- China

- /

- Electrical

- /

- SHSE:603530

3 Stocks Estimated To Be Below Their Fair Value In January 2025

Reviewed by Simply Wall St

As global markets navigate through easing inflation and robust bank earnings, major indices like the S&P 500 and Dow Jones have shown significant gains, reflecting renewed investor optimism. In this environment where value stocks are outperforming growth shares, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY38.94 | TRY77.88 | 50% |

| Aidma Holdings (TSE:7373) | ¥1816.00 | ¥3611.34 | 49.7% |

| Tabuk Cement (SASE:3090) | SAR13.46 | SAR26.85 | 49.9% |

| Fevertree Drinks (AIM:FEVR) | £6.595 | £13.12 | 49.7% |

| World Fitness Services (TWSE:2762) | NT$92.70 | NT$183.67 | 49.5% |

| Mentice (OM:MNTC) | SEK25.10 | SEK49.91 | 49.7% |

| CYND (TSE:4256) | ¥1075.00 | ¥2099.87 | 48.8% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.79 | CN¥27.79 | 50.4% |

| Verra Mobility (NasdaqCM:VRRM) | US$26.08 | US$52.02 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5875.00 | ¥11690.72 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

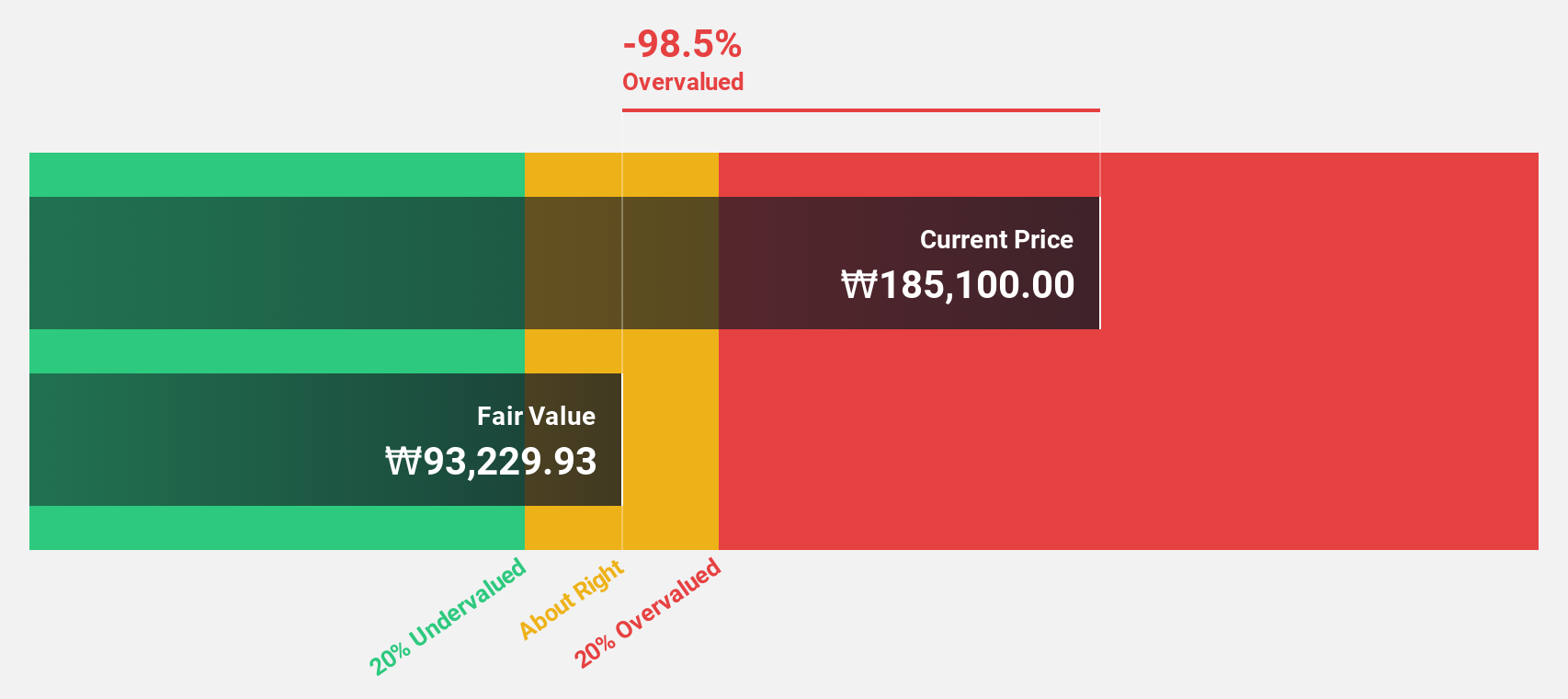

EO Technics (KOSDAQ:A039030)

Overview: EO Technics Co., Ltd. manufactures and supplies laser processing equipment worldwide, with a market cap of ₩1.90 trillion.

Operations: The company's revenue is primarily derived from its Semiconductor Machine Division, which accounts for ₩301.92 billion.

Estimated Discount To Fair Value: 16.4%

EO Technics is trading 16.4% below its estimated fair value of ₩195,965.51, with a current price of ₩163,900. Revenue is projected to grow at 24.3% annually, outpacing the Korean market's 9.3%. Earnings growth is expected at a robust rate of over 50% per year for the next three years despite recent share price volatility and low forecasted return on equity (12.7%).

- The analysis detailed in our EO Technics growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of EO Technics.

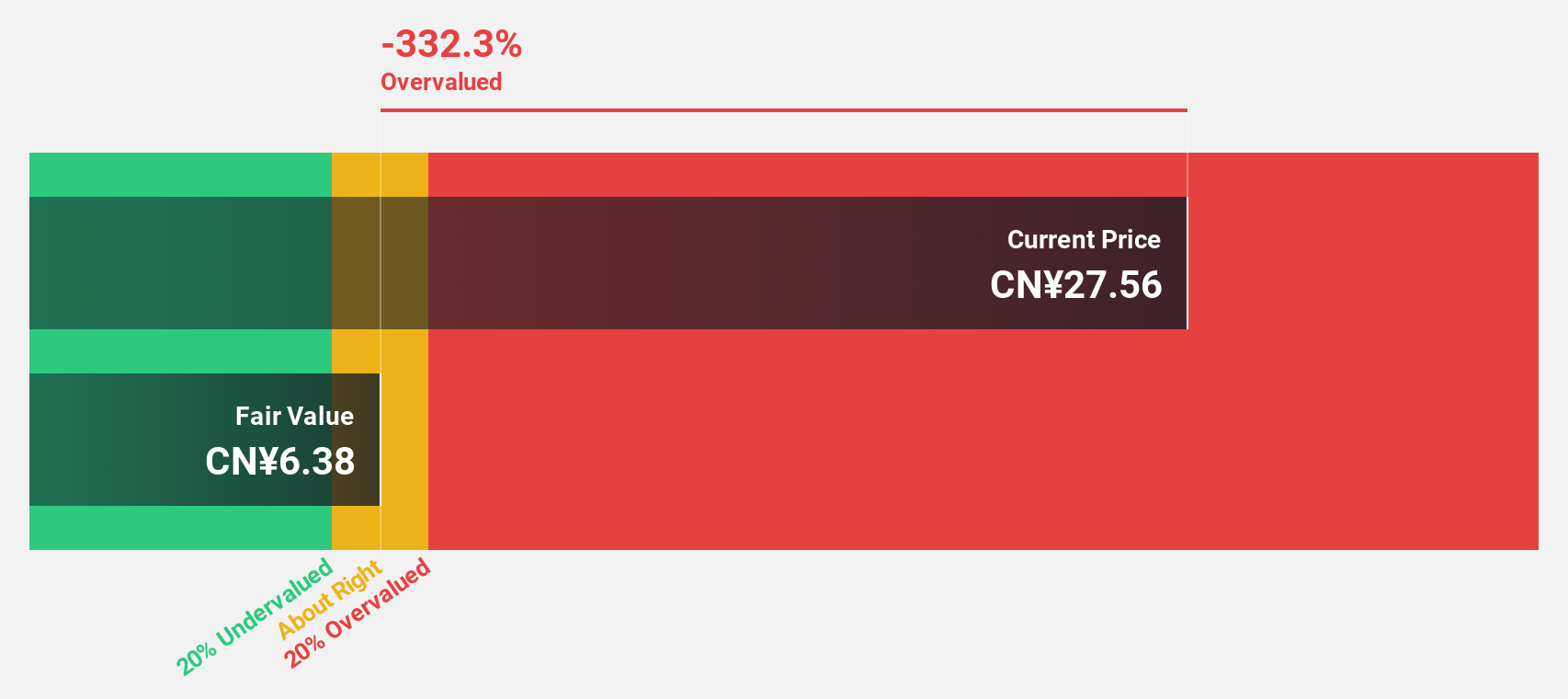

Jiangsu Shemar ElectricLtd (SHSE:603530)

Overview: Jiangsu Shemar Electric Co., Ltd specializes in the R&D, production, and sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals in China with a market cap of CN¥10.65 billion.

Operations: The company's revenue segments include power system substation composite external insulation, transmission and distribution lines, and rubber seals in China.

Estimated Discount To Fair Value: 7.5%

Jiangsu Shemar Electric Ltd. is trading at CN¥25.91, about 7.5% below its estimated fair value of CN¥28.02, suggesting potential undervaluation based on cash flows. The company's earnings grew significantly by 130.9% over the past year and are forecast to grow at 33% annually, outpacing the Chinese market's expected growth of 25.2%. Despite this growth, its dividend yield of 1% is not well covered by free cash flows, indicating a potential risk area for investors.

- Our expertly prepared growth report on Jiangsu Shemar ElectricLtd implies its future financial outlook may be stronger than recent results.

- Take a closer look at Jiangsu Shemar ElectricLtd's balance sheet health here in our report.

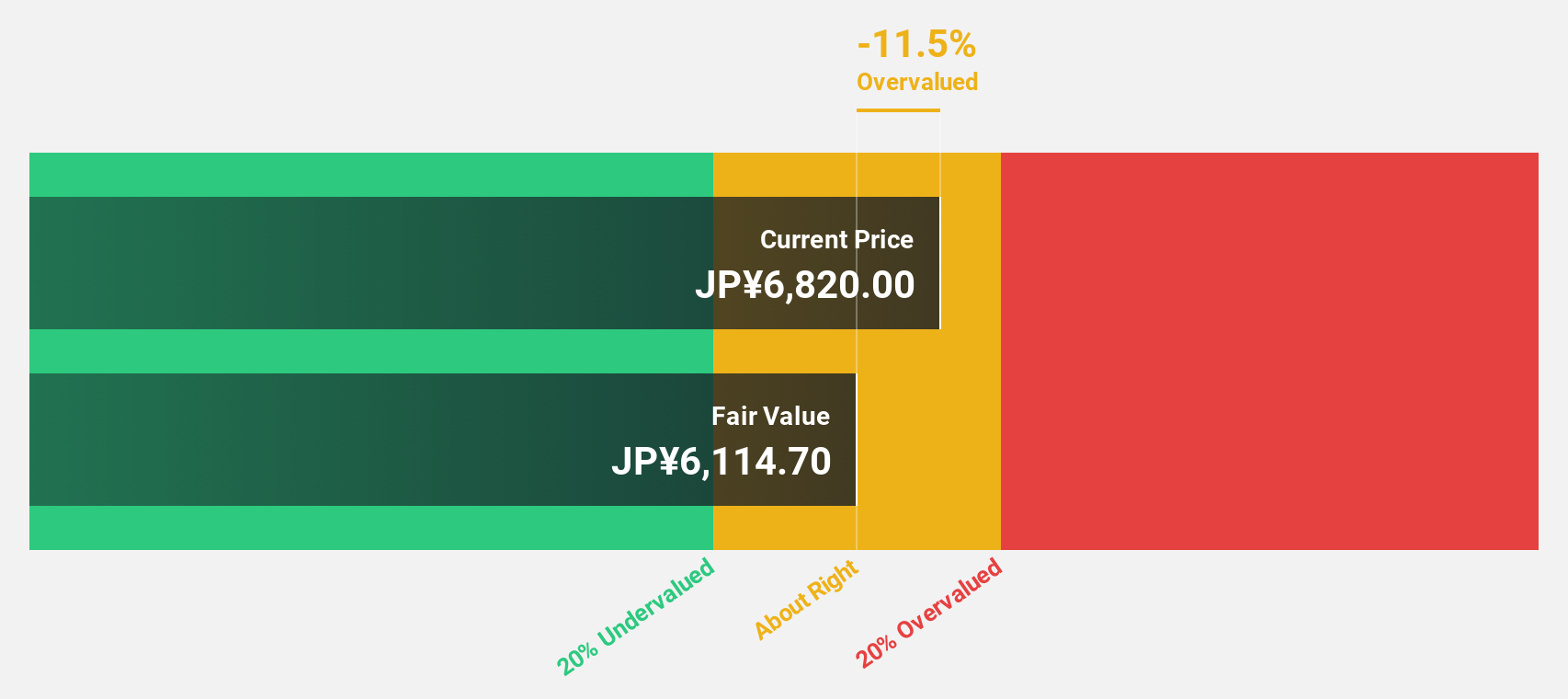

Meiko Electronics (TSE:6787)

Overview: Meiko Electronics Co., Ltd. designs, manufactures, and sells printed circuit boards and auxiliary electronics across Japan, China, Vietnam, other parts of Asia, North America, Europe, and internationally with a market cap of ¥226.80 billion.

Operations: The company generates revenue of ¥191.26 billion from its electronic-related business segment.

Estimated Discount To Fair Value: 16.2%

Meiko Electronics is trading at ¥9,030, below its fair value estimate of ¥10,775.41. The company has revised its 2024 earnings guidance upwards, with net income now expected at ¥15 billion. Earnings are forecast to grow significantly at 22.3% annually over the next three years, outpacing the JP market's growth rate of 8.1%. However, high debt levels and recent share price volatility present potential risks despite strong cash flow valuation fundamentals.

- The growth report we've compiled suggests that Meiko Electronics' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Meiko Electronics' balance sheet health report.

Summing It All Up

- Discover the full array of 878 Undervalued Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603530

Jiangsu Shemar ElectricLtd

Engages in the research and development, production, and sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals in China.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives