- China

- /

- Auto Components

- /

- SZSE:300733

Further Upside For Chengdu Xiling Power Science & Technology Incorporated Company (SZSE:300733) Shares Could Introduce Price Risks After 34% Bounce

Those holding Chengdu Xiling Power Science & Technology Incorporated Company (SZSE:300733) shares would be relieved that the share price has rebounded 34% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 43% over that time.

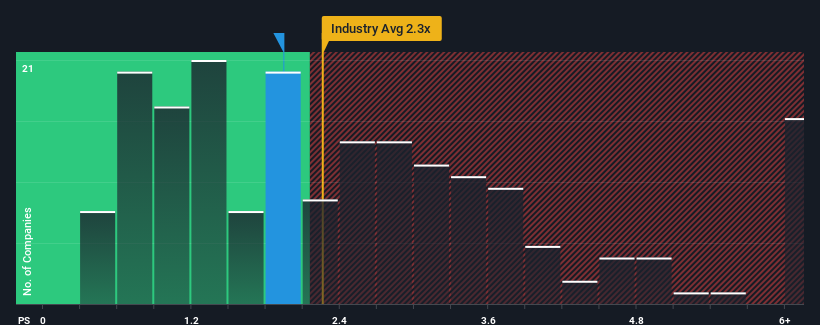

In spite of the firm bounce in price, it's still not a stretch to say that Chengdu Xiling Power Science & Technology's price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" compared to the Auto Components industry in China, where the median P/S ratio is around 2.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Chengdu Xiling Power Science & Technology

What Does Chengdu Xiling Power Science & Technology's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Chengdu Xiling Power Science & Technology has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Chengdu Xiling Power Science & Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Chengdu Xiling Power Science & Technology's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Chengdu Xiling Power Science & Technology's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 47%. Pleasingly, revenue has also lifted 174% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 42% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Chengdu Xiling Power Science & Technology's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Chengdu Xiling Power Science & Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Chengdu Xiling Power Science & Technology's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 1 warning sign for Chengdu Xiling Power Science & Technology that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300733

Chengdu Xiling Power Science & Technology

Engages in the production and sale of automotive engine components used in internal combustion engine vehicles in China.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026