for nine months ended September 2024.

- Take a closer look at Shanghai Liangxin ElectricalLTD's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Shanghai Liangxin ElectricalLTD is trading behind its estimated value.

Key Takeaways

- Gain an insight into the universe of 1996 Top Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002706

Shanghai Liangxin ElectricalLTD

Research, develops, produces, and sells low-voltage electrical apparatus in China and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives