- China

- /

- Electronic Equipment and Components

- /

- SHSE:688286

3 Growth Companies With High Insider Ownership Expect Up To 119% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by easing inflation in the U.S. and Europe, alongside strong bank earnings propelling stocks higher, investors are keenly observing shifts in growth and value dynamics. With major indices like the S&P 500 and Dow Jones Industrial Average recording significant gains, attention is turning towards growth companies where high insider ownership could signal confidence in future performance. In this context, companies that demonstrate robust earnings potential coupled with substantial insider stakes may offer compelling opportunities amid current market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 35.8% | 110.9% |

Here we highlight a subset of our preferred stocks from the screener.

China Catalyst Holding (SHSE:688267)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Catalyst Holding Co., Ltd. focuses on the R&D, production, and sale of zeolite catalysts, customized process package solutions, and fine chemicals both in China and internationally, with a market cap of CN¥4.07 billion.

Operations: The company's revenue primarily comes from its Chemical Reagent and Auxiliary Manufacturing segment, which generated CN¥708.63 million.

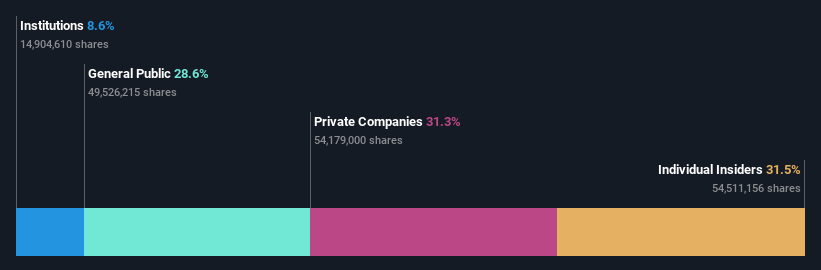

Insider Ownership: 31.5%

Earnings Growth Forecast: 20.2% p.a.

China Catalyst Holding demonstrates strong growth potential with revenue forecasted to increase by 24.9% annually, outpacing the Chinese market's average. Despite a low future return on equity of 7.3%, its earnings grew by 35.5% last year and are expected to rise significantly at 20.18% per annum over the next three years, although slightly below market expectations. The company's price-to-earnings ratio of 27.6x is attractive compared to the broader market's valuation.

- Click to explore a detailed breakdown of our findings in China Catalyst Holding's earnings growth report.

- According our valuation report, there's an indication that China Catalyst Holding's share price might be on the expensive side.

MEMSensing Microsystems (Suzhou China) (SHSE:688286)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MEMSensing Microsystems (Suzhou, China) Co., Ltd. operates in the field of micro-electromechanical systems (MEMS) technology and has a market cap of CN¥3.87 billion.

Operations: The company generates revenue primarily from its Integrated Circuit segment, amounting to CN¥450.24 million.

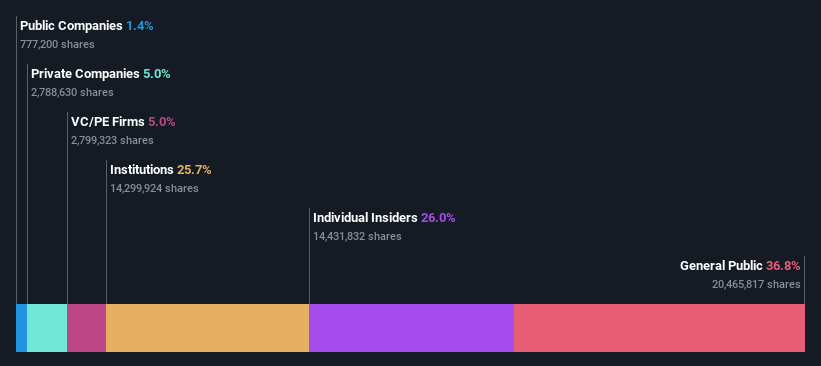

Insider Ownership: 26%

Earnings Growth Forecast: 119.8% p.a.

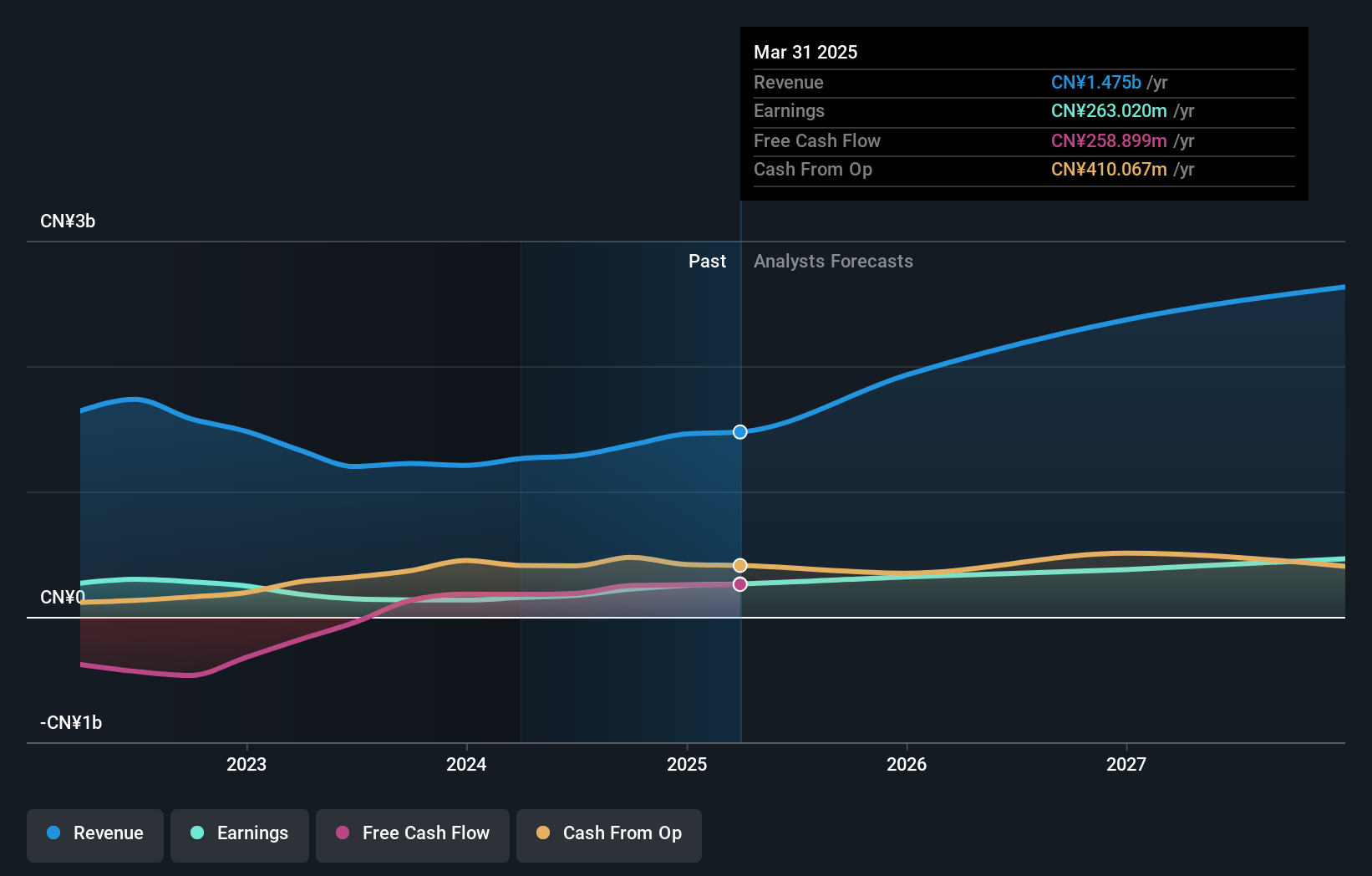

MEMSensing Microsystems (Suzhou, China) is experiencing rapid growth, with revenue forecasted to increase by 27.1% annually, surpassing the broader Chinese market. Despite a volatile share price and a low future return on equity of 5.3%, the company reported improved financials with reduced net loss from CNY 82.32 million to CNY 48.09 million year-over-year for the first nine months of 2024. Profitability is expected within three years despite limited cash runway.

- Delve into the full analysis future growth report here for a deeper understanding of MEMSensing Microsystems (Suzhou China).

- Insights from our recent valuation report point to the potential overvaluation of MEMSensing Microsystems (Suzhou China) shares in the market.

Xi'an Manareco New MaterialsLtd (SHSE:688550)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xi'an Manareco New Materials Co., Ltd specializes in the production and sale of liquid crystal materials, OLED materials, and drug intermediates, with a market cap of CN¥5.71 billion.

Operations: The company generates revenue from its specialty chemicals segment, amounting to CN¥1.37 billion.

Insider Ownership: 13%

Earnings Growth Forecast: 25% p.a.

Xi'an Manareco New Materials Ltd is positioned for significant growth, with earnings projected to rise by 25.04% annually and revenue expected to increase by 23.9% per year, outpacing the Chinese market. Despite trading at a substantial discount of 40.6% below estimated fair value, its return on equity is forecasted to be modest at 10%. Recent financials show strong performance with net income nearly doubling to CNY 185.3 million for the first nine months of 2024 compared to the previous year.

- Get an in-depth perspective on Xi'an Manareco New MaterialsLtd's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Xi'an Manareco New MaterialsLtd implies its share price may be lower than expected.

Seize The Opportunity

- Get an in-depth perspective on all 1466 Fast Growing Companies With High Insider Ownership by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688286

MEMSensing Microsystems (Suzhou China)

MEMSensing Microsystems (Suzhou, China) Co., Ltd.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives