- China

- /

- Auto Components

- /

- SZSE:300473

Fuxin Dare Automotive Parts Co., Ltd. (SZSE:300473) Shares Fly 30% But Investors Aren't Buying For Growth

Despite an already strong run, Fuxin Dare Automotive Parts Co., Ltd. (SZSE:300473) shares have been powering on, with a gain of 30% in the last thirty days. The last 30 days bring the annual gain to a very sharp 90%.

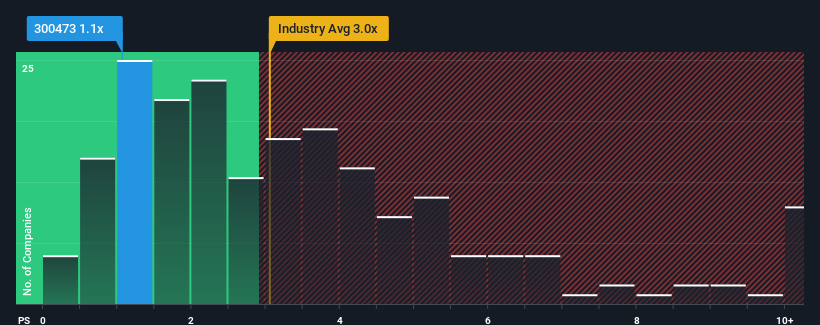

Although its price has surged higher, considering around half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") above 3x, you may still consider Fuxin Dare Automotive Parts as an solid investment opportunity with its 1.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Fuxin Dare Automotive Parts

What Does Fuxin Dare Automotive Parts' Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Fuxin Dare Automotive Parts, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Fuxin Dare Automotive Parts will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Fuxin Dare Automotive Parts' to be considered reasonable.

Retrospectively, the last year delivered a decent 2.6% gain to the company's revenues. The latest three year period has also seen a 18% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 25% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Fuxin Dare Automotive Parts' P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

Despite Fuxin Dare Automotive Parts' share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

In line with expectations, Fuxin Dare Automotive Parts maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Fuxin Dare Automotive Parts.

If you're unsure about the strength of Fuxin Dare Automotive Parts' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300473

Fuxin Dare Automotive Parts

Engages in the research, development, manufacture, and sale of automotive components in China and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives