- China

- /

- Auto Components

- /

- SHSE:603121

3 Solid Dividend Stocks To Consider With Up To 6.8% Yield

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience, with major indices like the Dow Jones Industrial Average and S&P 500 Index reaching record highs despite geopolitical tensions and tariff concerns. This bullish sentiment presents an opportune moment to explore dividend stocks, which can offer a reliable income stream and potential for capital appreciation amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.18% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.20% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.33% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.34% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.91% | ★★★★★★ |

Click here to see the full list of 1946 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Xiamen C&D (SHSE:600153)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen C&D Inc. operates in the supply chain and real estate development sectors both within China and internationally, with a market cap of approximately CN¥30 billion.

Operations: Xiamen C&D Inc. generates revenue from its Real Estate Business Segment (CN¥183.26 billion), Supply Chain Operations Division (CN¥474.91 billion), and Home Furnishing Shopping Mall Operation Business Segment (CN¥8.94 billion).

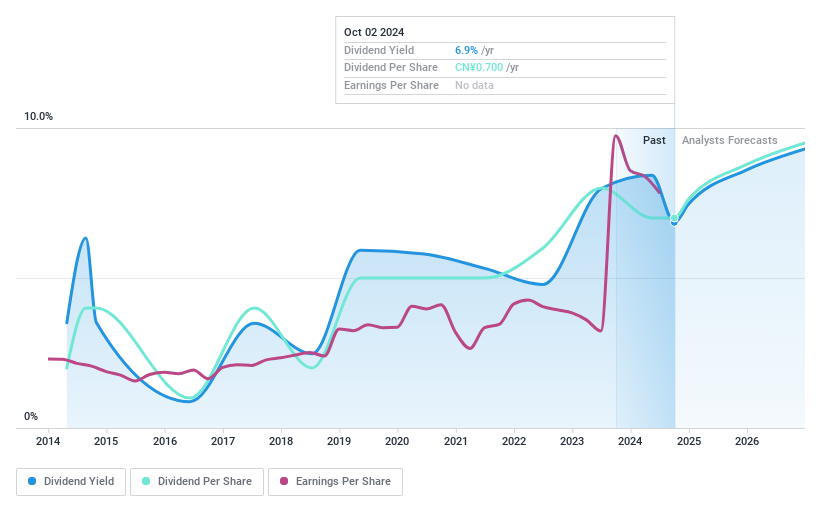

Dividend Yield: 6.9%

Xiamen C&D offers a dividend yield of 6.88%, placing it in the top 25% of CN market payers, but its dividends are not covered by free cash flow and have been unreliable over the past decade. The company's earnings have decreased significantly, with net income dropping to CNY 2.06 billion from CNY 12.42 billion year-on-year, affecting payout sustainability despite a manageable payout ratio of 88%.

- Delve into the full analysis dividend report here for a deeper understanding of Xiamen C&D.

- The analysis detailed in our Xiamen C&D valuation report hints at an deflated share price compared to its estimated value.

Chongqing Department StoreLtd (SHSE:600729)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chongqing Department Store Co., Ltd. operates department stores, supermarkets, and electrical appliances stores in the People's Republic of China with a market cap of CN¥13.21 billion.

Operations: Chongqing Department Store Co., Ltd. generates revenue through its operations in department stores, supermarkets, and electrical appliances stores across the People's Republic of China.

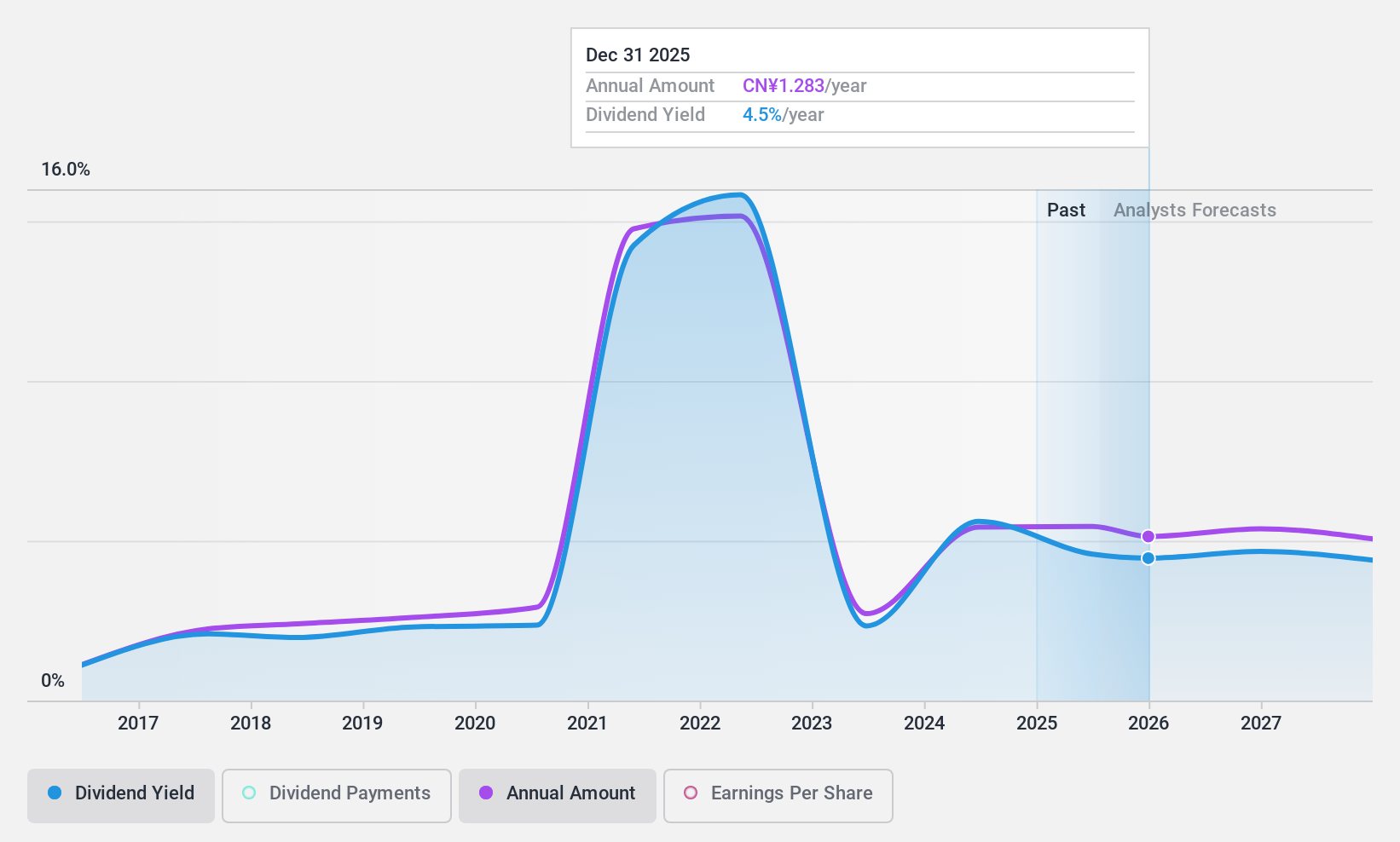

Dividend Yield: 4.5%

Chongqing Department Store Ltd. offers a dividend yield of 4.52%, ranking in the top 25% of CN market payers, with dividends well covered by earnings and cash flows due to low payout ratios of 49% and 47.7%, respectively. However, its dividend history is volatile, lacking consistent growth over the past decade. Recent earnings show a decline in net income to CNY 923.05 million from CNY 1,142.9 million year-on-year, potentially impacting future payouts.

- Take a closer look at Chongqing Department StoreLtd's potential here in our dividend report.

- According our valuation report, there's an indication that Chongqing Department StoreLtd's share price might be on the cheaper side.

Shanghai Sinotec (SHSE:603121)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Sinotec Co., Ltd. is engaged in the development, production, and sale of auto parts in China with a market capitalization of approximately CN¥3.35 billion.

Operations: Shanghai Sinotec Co., Ltd. generates revenue through the development, production, and sale of auto parts within the Chinese market.

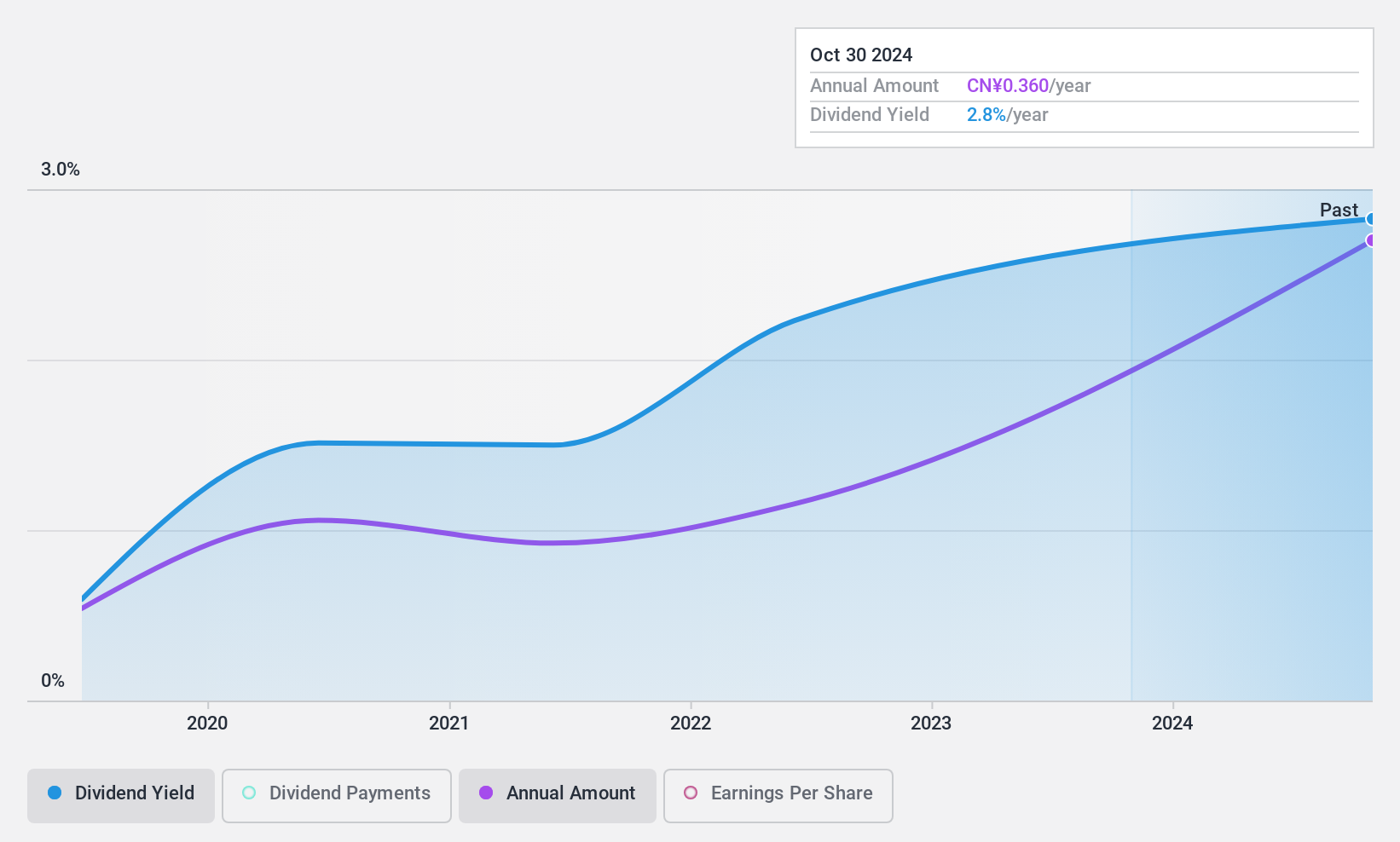

Dividend Yield: 3.6%

Shanghai Sinotec's dividend yield of 3.64% places it among the top quarter of CN market payers, though its dividend history is volatile with payments only spanning five years. Despite this, dividends are covered by a payout ratio of 66.7% and cash flow coverage at 79.4%. Recent earnings show a decline in net income to CNY 71.24 million from CNY 96.53 million year-on-year, which may affect future stability in payouts.

- Navigate through the intricacies of Shanghai Sinotec with our comprehensive dividend report here.

- The analysis detailed in our Shanghai Sinotec valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1943 more companies for you to explore.Click here to unveil our expertly curated list of 1946 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603121

Solid track record with excellent balance sheet and pays a dividend.