- China

- /

- Auto Components

- /

- SZSE:300680

Undiscovered Gems To Explore In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. indices climbing higher on the back of easing core inflation and robust bank earnings, investors are turning their attention to smaller-cap stocks that could offer untapped potential. In this environment of shifting economic indicators and market dynamics, identifying promising small-cap stocks often involves looking for companies with strong fundamentals, innovative products or services, and the ability to capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Beijing Bewinner Communications (SZSE:002148)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Bewinner Communications Co., Ltd. operates in the telecommunications sector and has a market capitalization of CN¥3.64 billion.

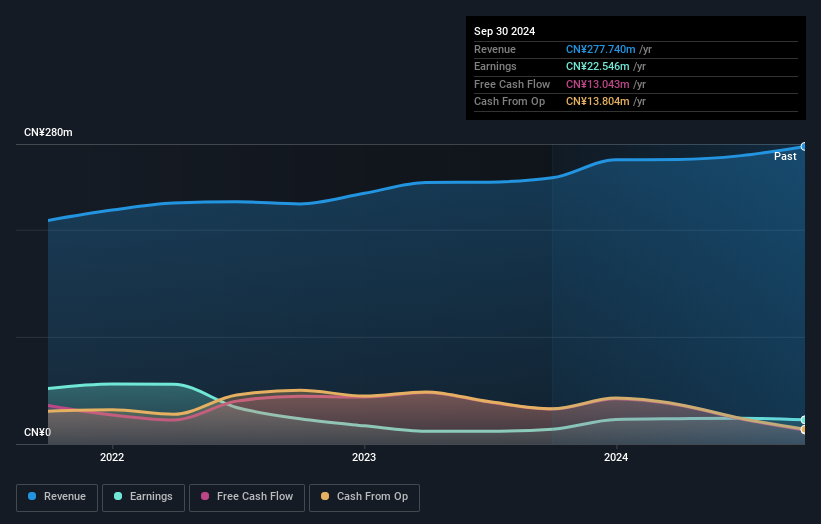

Operations: The company's revenue primarily comes from telecommunications services, amounting to CN¥277.74 million.

Beijing Bewinner Communications, a smaller player in the wireless telecom sector, has shown impressive earnings growth of 63.6% over the past year, outpacing the industry's 11.5%. The company is debt-free and has been for five years, which bodes well for its financial stability. Despite a one-off gain of CN¥11.2 million impacting recent results, its net income slightly dipped to CN¥13.56 million from CN¥13.9 million last year. With sales climbing to CN¥205.91 million from CN¥193.47 million previously and positive free cash flow, it seems poised for potential growth despite some volatility in share price recently.

Wuxi Longsheng TechnologyLtd (SZSE:300680)

Simply Wall St Value Rating: ★★★★☆☆

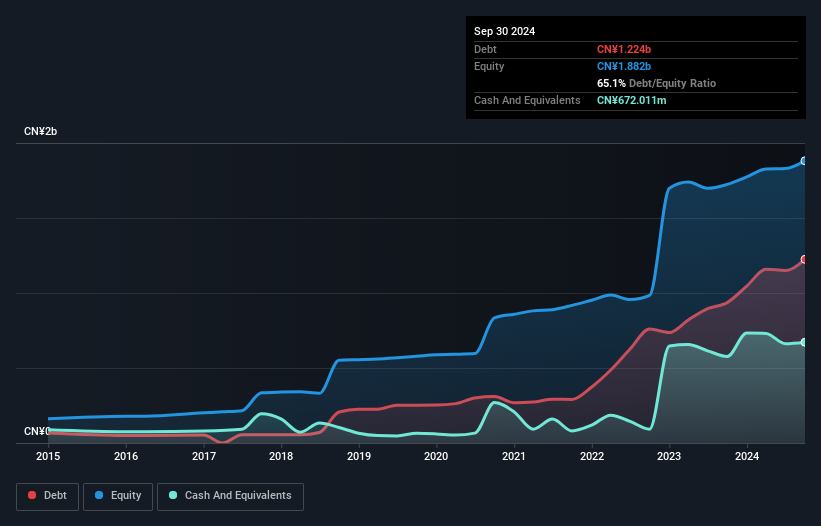

Overview: Wuxi Longsheng Technology Co., Ltd is involved in the manufacturing of auto parts in China and has a market capitalization of CN¥6.19 billion.

Operations: Wuxi Longsheng Technology Ltd generates revenue primarily from the sale of auto parts in China. The company's financial performance includes a notable net profit margin trend, which highlights its efficiency in converting sales into actual profit.

Wuxi Longsheng, a notable player in the auto components sector, has showcased impressive earnings growth of 92.6% over the past year, outpacing industry averages. The company's debt-to-equity ratio has risen from 43.7% to 65.1% over five years, suggesting increased leverage but remains manageable with interest payments well covered by EBIT at 13.2 times coverage. Despite not being free cash flow positive, Wuxi's net income for the nine months ended September 2024 reached CNY 153.6 million compared to CNY 97.08 million previously, reflecting robust operational performance and potential for future growth amidst strategic share repurchase plans discussed in recent meetings.

Global Brands Manufacture (TWSE:6191)

Simply Wall St Value Rating: ★★★★★★

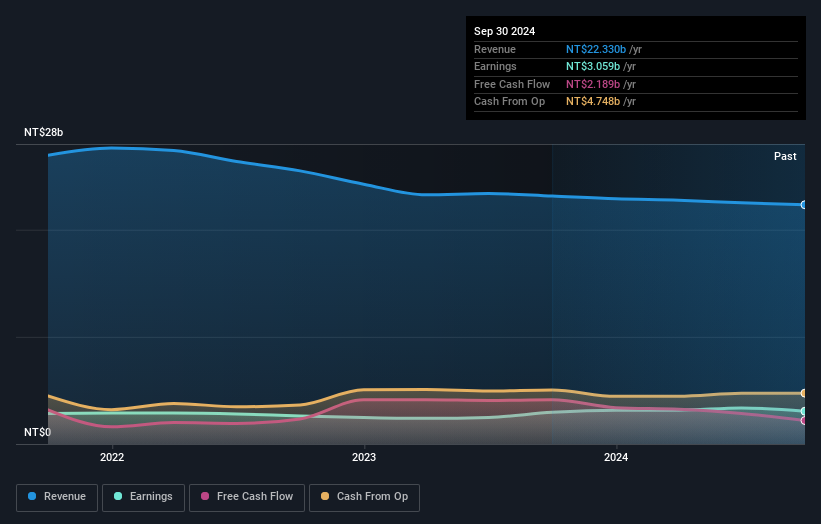

Overview: Global Brands Manufacture Ltd., along with its subsidiaries, operates in Taiwan focusing on the production of printed circuit boards (PCB) and providing electronic manufacturing services (EMS), with a market capitalization of NT$29.88 billion.

Operations: Global Brands Manufacture Ltd. generates revenue primarily from its Printed Circuit Board (PCB) and Electronic Manufacturing Service (EMS) segments, with PCB contributing NT$14.10 billion and EMS adding NT$7.68 billion.

Global Brands Manufacture, a smaller player in the electronics industry, shows a satisfactory net debt to equity ratio of 4.4%, with debt levels reducing from 63.9% to 49% over five years. Despite high-quality earnings, recent figures indicate challenges; third-quarter sales were TWD 5.9 billion compared to TWD 6 billion previously, and net income fell to TWD 901 million from TWD 1.2 billion year-on-year. The company recently completed a buyback of 2.5 million shares for TWD 163 million, potentially enhancing shareholder value by transferring repurchased shares to employees under its announced program through February 2025.

Turning Ideas Into Actions

- Navigate through the entire inventory of 4659 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Longsheng TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300680

Wuxi Longsheng TechnologyLtd

Engages in the manufacturing of auto parts in China.

High growth potential with solid track record.