- Taiwan

- /

- Communications

- /

- TPEX:8048

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic reports and geopolitical uncertainties, investors have witnessed mixed performances across major indices. With growth stocks lagging behind value shares and small-caps showing resilience, the current environment underscores the importance of stability in investment choices. In this context, dividend stocks can offer a reliable income stream and potential for long-term capital appreciation, making them an attractive consideration for those seeking to balance risk with reward amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.87% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.92% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Globeride (TSE:7990) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.39% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.11% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

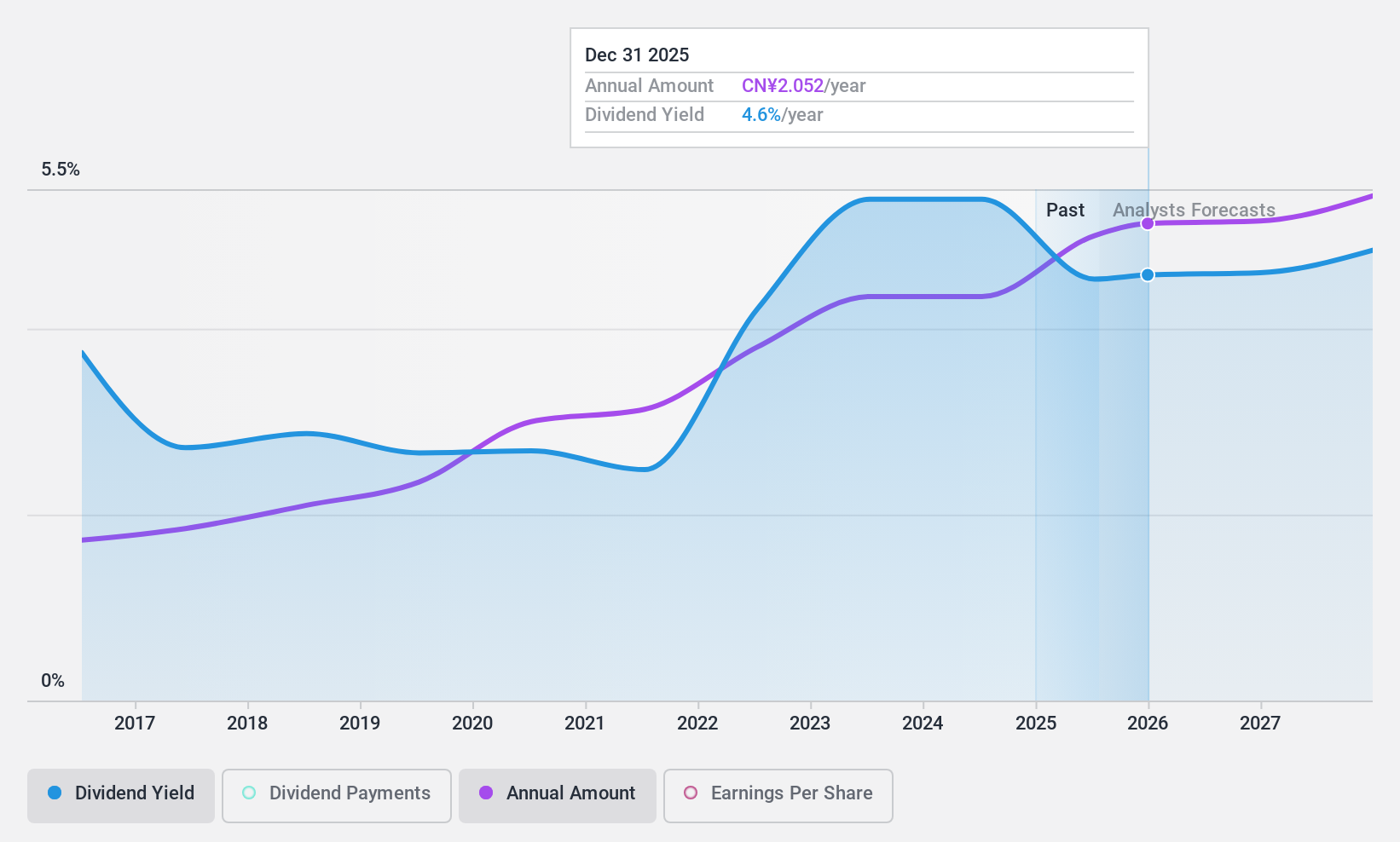

China Merchants Bank (SHSE:600036)

Simply Wall St Dividend Rating: ★★★★★★

Overview: China Merchants Bank Co., Ltd., along with its subsidiaries, offers a range of banking products and services, with a market capitalization of CN¥985.49 billion.

Operations: China Merchants Bank Co., Ltd. generates revenue through diverse banking products and services, segmented into corporate banking, retail banking, and treasury operations.

Dividend Yield: 5%

China Merchants Bank offers a stable and reliable dividend profile, with payouts well covered by earnings at a 35.2% payout ratio, maintaining this coverage in future forecasts. The bank's dividends have shown consistent growth over the past decade without volatility and are considered attractive with a yield of 4.98%, placing it among the top dividend payers in China. Despite slightly declining net interest income recently, its earnings remain robust enough to support ongoing dividend payments.

- Delve into the full analysis dividend report here for a deeper understanding of China Merchants Bank.

- Insights from our recent valuation report point to the potential overvaluation of China Merchants Bank shares in the market.

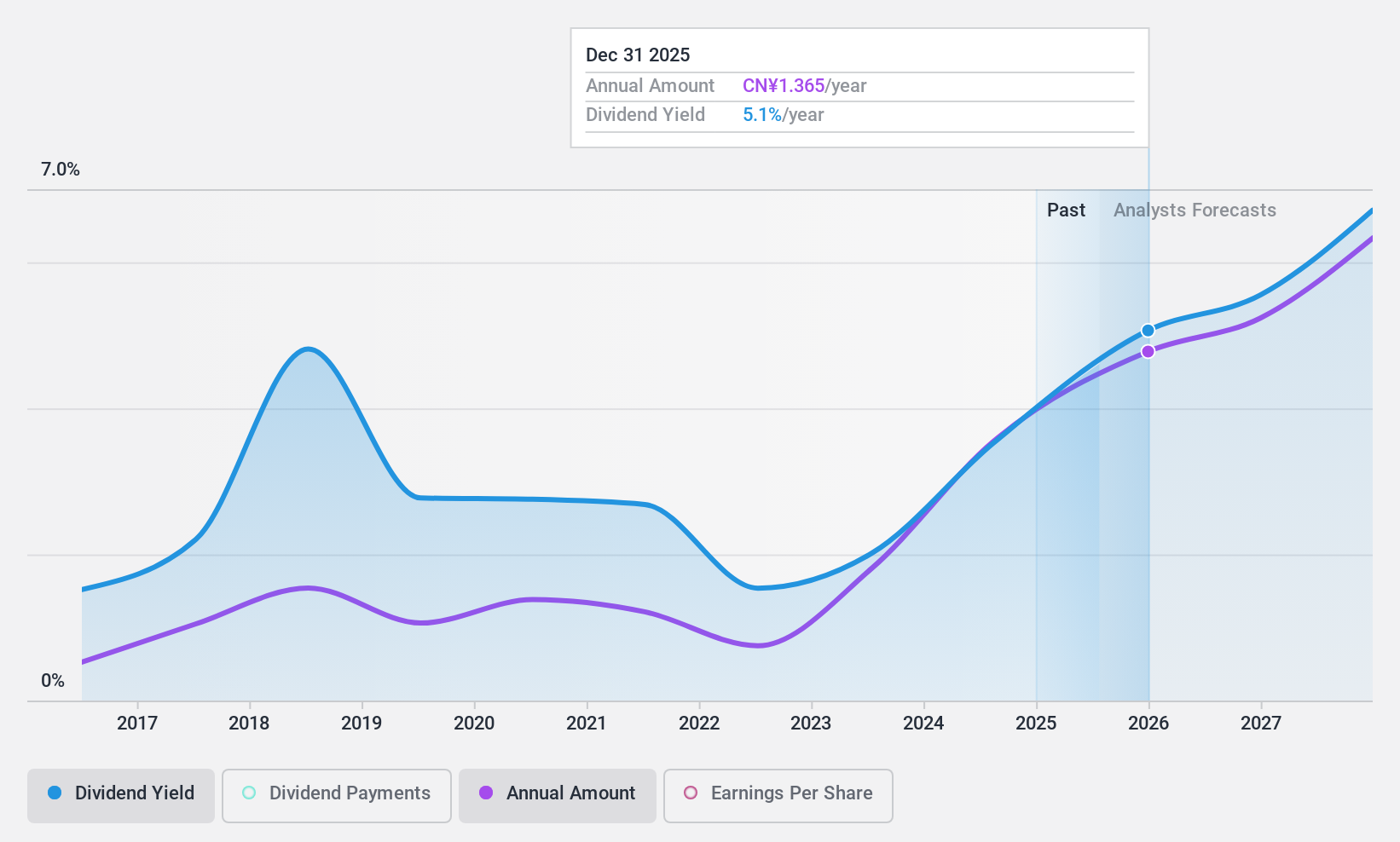

Hisense Home Appliances Group (SZSE:000921)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hisense Home Appliances Group Co., Ltd. manufactures and sells household electrical appliances under various brands such as Hisense, Ronshen, Kelon, Hitachi, and York both in China and internationally, with a market cap of CN¥37.70 billion.

Operations: Hisense Home Appliances Group Co., Ltd. generates revenue through the manufacturing and sale of household electrical appliances under multiple brand names, catering to both domestic and international markets.

Dividend Yield: 3.4%

Hisense Home Appliances Group, trading below its estimated fair value, offers a dividend yield of 3.41%, ranking in the top 25% of CN market payers. Despite its attractive payout ratio (43.1%) and cash flow coverage (24.3%), dividend reliability is a concern due to volatility over its nine-year history. Recent earnings growth of 14.8% supports dividend sustainability, yet the inconsistent track record may deter some investors seeking stable returns from dividends alone.

- Get an in-depth perspective on Hisense Home Appliances Group's performance by reading our dividend report here.

- Our expertly prepared valuation report Hisense Home Appliances Group implies its share price may be lower than expected.

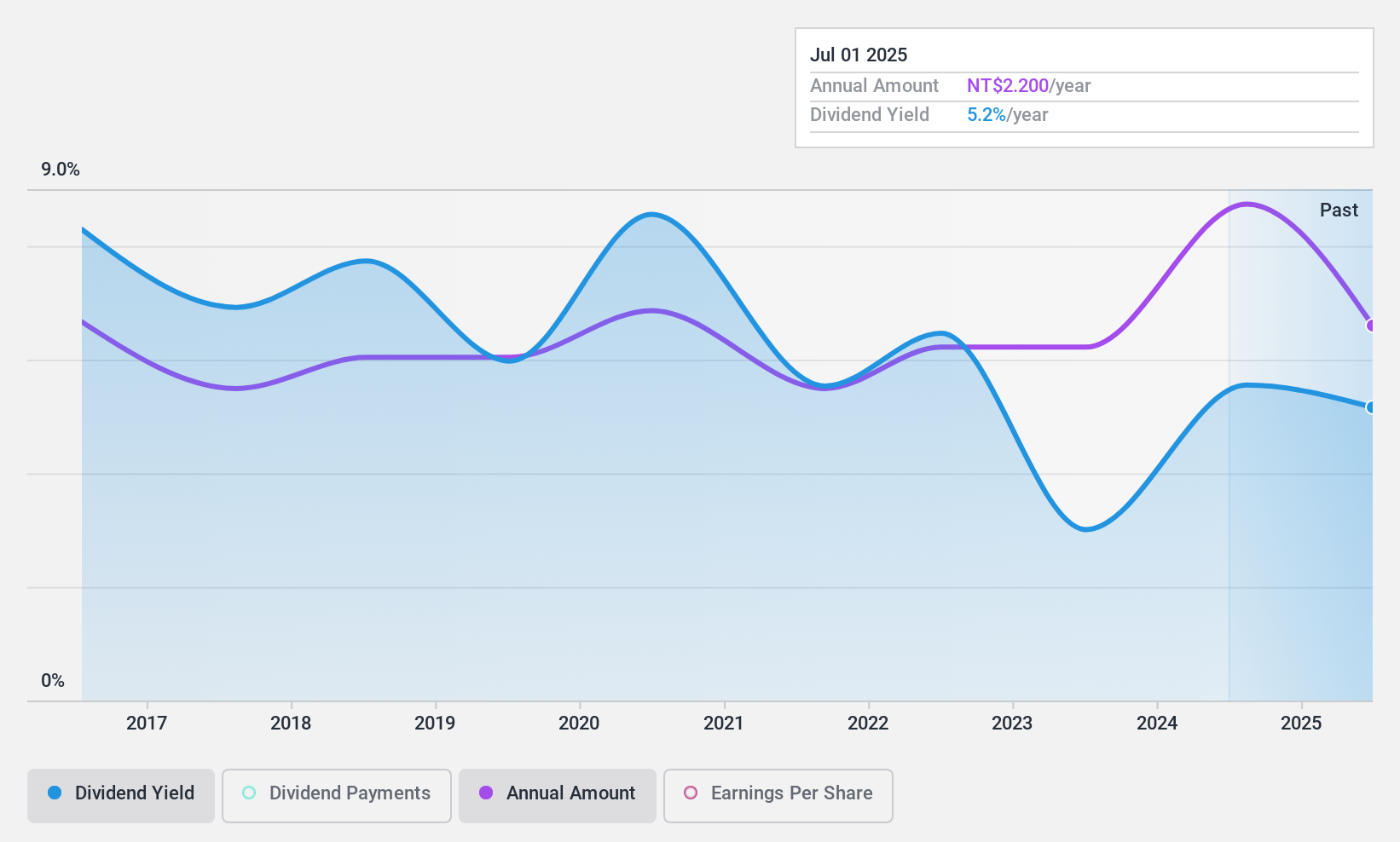

Ruby Tech (TPEX:8048)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ruby Tech Corporation manufactures and sells networking products in Taiwan with a market cap of approximately NT$3.35 billion.

Operations: Ruby Tech Corporation generates revenue from its Computer and Peripheral Equipment segment, amounting to NT$1.57 billion.

Dividend Yield: 5%

Ruby Tech's dividend yield of 5.02% ranks in the top 25% of the TW market, though its history shows volatility and unreliability over the past decade. The company's dividends are covered by earnings (76.3% payout ratio) and cash flows (69%), suggesting current sustainability despite a volatile track record. Recent financials reveal declining sales and net income, which could impact future dividend stability if trends continue without improvement in performance metrics.

- Unlock comprehensive insights into our analysis of Ruby Tech stock in this dividend report.

- Our valuation report unveils the possibility Ruby Tech's shares may be trading at a discount.

Next Steps

- Gain an insight into the universe of 1928 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8048

Ruby Tech

Engages in the research and development, manufacture, and sale of networking products in Taiwan.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives