- China

- /

- Auto Components

- /

- SZSE:301005

Essence Fastening Systems (Shanghai)'s (SZSE:301005) Problems Go Beyond Weak Profit

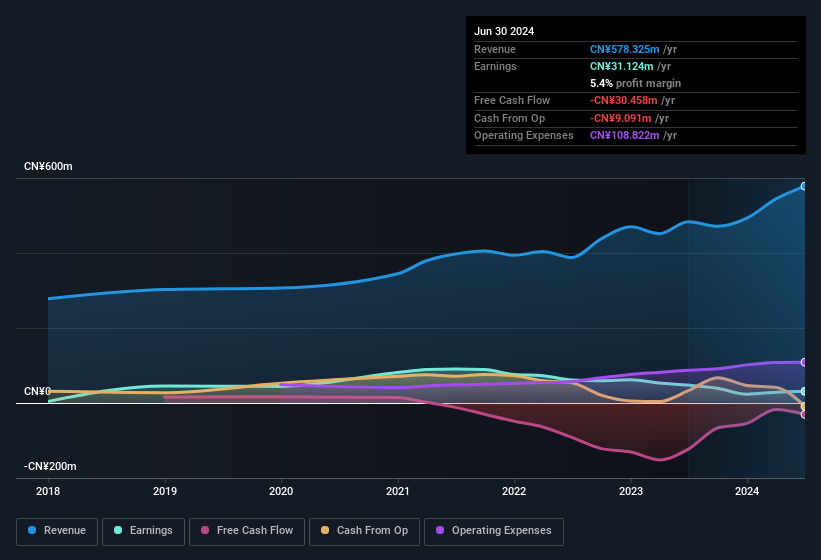

Last week's earnings announcement from Essence Fastening Systems (Shanghai) Co., Ltd. (SZSE:301005) was disappointing to investors, with a sluggish profit figure. We did some analysis, and found that there are some reasons to be cautious about the headline numbers.

View our latest analysis for Essence Fastening Systems (Shanghai)

The Impact Of Unusual Items On Profit

For anyone who wants to understand Essence Fastening Systems (Shanghai)'s profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from CN¥19m worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. Essence Fastening Systems (Shanghai) had a rather significant contribution from unusual items relative to its profit to June 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Essence Fastening Systems (Shanghai).

Our Take On Essence Fastening Systems (Shanghai)'s Profit Performance

As we discussed above, we think the significant positive unusual item makes Essence Fastening Systems (Shanghai)'s earnings a poor guide to its underlying profitability. For this reason, we think that Essence Fastening Systems (Shanghai)'s statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. In further bad news, its earnings per share decreased in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Case in point: We've spotted 4 warning signs for Essence Fastening Systems (Shanghai) you should be mindful of and 2 of these bad boys shouldn't be ignored.

This note has only looked at a single factor that sheds light on the nature of Essence Fastening Systems (Shanghai)'s profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Essence Fastening Systems (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301005

Essence Fastening Systems (Shanghai)

Essence Fastening Systems (Shanghai) Co., Ltd.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)