- China

- /

- Auto Components

- /

- SZSE:301613

Global Growth Stocks With High Insider Ownership For May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances in major indices and ongoing trade discussions, investors are closely watching for signs of economic stability amid uncertain outlooks. With the Federal Reserve maintaining interest rates and international trade negotiations potentially easing tensions, the focus on growth companies with high insider ownership becomes particularly relevant, as these stocks often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 66.1% |

| Vow (OB:VOW) | 13.1% | 81% |

| Laopu Gold (SEHK:6181) | 31.9% | 40.5% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 51.9% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.7% |

We're going to check out a few of the best picks from our screener tool.

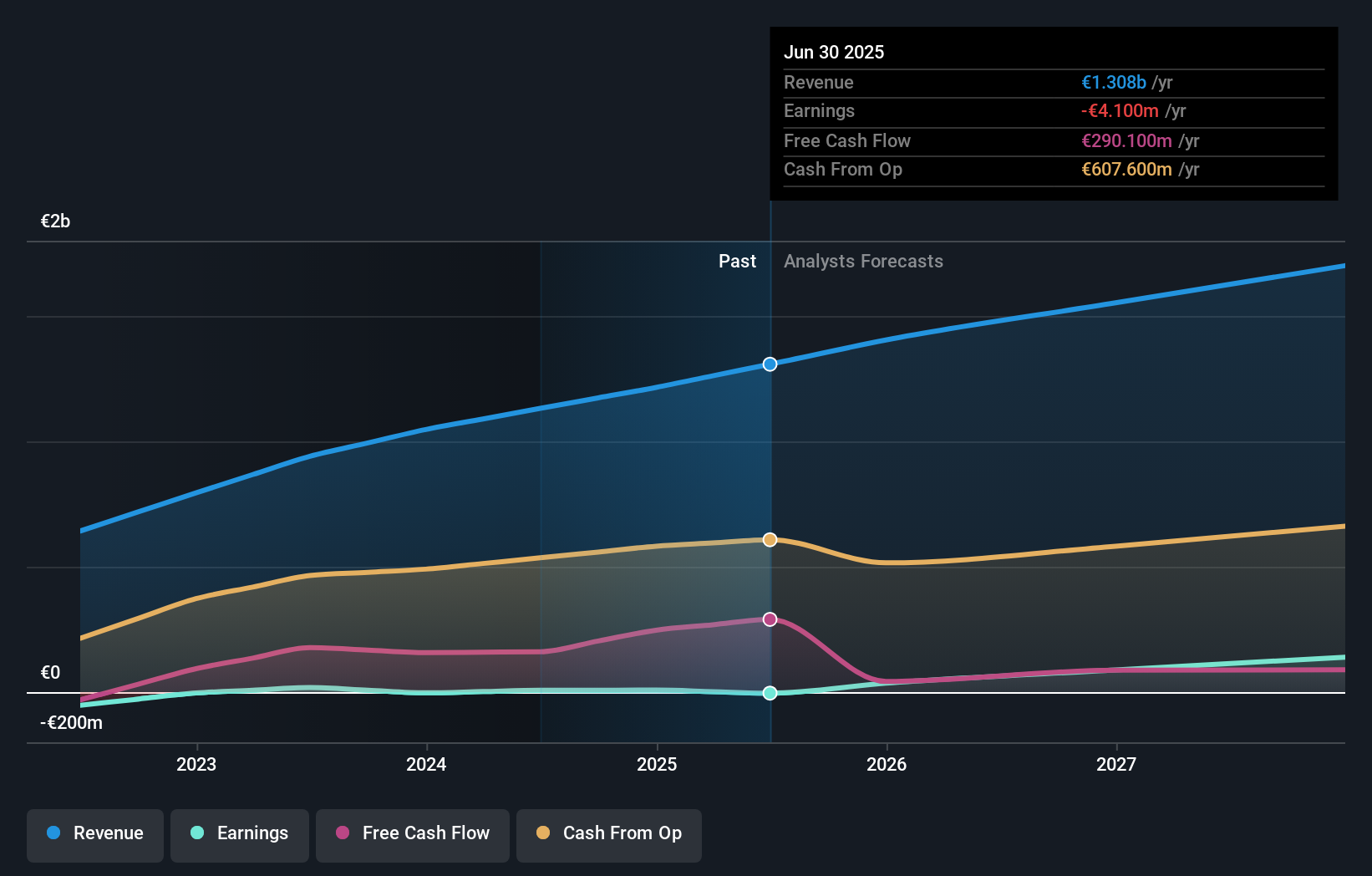

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V., with a market cap of €1.45 billion, operates fitness clubs through its subsidiaries.

Operations: The company's revenue segments include €522.10 million from Benelux and €693.10 million from France, Spain & Germany.

Insider Ownership: 12%

Earnings Growth Forecast: 61.6% p.a.

Basic-Fit has demonstrated strong growth potential with earnings expected to grow significantly at 61.6% annually, outpacing the Dutch market. Despite a volatile share price and interest payments not well covered by earnings, the company became profitable this year with €8 million in net income. Insider activity shows more buying than selling recently, though not substantially. A €40 million share repurchase program reflects confidence in future prospects amid forecasted revenue growth of 9.3% annually.

- Click to explore a detailed breakdown of our findings in Basic-Fit's earnings growth report.

- The valuation report we've compiled suggests that Basic-Fit's current price could be inflated.

Shenzhen Prince New MaterialsLtd (SZSE:002735)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Prince New Materials Co., Ltd. produces and sells packaging materials in China with a market cap of CN¥4.38 billion.

Operations: The company generates revenue from the production and sale of packaging materials within China.

Insider Ownership: 37.1%

Earnings Growth Forecast: 108.8% p.a.

Shenzhen Prince New Materials demonstrates growth potential, with earnings forecasted to grow over 100% annually and revenue expected to outpace the broader CN market. Recent financials show a sales increase from CNY 379.71 million to CNY 517.19 million year-on-year for Q1 2025, alongside a net income rise to CNY 8.42 million despite past annual losses. The company has approved amendments to its articles of association and reduced dividends, indicating strategic adjustments amid volatile share prices.

- Dive into the specifics of Shenzhen Prince New MaterialsLtd here with our thorough growth forecast report.

- According our valuation report, there's an indication that Shenzhen Prince New MaterialsLtd's share price might be on the expensive side.

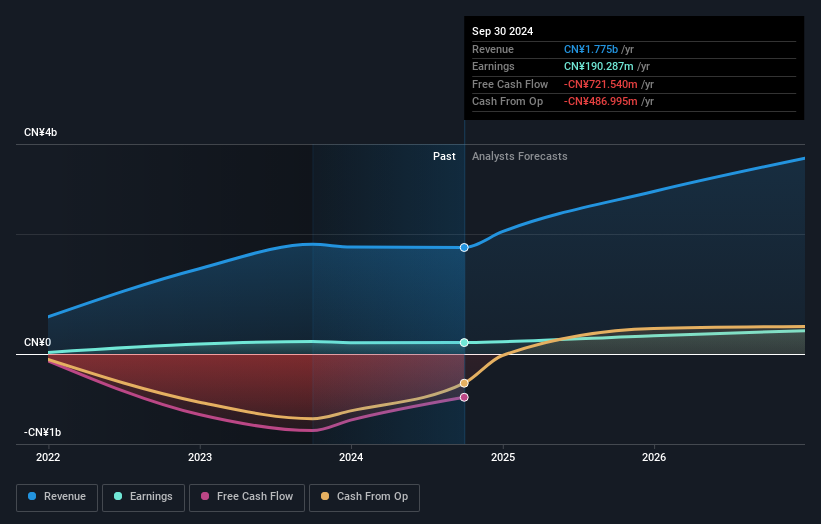

Alnera Aluminium (SZSE:301613)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alnera Aluminium Co., Ltd. specializes in the research, development, production, and sale of aluminum alloy parts for new energy vehicle battery systems and has a market cap of CN¥7.55 billion.

Operations: Alnera Aluminium Co., Ltd. focuses on the innovation and manufacturing of aluminum alloy components specifically designed for battery systems in new energy vehicles.

Insider Ownership: 35.4%

Earnings Growth Forecast: 35.1% p.a.

Alnera Aluminium is poised for significant growth, with earnings projected to rise 35.1% annually, surpassing the CN market's average. Revenue growth forecasts also exceed market expectations at 23% per year. Despite a volatile share price and dividends not well-covered by free cash flows, recent financials reveal a robust sales increase in Q1 2025 to CNY 629.79 million from CNY 370.72 million the previous year, though net income growth was modest.

- Click here to discover the nuances of Alnera Aluminium with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Alnera Aluminium is priced higher than what may be justified by its financials.

Seize The Opportunity

- Reveal the 842 hidden gems among our Fast Growing Global Companies With High Insider Ownership screener with a single click here.

- Curious About Other Options? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Alnera Aluminium, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301613

Alnera Aluminium

Engages in the research and development, production, and sale of aluminum alloy parts for new energy vehicle battery systems.

High growth potential slight.

Market Insights

Community Narratives