3 High-Yield Dividend Stocks In China With Yields Up To 5.9%

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, China's market has shown resilience with sectors like retail showcasing growth despite broader challenges. In this context, high-yield dividend stocks in China may offer investors a blend of stability and potential income in an otherwise uncertain environment.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Lao Feng Xiang (SHSE:600612) | 3.29% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.68% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.95% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.60% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.10% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.66% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.80% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.50% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.65% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

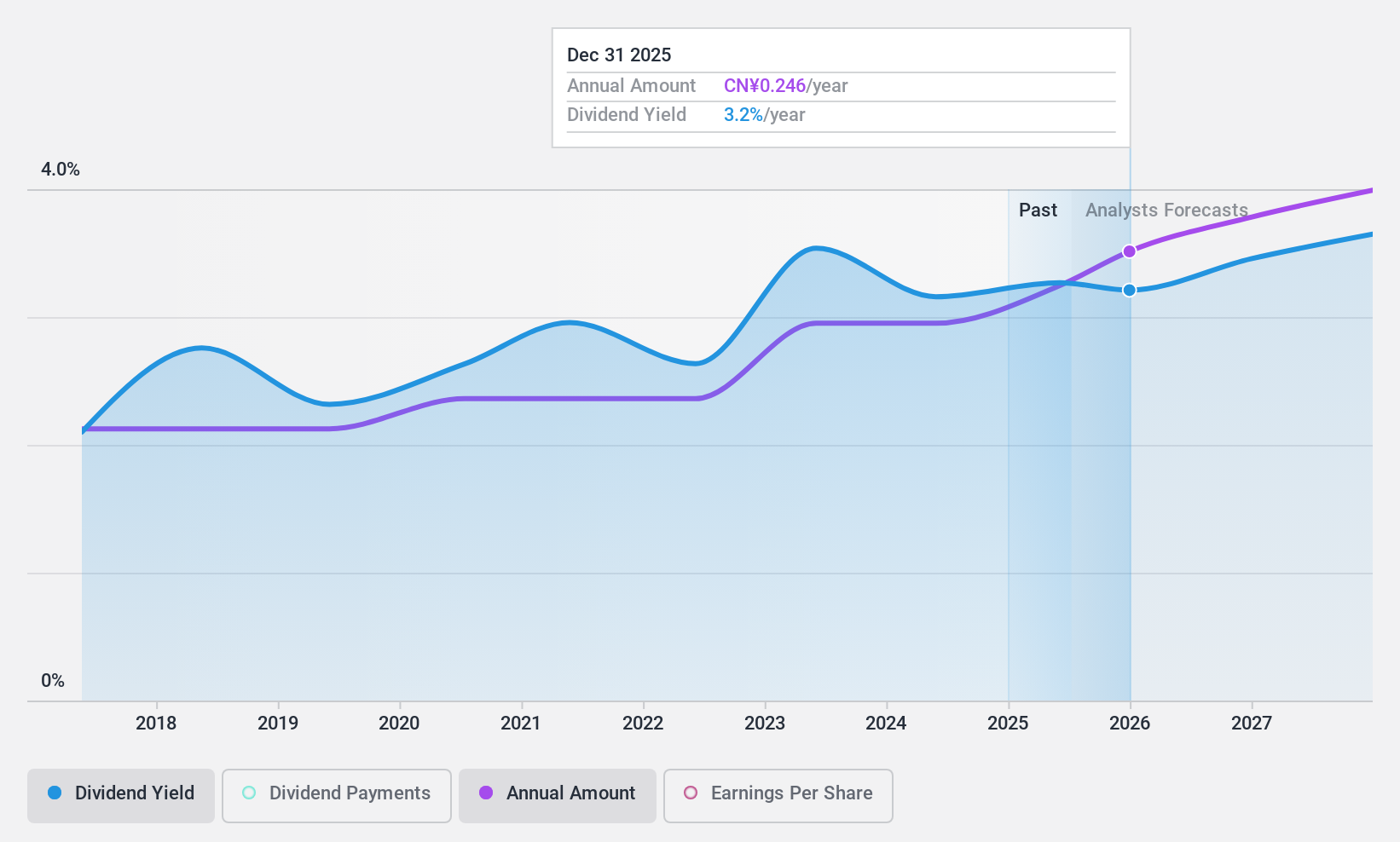

Jiangsu Changshu Rural Commercial Bank (SHSE:601128)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Changshu Rural Commercial Bank Co., Ltd. operates as a regional bank in China, providing a range of banking services with a market capitalization of approximately CN¥22.49 billion.

Operations: The provided text does not include specific details on the revenue segments of Jiangsu Changshu Rural Commercial Bank Co., Ltd.

Dividend Yield: 3%

Jiangsu Changshu Rural Commercial Bank has demonstrated robust financial growth, with a notable increase in net interest income and net income as of Q1 2024. While the bank's dividend payments have shown stability and growth, it is important to note that it has a relatively short history of dividend distribution, having initiated this practice less than ten years ago. Despite this shorter track record, the dividends are well-covered by earnings with a conservative payout ratio of 19.9%, suggesting sustainability. Additionally, the stock is trading significantly below its estimated fair value, offering potential value for dividend investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Jiangsu Changshu Rural Commercial Bank.

- Upon reviewing our latest valuation report, Jiangsu Changshu Rural Commercial Bank's share price might be too optimistic.

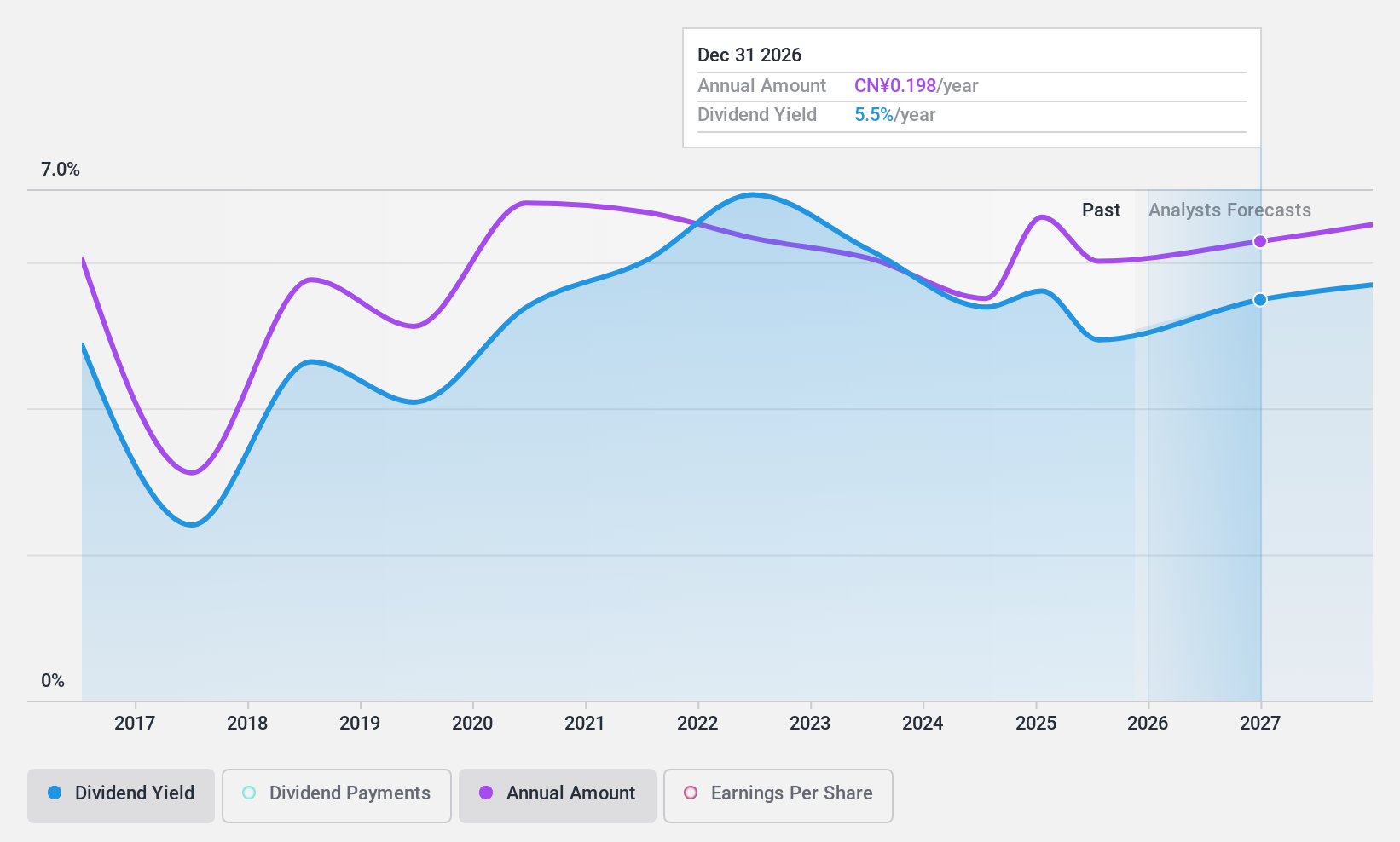

China Everbright Bank (SHSE:601818)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Everbright Bank Company Limited offers a variety of financial products and services to corporations, government agencies, retail customers, and individuals across Mainland China, Hong Kong, Luxembourg, Seoul, and Sydney with a market capitalization of approximately CN¥175.42 billion.

Operations: China Everbright Bank Company Limited generates revenue primarily from providing diverse financial products and services across significant global markets including Mainland China, Hong Kong, Luxembourg, Seoul, and Sydney.

Dividend Yield: 6%

China Everbright Bank has a stable dividend coverage with a payout ratio of 28.4%, suggesting financial prudence in its distributions. Despite this, the bank's dividends have shown volatility over the past decade, indicating some inconsistency in payments. The bank's earnings are projected to grow by 4.83% annually, which could support future dividends. Recent executive changes and fixed-income offerings might impact operational focus but provide liquidity for ongoing commitments and growth strategies.

- Delve into the full analysis dividend report here for a deeper understanding of China Everbright Bank.

- The valuation report we've compiled suggests that China Everbright Bank's current price could be quite moderate.

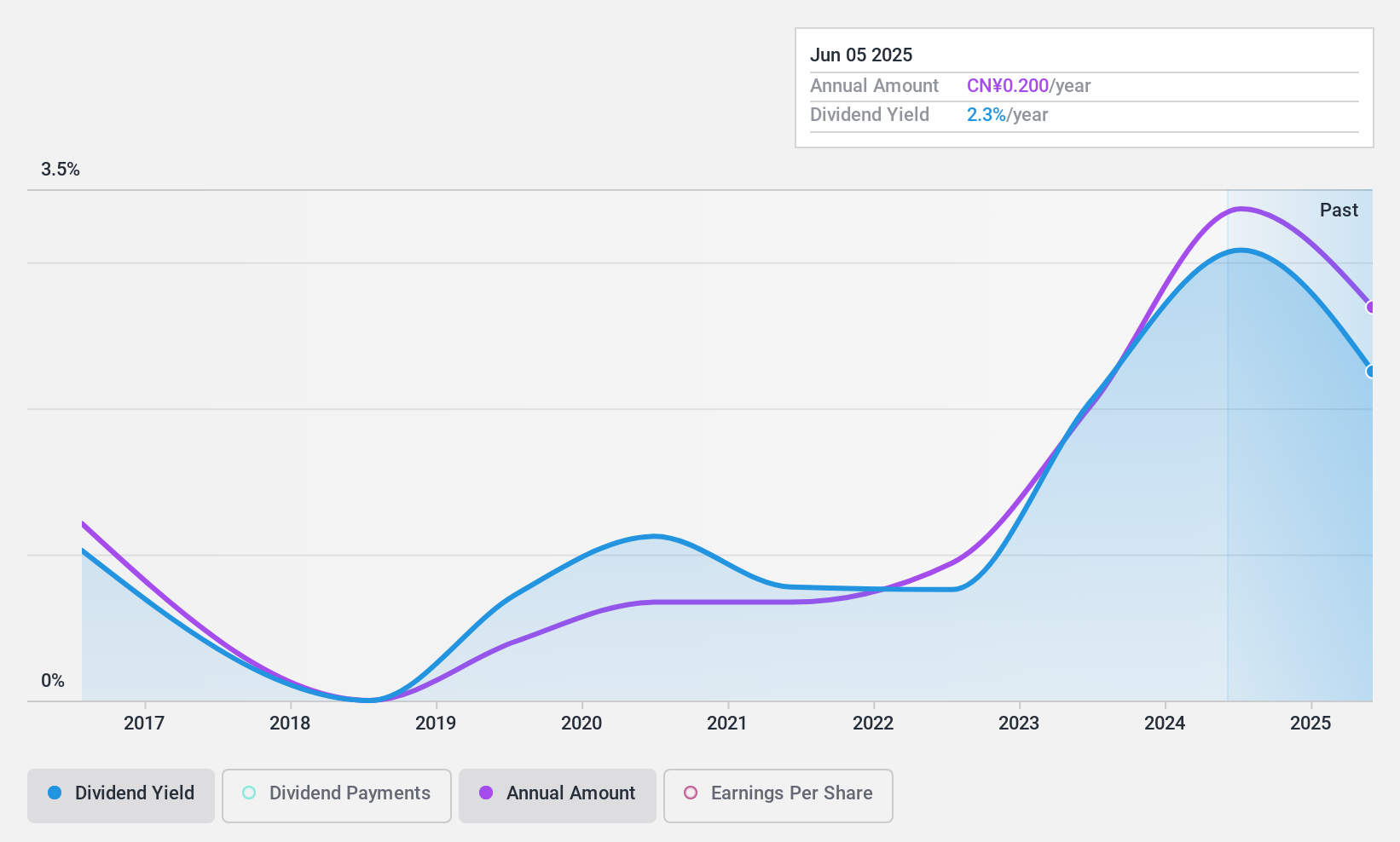

Xinjiang Xuefeng Sci-Tech(Group)Co.Ltd (SHSE:603227)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang Xuefeng Sci-Tech (Group) Co., Ltd operates primarily in the research, development, production, and sale of civil explosives, with a market capitalization of approximately CN¥6.63 billion.

Operations: Xinjiang Xuefeng Sci-Tech (Group) Co., Ltd generates its revenue primarily from the research, development, production, and sales of civil explosives.

Dividend Yield: 4%

Xinjiang Xuefeng Sci-Tech(Group)Co.,Ltd has experienced a mixed performance in dividend reliability, with payments showing significant fluctuations over the past 8 years. Despite this, dividends are well-supported by both earnings and cash flow, with payout ratios of 35.7% and 27.9% respectively. The company's dividend yield stands at a competitive 4.04%, ranking in the top quartile within its market. Recent financial results indicate a downturn in quarterly revenues and net income as of March 2024, contrasting with an overall annual revenue increase reported for December 2023.

- Click here to discover the nuances of Xinjiang Xuefeng Sci-Tech(Group)Co.Ltd with our detailed analytical dividend report.

- Our expertly prepared valuation report Xinjiang Xuefeng Sci-Tech(Group)Co.Ltd implies its share price may be lower than expected.

Turning Ideas Into Actions

- Access the full spectrum of 237 Top Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601128

Jiangsu Changshu Rural Commercial Bank

Jiangsu Changshu Rural Commercial Bank Co., Ltd.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives